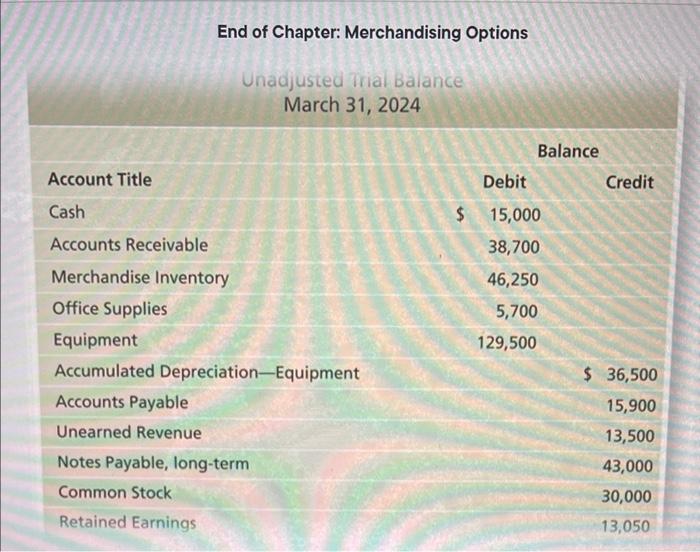

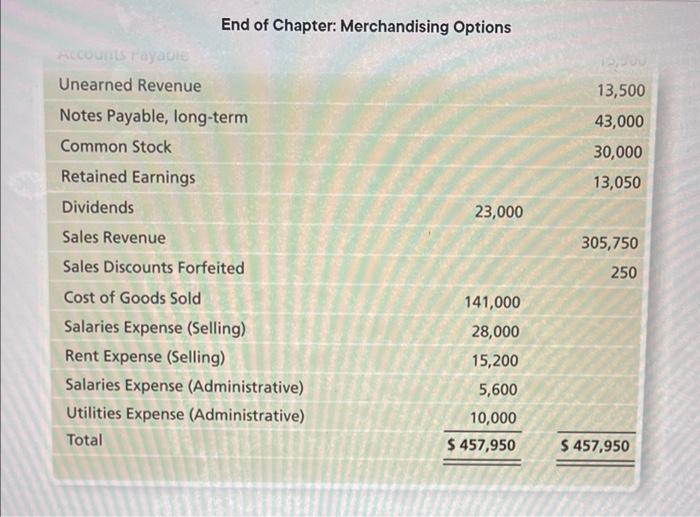

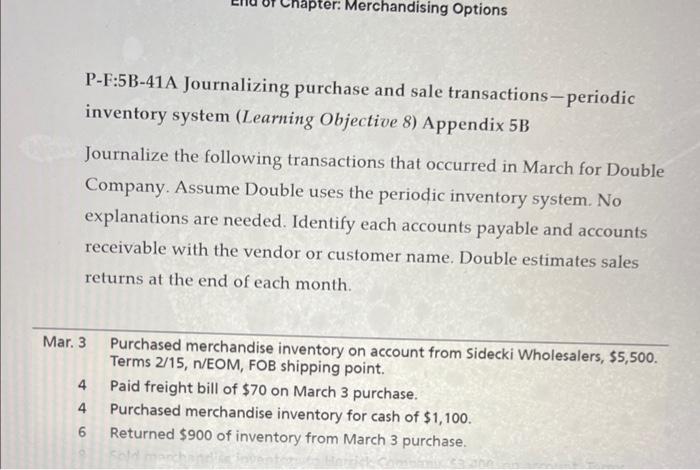

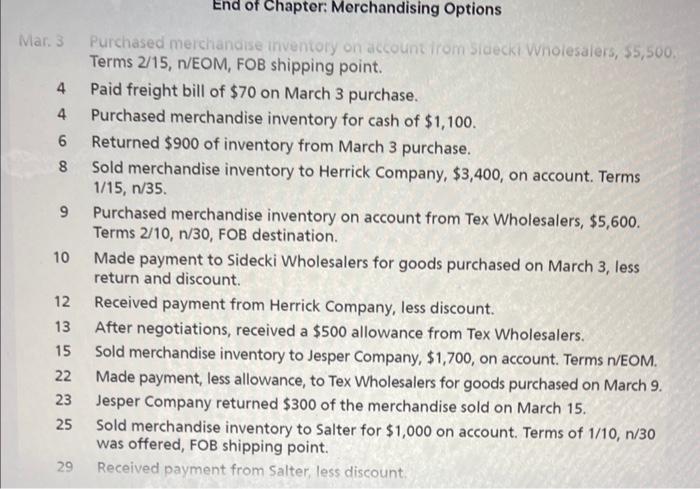

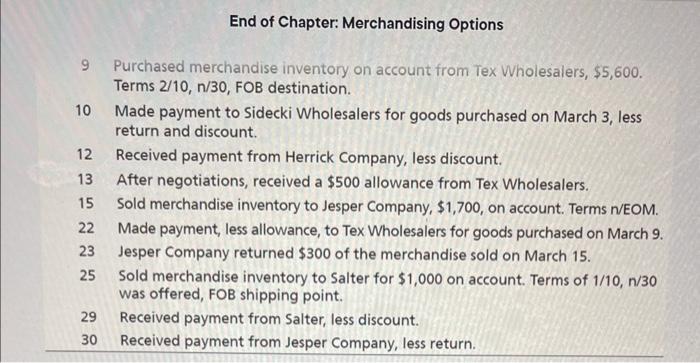

P-F:5-37A Journalizing purchase and sale transactions (with returns) (Learning Objectives 2, 3) Journalize the following transactions that occurred in November for May's Adventure Park. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. May's Adventure Park estimates sales returns at the end of each month and has a November 1 balance of $500 (debit) in Estimated Returns Inventory and $800 (credit) in Refunds Payable. Nov. 4 Purchased merchandise inventory on account from Valsad Company, $10,000. Terms 1/10, n/EOM, FOB shipping point. 6 Paid freight bill of $110 on November 4 purchase. End of Chapter: Merchandising Options Nov. 4 Purchased merchandise inventory on account from Valsad Company, $10,000. Terms 1/10,n/EOM,FOB shipping point. 6 Paid freight bill of $110 on November 4 purchase. 8 Returned half the inventory purchased on November 4 from Valsad Company. 10 Sold merchandise inventory for cash, $1,000. Cost of goods, $400. FOB destination. 11 Sold merchandise inventory to Garland Corporation, $10,000, on account, terms of 1/10,n/EOM. Cost of goods, $5,000. FOB shipping point. 12 Paid freight bill of $50 on November 10 sale. 13 Sold merchandise inventory to Cabot Company, $8,700, on account, terms of n/45. Cost of goods, $4,785. FOB shipping point. 14 Paid the amount owed on account from November 4 , less return and discount. 17 Received defective inventory as a sales return from the November 13 sale, $300. Cost of goods, $165 End of Chapter: Merchandising Options terms of 1/10, n/EOM. Cost of goods, $5,000. FOE shipping point. 12 Paid freight bill of $50 on November 10 sale. 13 Sold merchandise inventory to Cabot Company, $8,700, on account, terms of n/45. Cost of goods, $4,785. FOB shipping point. 14 Paid the amount owed on account from November 4 , less return and discount. 17 Received defective inventory as a sales return from the November 13 sale, $300. Cost of goods, $165. 18 Purchased inventory of $4,000 on account from Rainer Corporation. Payment terms were 2/10,n/30, FOB destination. 20 Received cash from Garland Corporation, less discount. 26 Paid amount owed on account from November 18 , less discount. 28 Received cash from Cabot Company, less return. 