Question

P.FINANCE Based on Statement of Comprehensive Income and Statements of Financial Position, you need to calculate financial ratios (show your workings). Based on your calculation,

P.FINANCE

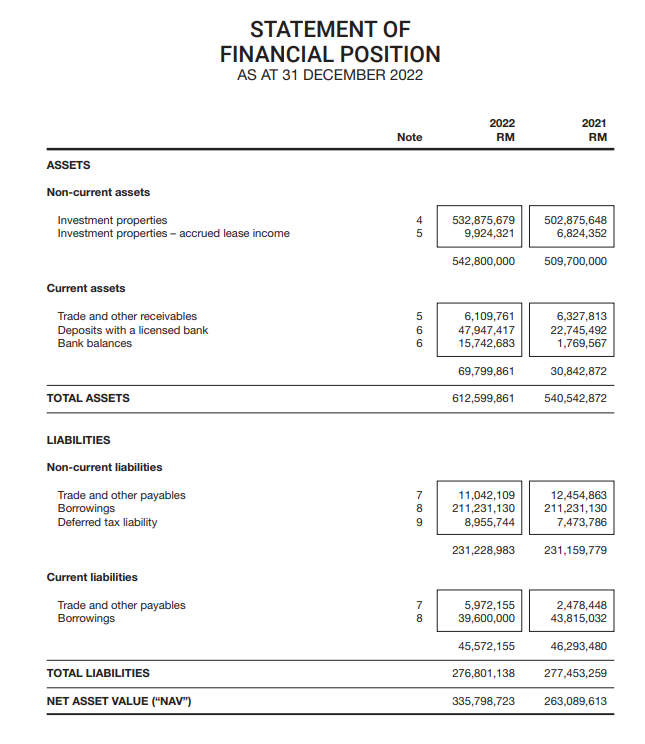

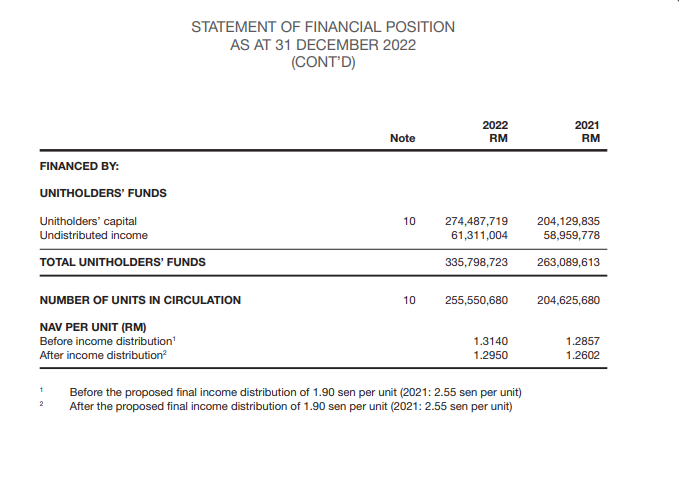

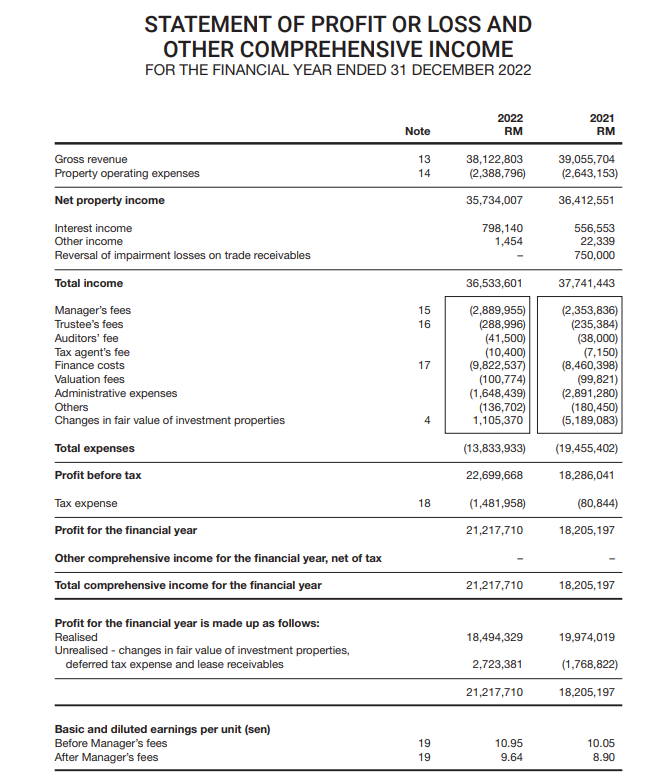

Based on Statement of Comprehensive Income and Statements of Financial Position, you need to calculate financial ratios (show your workings). Based on your calculation, interpret, and compare the performance for the year 2022 and the year 2021 based on the following categories of ratio:

| Liquidity: |

| i. Current ratio |

| ii. Quick ratio |

| Asset Management: |

| i. Inventory turnover |

| ii. Receivables turnover |

| iii. Total assets turnover |

| iv. Average collection period |

| Debt Management: |

| i. Total debt ratio |

| ii. Times interest earned ratio |

| Profitability: |

| i. Net profit margin |

| ii. Return on assets |

| iii. Return on equity |

PLS DO HELP ME TO ANSWER THE QUESTIONS. I'M POSTING THIS FOR THE SECOND TIME. PLS I DONT WANT ANY COPY & PASTE WORK. THANK YOU...

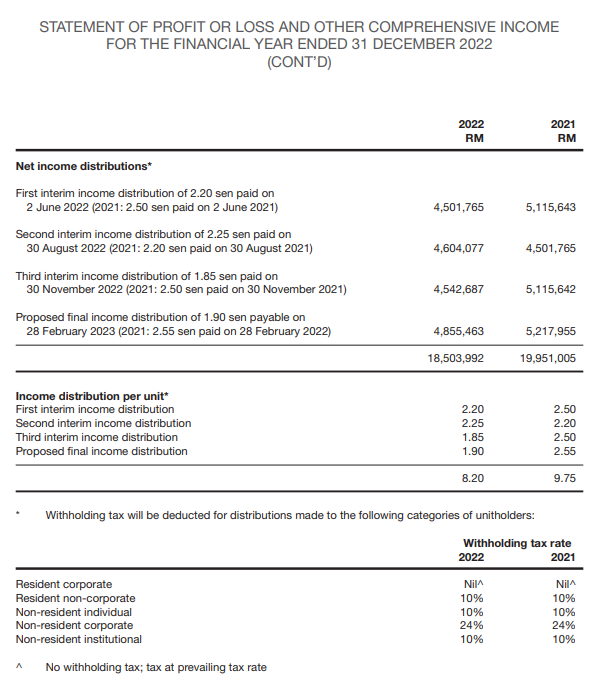

STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2022 \begin{tabular}{rrrrr} & & 2022 & 2021 \\ & Note & RM & RM \\ \hline \end{tabular} ASSETS Non-current assets Investment properties Investment properties - accrued lease income Current assets LIABILITIES Non-current liabilities Trade and other payables Borrowings Deferred tax liability Current liabilities Trade and other payables Borrowings STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2022 (CONT'D) Before the proposed final income distribution of 1.90 sen per unit (2021: 2.55 sen per unit) After the proposed final income distribution of 1.90 sen per unit (2021: 2.55 sen per unit) STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2022 STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2022 (CONT'D) 2022 ncome distribution per unit* First interim income distribution Second interim income distribution Third interim income distribution Proposed final income distribution \begin{tabular}{ll} 2.20 & 2.50 \\ 2.25 & 2.20 \\ 1.85 & 2.50 \\ 1.90 & 2.55 \\ \hline 8.20 & 9.75 \\ \hline \end{tabular} Withholding tax will be deducted for distributions made to the following categories of unitholdersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started