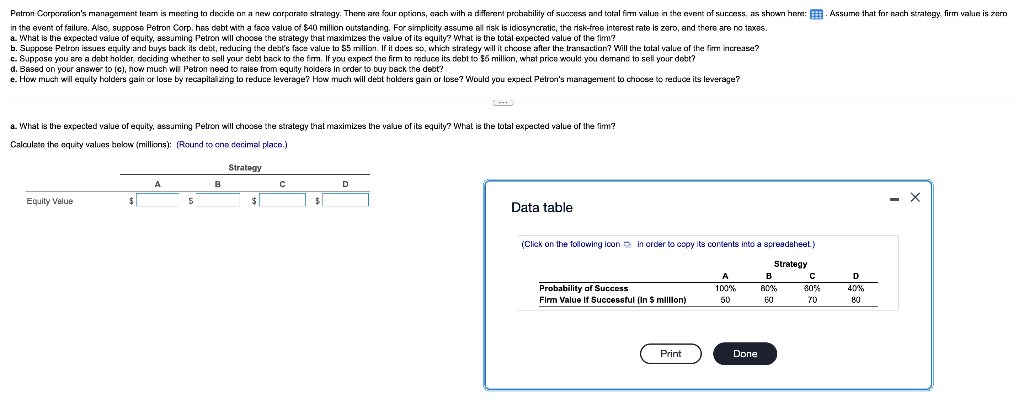

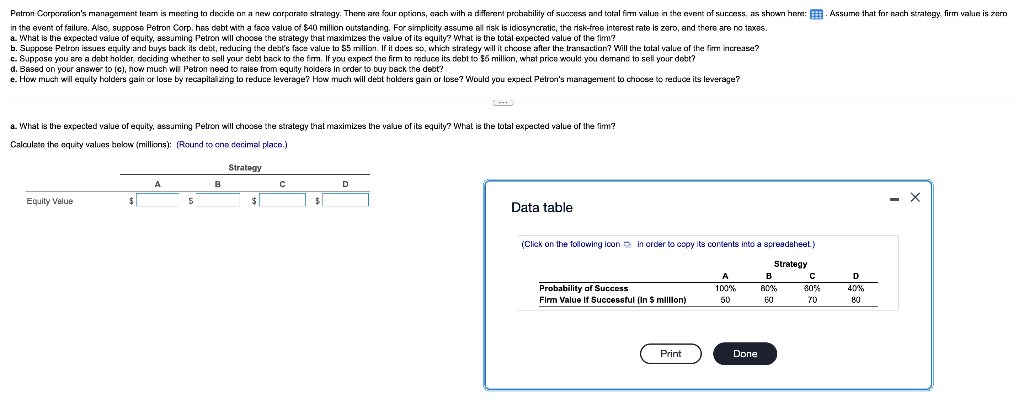

Petron Corporation's management team is menting to decide on a new corporate strategy. There are four options, each with a different probability of sucoss and total firm value in the event of success, as shown here: . Assume that for each strategy firm value is zero in the event of failure. Also, suppose Petron Corp. has clabt with a face value of $40 million outstanding. For simplicity assume all risk is idiosyncratic, the risk-free interest rate is zero, and there are no temas. a. What is the expected value of equity, assuming Petron will choose the strategy that maximizes the value of its equity? What is the total expected value of the tim? b. Suppose Petron issues equity and buys back its debt, reducing the deat's face value to $5 million. If it does so, which strategy will it choose after the transaction? Will the total value of the firm increase? c. Suppose you are a debt holder, deciding whether to sell your debt back to the firm. If you expect the firm to reduce its debt to $5 million, what price would you demand to sell your debt? d. Based on your answer to iCl, how much will Petron need to raise from equity holders in order to buy back the det? e. How much will equily holders gain or lose by recapitalizing to reduce leverage? How much will debt holders gain or lose? Would you expect Pelron's management to choose to reduce its leverage? a. What is the expected value of equity, assuming Petron will choose the strategy that maximizes the value of its equily? What is the total expected value of the fim? Calculate the equity values below (millions): (Round to one decimal place.) Strategy A Equity Value $ $ X Data table (Click on the following icon in order to copy its contents into a spreadsheet) Strategy Probability of Success Firm Value If Successful in 5 million) 100%. 50 B BO 60 80% TO D 40/42 80 Print Done Petron Corporation's management team is menting to decide on a new corporate strategy. There are four options, each with a different probability of sucoss and total firm value in the event of success, as shown here: . Assume that for each strategy firm value is zero in the event of failure. Also, suppose Petron Corp. has clabt with a face value of $40 million outstanding. For simplicity assume all risk is idiosyncratic, the risk-free interest rate is zero, and there are no temas. a. What is the expected value of equity, assuming Petron will choose the strategy that maximizes the value of its equity? What is the total expected value of the tim? b. Suppose Petron issues equity and buys back its debt, reducing the deat's face value to $5 million. If it does so, which strategy will it choose after the transaction? Will the total value of the firm increase? c. Suppose you are a debt holder, deciding whether to sell your debt back to the firm. If you expect the firm to reduce its debt to $5 million, what price would you demand to sell your debt? d. Based on your answer to iCl, how much will Petron need to raise from equity holders in order to buy back the det? e. How much will equily holders gain or lose by recapitalizing to reduce leverage? How much will debt holders gain or lose? Would you expect Pelron's management to choose to reduce its leverage? a. What is the expected value of equity, assuming Petron will choose the strategy that maximizes the value of its equily? What is the total expected value of the fim? Calculate the equity values below (millions): (Round to one decimal place.) Strategy A Equity Value $ $ X Data table (Click on the following icon in order to copy its contents into a spreadsheet) Strategy Probability of Success Firm Value If Successful in 5 million) 100%. 50 B BO 60 80% TO D 40/42 80 Print Done