Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PetSmart, Inc. is a large specialty pet retailer of services and solutions for the needs of pets. In addition to selling pet food and

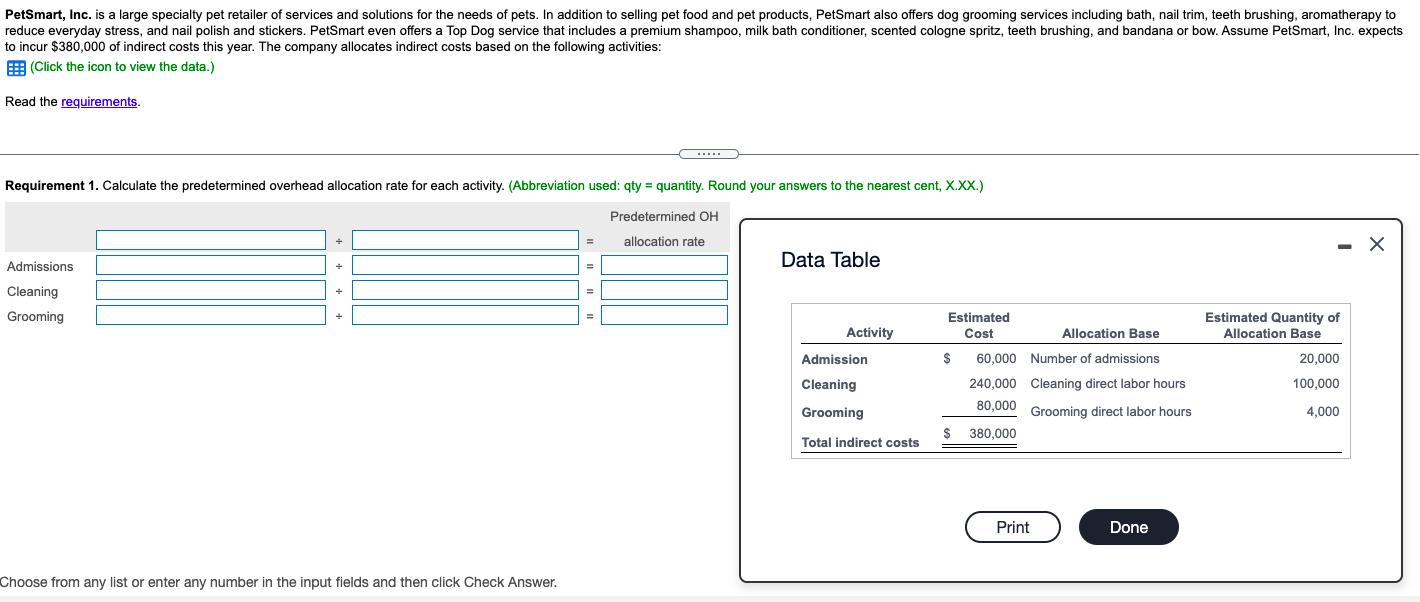

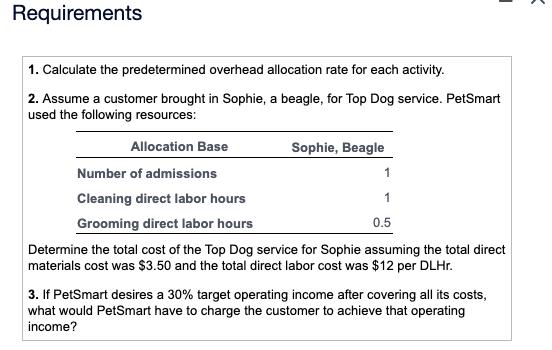

PetSmart, Inc. is a large specialty pet retailer of services and solutions for the needs of pets. In addition to selling pet food and pet products, PetSmart also offers dog grooming services including bath, nail trim, teeth brushing, aromatherapy to reduce everyday stress, and nail polish and stickers. PetSmart even offers a Top Dog service that includes a premium shampoo, milk bath conditioner, scented cologne spritz, teeth brushing, and bandana or bow. Assume PetSmart, Inc. expects to incur $380,000 of indirect costs this year. The company allocates indirect costs based on the following activities: E (Click the icon to view the data.) Read the reguirements. ... Requirement 1. Calculate the predetermined overhead allocation rate for each activity. (Abbreviation used: gty = quantity. Round your answers to the nearest cent, X.XX.) Predetermined OH allocation rate Data Table Admissions Cleaning Grooming Estimated Estimated Quantity of Activity Cost Allocation Base Allocation Base Admission 2$ 60,000 Number of admissions 20,000 Cleaning 240,000 Cleaning direct labor hours 100,000 80,000 Grooming Grooming direct labor hours 4,000 380,000 Total indirect costs Print Done Choose from any list or enter any number in the input fields and then click Check Answer. Requirements 1. Calculate the predetermined overhead allocation rate for each activity. 2. Assume a customer brought in Sophie, a beagle, for Top Dog service. PetSmart used the following resources: Allocation Base Sophie, Beagle Number of admissions Cleaning direct labor hours 1 Grooming direct labor hours 0.5 Determine the total cost of the Top Dog service for Sophie assuming the total direct materials cost was $3.50 and the total direct labor cost was $12 per DLH.. 3. If PetSmart desires a 30% target operating income after covering all its costs, what would PetSmart have to charge the customer to achieve that operating income? PetSmart, Inc. is a large specialty pet retailer of services and solutions for the needs of pets. In addition to selling pet food and pet products, PetSmart also offers dog grooming services including bath, nail trim, teeth brushing, aromatherapy to reduce everyday stress, and nail polish and stickers. PetSmart even offers a Top Dog service that includes a premium shampoo, milk bath conditioner, scented cologne spritz, teeth brushing, and bandana or bow. Assume PetSmart, Inc. expects to incur $380,000 of indirect costs this year. The company allocates indirect costs based on the following activities: E (Click the icon to view the data.) Read the reguirements. ... Requirement 1. Calculate the predetermined overhead allocation rate for each activity. (Abbreviation used: gty = quantity. Round your answers to the nearest cent, X.XX.) Predetermined OH allocation rate Data Table Admissions Cleaning Grooming Estimated Estimated Quantity of Activity Cost Allocation Base Allocation Base Admission 2$ 60,000 Number of admissions 20,000 Cleaning 240,000 Cleaning direct labor hours 100,000 80,000 Grooming Grooming direct labor hours 4,000 380,000 Total indirect costs Print Done Choose from any list or enter any number in the input fields and then click Check Answer. Requirements 1. Calculate the predetermined overhead allocation rate for each activity. 