Question: Pets in a JAR had two very successful years in 2021 and 2022. As a result, the company decided to once again expand its

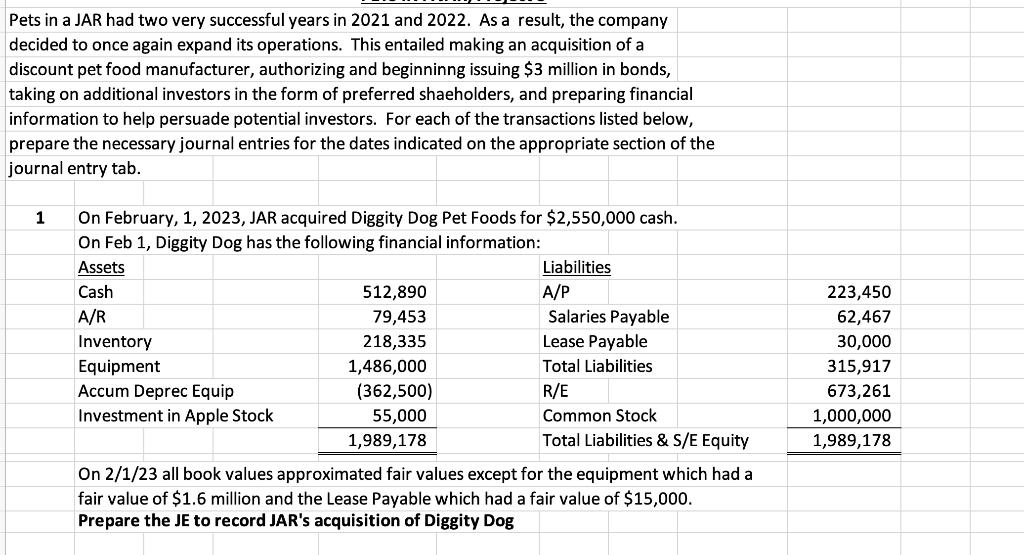

Pets in a JAR had two very successful years in 2021 and 2022. As a result, the company decided to once again expand its operations. This entailed making an acquisition of a discount pet food manufacturer, authorizing and beginninng issuing $3 million in bonds, taking on additional investors in the form of preferred shaeholders, and preparing financial information to help persuade potential investors. For each of the transactions listed below, prepare the necessary journal entries for the dates indicated on the appropriate section of the journal entry tab. 1 On February, 1, 2023, JAR acquired Diggity Dog Pet Foods for $2,550,000 cash. On Feb 1, Diggity Dog has the following financial information: Assets Cash A/R Inventory Equipment Accum Deprec Equip Investment in Apple Stock 512,890 79,453 218,335 1,486,000 (362,500) 55,000 1,989,178 Liabilities A/P Salaries Payable Lease Payable Total Liabilities R/E Common Stock Total Liabilities & S/E Equity On 2/1/23 all book values approximated fair values except for the equipment which had a fair value of $1.6 million and the Lease Payable which had a fair value of $15,000. Prepare the JE to record JAR's acquisition of Diggity Dog 223,450 62,467 30,000 315,917 673,261 1,000,000 1,989,178

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts