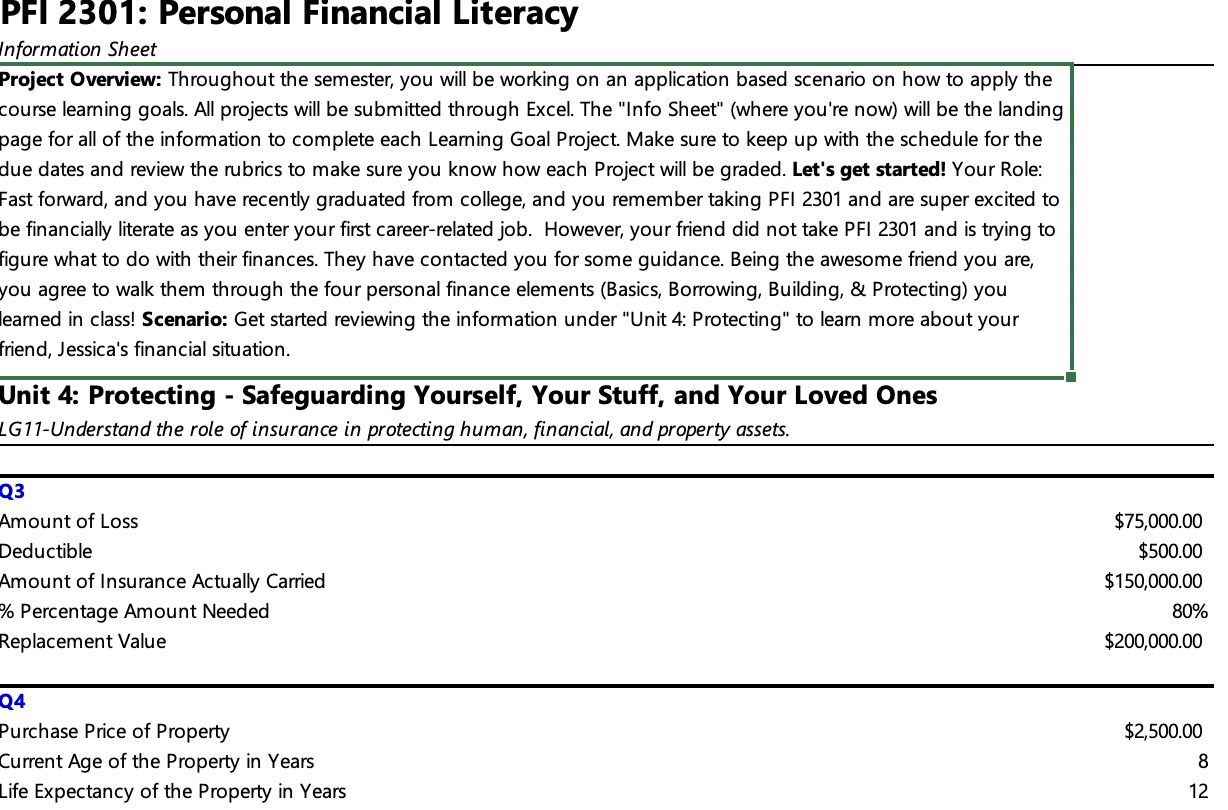

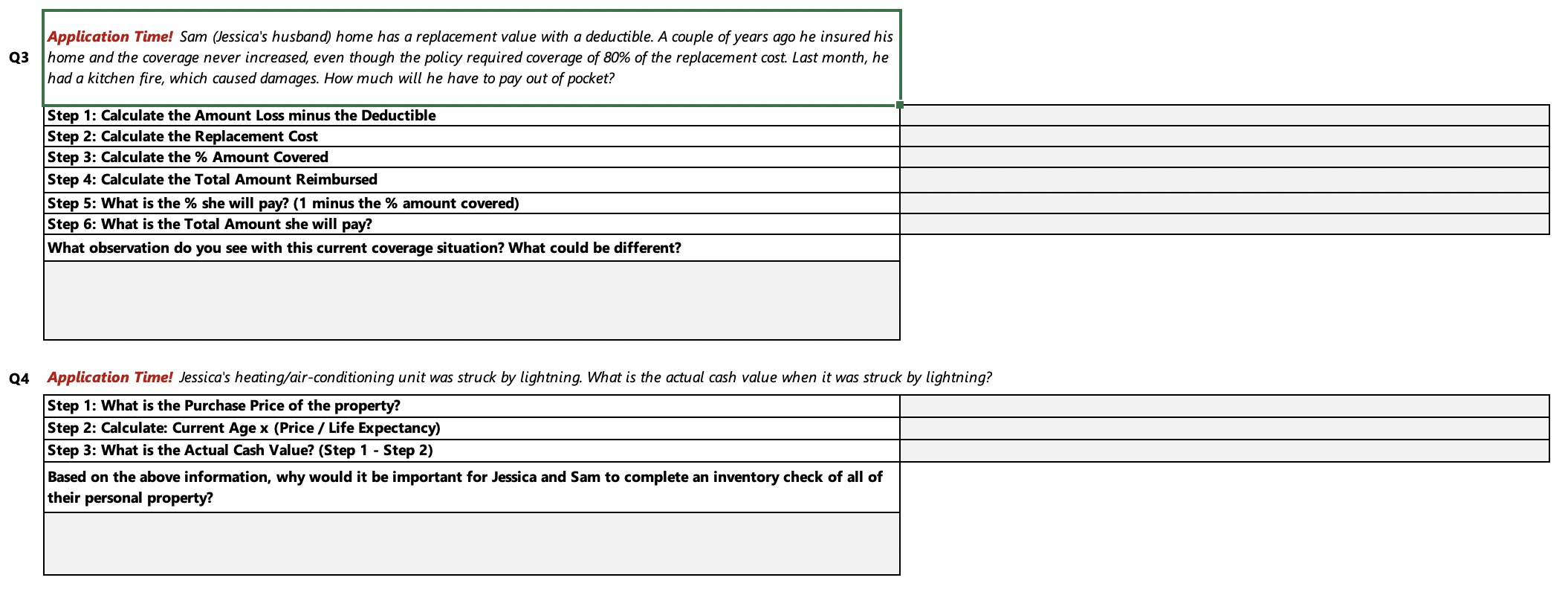

PFI 2301: Personal Financial Literacy Information Sheet Project Overview: Throughout the semester, you will be working on an application based scenario on how to apply the course learning goals. All projects will be submitted through Excel. The "Info Sheet" (where you're now) will be the landing page for all of the information to complete each Learning Goal Project. Make sure to keep up with the schedule for the due dates and review the rubrics to make sure you know how each Project will be graded. Let's get started! Your Role: Fast forward, and you have recently graduated from college, and you remember taking PFI 2301 and are super excited to be financially literate as you enter your first career-related job. However, your friend did not take PFI 2301 and is trying to figure what to do with their finances. They have contacted you for some guidance. Being the awesome friend you are, you agree to walk them through the four personal finance elements (Basics, Borrowing, Building, & Protecting) you learned in class! Scenario: Get started reviewing the information under "Unit 4: Protecting" to learn more about your friend, Jessica's financial situation. Unit 4: Protecting - Safeguarding Yourself, Your Stuff, and Your Loved Ones LG11-Understand the role of insurance in protecting human, financial, and property assets. Q3 Amount of Loss Deductible Amount of Insurance Actually Carried % Percentage Amount Needed Replacement Value Q4 Purchase Price of Property Current Age of the Property in Years Life Expectancy of the Property in Years $75,000.00 $500.00 $150,000.00 80% $200,000.00 $2,500.00 8 12 Application Time! Sam (Jessica's husband) home has a replacement value with a deductible. A couple of years ago he insured his Q3 home and the coverage never increased, even though the policy required coverage of 80% of the replacement cost. Last month, he had a kitchen fire, which caused damages. How much will he have to pay out of pocket? Step 1: Calculate the Amount Loss minus the Deductible Step 2: Calculate the Replacement Cost Step 3: Calculate the % Amount Covered Step 4: Calculate the Total Amount Reimbursed Step 5: What is the % she will pay? (1 minus the % amount covered) Step 6: What is the Total Amount she will pay? What observation do you see with this current coverage situation? What could be different? Q4 Application Time! Jessica's heating/air-conditioning unit was struck by lightning. What is the actual cash value when it was struck by lightning? Step 1: What is the Purchase Price of the property? Step 2: Calculate: Current Age x (Price / Life Expectancy) Step 3: What is the Actual Cash Value? (Step 1 - Step 2) Based on the above information, why would it be important for Jessica and Sam to complete an inventory