2. Assume a customer brought in Sophie, a beagle, for Top Dog service. PetSmart used the following resources: Allocation Base Sophie, Beagle Number of admissions Cleaning direct labor hours 1 Grooming direct labor hours 0.5 Determine the total cost of the Top Dog service for Sophie assuming the total direct materials cost was $3.50 and the total direct labor cost was $12 per DLH.. 3. If PetSmart desires a 30% target operating income after covering all its costs, what would PetSmart have to charge the customer to achieve that operating income? PetSmart, Inc. is a large specialty pet retailer of services and solutions for the needs of pets. In addition to selling pet food and pet products, PetSmart also offers dog grooming services including bath, nail trim, teeth brushing, aromatherapy to reduce everyday stress, and nail polish and stickers. PetSmart even offers a Top Dog service that includes a premium shampoo, milk bath conditioner, scented cologne spritz, teeth brushing, and bandana or bow. Assume PetSmart, Inc. expects to incur $380,000 of indirect costs this year. The company allocates indirect costs based on the following activities: E (Click the icon to view the data.) Read the reguirements. ... Requirement 1. Calculate the predetermined overhead allocation rate for each activity. (Abbreviation used: gty = quantity. Round your answers to the nearest cent, X.XX.) Predetermined OH allocation rate Data Table Admissions Cleaning Grooming Estimated Estimated Quantity of Activity Cost Allocation Base Allocation Base Admission 2$ 60,000 Number of admissions 20,000 Cleaning 240,000 Cleaning direct labor hours 100,000 80,000 Grooming Grooming direct labor hours 4,000 380,000 Total indirect costs Print Done Choose from any list or enter any number in the input fields and then click Check Answer. Requirements 1. Calculate the predetermined overhead allocation rate for each activity. 2. Assume a customer brought in Sophie, a beagle, for Top Dog service. PetSmart used the following resources: Allocation Base Sophie, Beagle Number of admissions Cleaning direct labor hours 1 Grooming direct labor hours 0.5 Determine the total cost of the Top Dog service for Sophie assuming the total direct materials cost was $3.50 and the total direct labor cost was $12 per DLH.. 3. If PetSmart desires a 30% target operating income after covering all its costs, what would PetSmart have to charge the customer to achieve that operating income?

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Solution 1 Calculation of Predetermined Overhead allocatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started