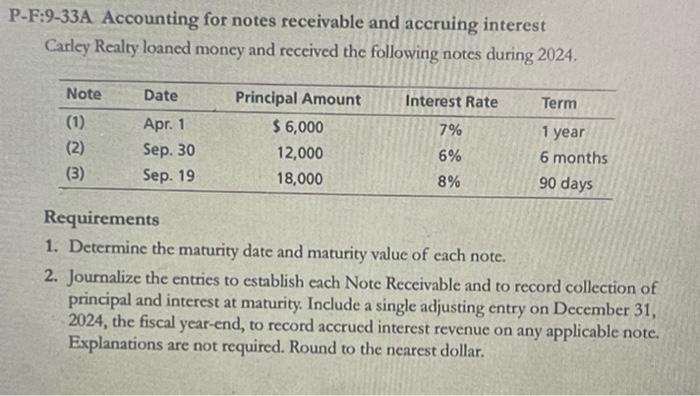

P-F:9-33A Accounting for notes receivable and accruing interest Carley Realty loaned money and received the following notes during 2024. Note (1) (2) (3) Date Apr. 1 Sep. 30 Sep. 19 Principal Amount $ 6,000 12,000 18,000 Interest Rate 7% 6% 8% Term 1 year 6 months 90 days Requirements 1. Determine the maturity date and maturity value of each note. 2. Journalize the entries to establish each Note Receivable and to record collection of principal and interest at maturity. Include a single adjusting entry on December 31, 2024, the fiscal year-end, to record accrued interest revenue on any applicable note. Explanations are not required. Round to the nearest dollar.

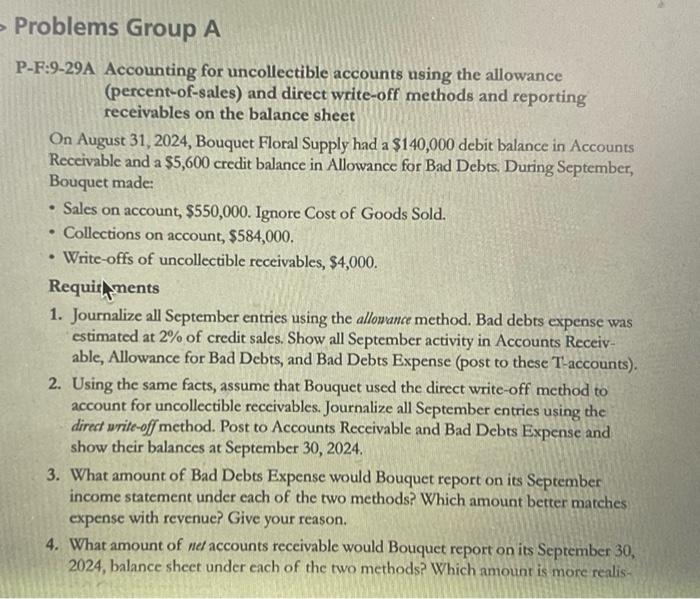

P-F:9-33A Accounting for notes receivable and accruing interest Carley Realty loaned money and received the following notes during 2024. Requirements 1. Determine the maturity date and maturity value of each note. 2. Journalize the entries to establish each Note Receivable and to record collection of principal and interest at maturity. Include a single adjusting entry on December 31 , 2024, the fiscal year-end, to record accrued interest revenue on any applicable note. Explanations are not required. Round to the nearest dollar. -F:9-29A Accounting for uncollectible accounts using the allowance (percent-of-sales) and direct write-off methods and reporting receivables on the balance sheet On August 31, 2024, Bouquet Floral Supply had a $140,000 debit balance in Accounts Receivable and a $5,600 credit balance in Allowance for Bad Debts. During September, Bouquet made: - Sales on account, $550,000. Ignore Cost of Goods Sold. - Collections on account, $584,000. - Write-offs of uncollectible receivables, $4,000. Requirhents 1. Journalize all September entries using the allowance method. Bad debts expense was estimated at 2% of credit sales. Show all September activity in Accounts Receivable, Allowance for Bad Debts, and Bad Debts Expense (post to these T-accounts). 2. Using the same facts, assume that Bouquet used the direct write-off method to account for uncollectible reccivables. Journalize all September entries using the direct write-off method. Post to Accounts Receivable and Bad Debts Expense and show their balances at September 30, 2024. 3. What amount of Bad Debts Expense would Bouquet report on its September income statement under each of the two methods? Which amount better matehes expense with revenue? Give your reason. 4. What amount of net accounts receivable would Bouquet report on its September 30 , 2024, balance sheet under each of the two methods? Which amount is more realis- receivables on the balance sheet On August 31, 2024, Bouquet Floml Supply had a $140,000 debit balance in Accounts Receivable and a $5,600 credit balance in Allowance for Bad Debts. During September. Bouquet made: - Sales on account, $550,000. Ignore Cost of Goods Sold. - Collections on account, $584,000. - Write-offs of ncollectible receivables, $4,000. Requirements 1. Journalize all September entries using the allonance method. Bad debts expense was estimated at 2% of credit sales. Show all September activity in Accounts Receivable, Allowance for Bad Debts, and Bad Debts Expense (post to these T-accounts). 2. Using the same facts, assume that Bouquet used the direct write-off method to account for uncollectible receivibles. Journalize all September entries using the direct write-off method. Post to Accounts Reccivable and Bad Debts Expense and show their balances at September 30, 2024. 3. What amount of Bad Debts Expense would Bouquet report on its September income statement under each of the two methods? Which amount better matches expense with revenue? Give your reason. 4. What amount of net accounts receivable would Bouquet report on its September 30 , 2024 , balance sheet under each of the two methods? Which amount is more realistic? Give your reason