check of all of their personal property? PFI 2301: Personal Financial Literacy Information Sheet Project Overview: Throughout the semester, you will be working on an application based scenario on how to apply the course learning goals. All projects will be submitted through Excel. The "Info Sheet" (where you're now) will be the landing page for all of the information to complete each Learning Goal Project. Make sure to keep up with the schedule for the due dates and review the rubrics to make sure you know how each Project will be graded. Let's get started! Your Role: Fast forward, and you have recently graduated from college, and you remember taking PFI 2301 and are super excited to be financially literate as you enter your first career-related job. However, your friend did not take PFI 2301 and is trying to figure what to do with their finances. They have contacted you for some guidance. Being the awesome friend you are, you agree to walk them through the four personal finance elements (Basics, Borrowing, Building, & Protecting) you learned in class! Scenario: Get started reviewing the information under "Unit 4: Protecting" to learn more about your friend, Jessica's financial situation. Unit 4: Protecting - Safeguarding Yourself, Your Stuff, and Your Loved Ones LG11-Understand the role of insurance in protecting human, financial, and property assets. Q3 Amount of Loss Deductible Amount of Insurance Actually Carried % Percentage Amount Needed Replacement Value Q4 Purchase Price of Property Current Age of the Property in Years Life Expectancy of the Property in Years $75,000.00 $500.00 $150,000.00 80% $200,000.00 $2,500.00 8 12 Application Time! Sam (Jessica's husband) home has a replacement value with a deductible. A couple of years ago he insured his Q3 home and the coverage never increased, even though the policy required coverage of 80% of the replacement cost. Last month, he had a kitchen fire, which caused damages. How much will he have to pay out of pocket? Step 1: Calculate the Amount Loss minus the Deductible Step 2: Calculate the Replacement Cost Step 3: Calculate the % Amount Covered Step 4: Calculate the Total Amount Reimbursed Step 5: What is the % she will pay? (1 minus the % amount covered) Step 6: What is the Total Amount she will pay? What observation do you see with this current coverage situation? What could be different? Q4 Application Time! Jessica's heating/air-conditioning unit was struck by lightning. What is the actual cash value when it was struck by lightning? Step 1: What is the Purchase Price of the property? Step 2: Calculate: Current Age x (Price / Life Expectancy) Step 3: What is the Actual Cash Value? (Step 1 - Step 2) Based on the above information, why would it be important for Jessica and Sam to complete an inventory check of all of their personal property