29 Purchased inventory from Swift Corporation for cash, $11,900, FOB shipping point. Freight in paid to shipping company, $200. P-F:5-38A Journalizing adjusting entries, preparing adjusted trial P-F:5-38A Journalizing adjusting entries, preparing adjusted trial balance, and preparing multi-step income statement (Learning Objectives 4, 5) The unadjusted trial balance for Tiger Electronics Company at March 31, 2024, follows: End of Chapter: Merchandising Options End of Chapter: Merchandising Options P-F:5B-41A Journalizing purchase and sale transactions-periodic inventory system (Learning Objective 8) Appendix 5B Journalize the following transactions that occurred in March for Double Company. Assume Double uses the periodic inventory system. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. Double estimates sales returns at the end of each month. Mar. 3 Purchased merchandise inventory on account from Sidecki Wholesalers, \$5,500. Terms 2/15,n/EOM, FOB shipping point. 4 Paid freight bill of $70 on March 3 purchase. 4 Purchased merchandise inventory for cash of $1,100. 6 Returned $900 of inventory from March 3 purchase. End of Chapter: Merchandising Options Mar. 3 Purchased merchandise inventoly on account irom Sidecki Wholesalers, 55,500. Terms 2/15, n/EOM, FOB shipping point. 4 Paid freight bill of $70 on March 3 purchase. 4 Purchased merchandise inventory for cash of $1,100. 6 Returned $900 of inventory from March 3 purchase. 8 Sold merchandise inventory to Herrick Company, $3,400, on account. Terms 1/15,n/35. 9 Purchased merchandise inventory on account from Tex Wholesalers, $5,600. Terms 2/10,n/30,FOB destination. 10 Made payment to Sidecki Wholesalers for goods purchased on March 3, less return and discount. 12 Received payment from Herrick Company, less discount. 13 After negotiations, received a $500 allowance from Tex Wholesalers. 15 Sold merchandise inventory to Jesper Company, \$1,700, on account. Terms n/EOM. 22 Made payment, less allowance, to Tex Wholesalers for goods purchased on March 9. 23 Jesper Company returned $300 of the merchandise sold on March 15. 25 Sold merchandise inventory to Salter for $1,000 on account. Terms of 1/10,n/30 was offered, FOB shipping point. 29 Received payment from Salter, less discount. End of Chapter: Merchandising Options 9 Purchased merchandise inventory on account from Tex Wholesalers, $5,600. Terms 2/10,n/30, FOB destination. 10 Made payment to Sidecki Wholesalers for goods purchased on March 3, less return and discount. 12 Received payment from Herrick Company, less discount. 13 After negotiations, received a $500 allowance from Tex Wholesalers. 15 Sold merchandise inventory to Jesper Company, $1,700, on account. Terms n/EOM. 22 Made payment, less allowance, to Tex Wholesalers for goods purchased on March 9. 23 Jesper Company returned $300 of the merchandise sold on March 15. 25 Sold merchandise inventory to Salter for $1,000 on account. Terms of 1/10,n/30 was offered, FOB shipping point. 29 Received payment from Salter, less discount. 30 Received payment from Jesper Company, less return