Question

Pfizer is one of the leading pharmaceutical companies located in New York. The massive efforts of Pfizer's research and development team have led to the

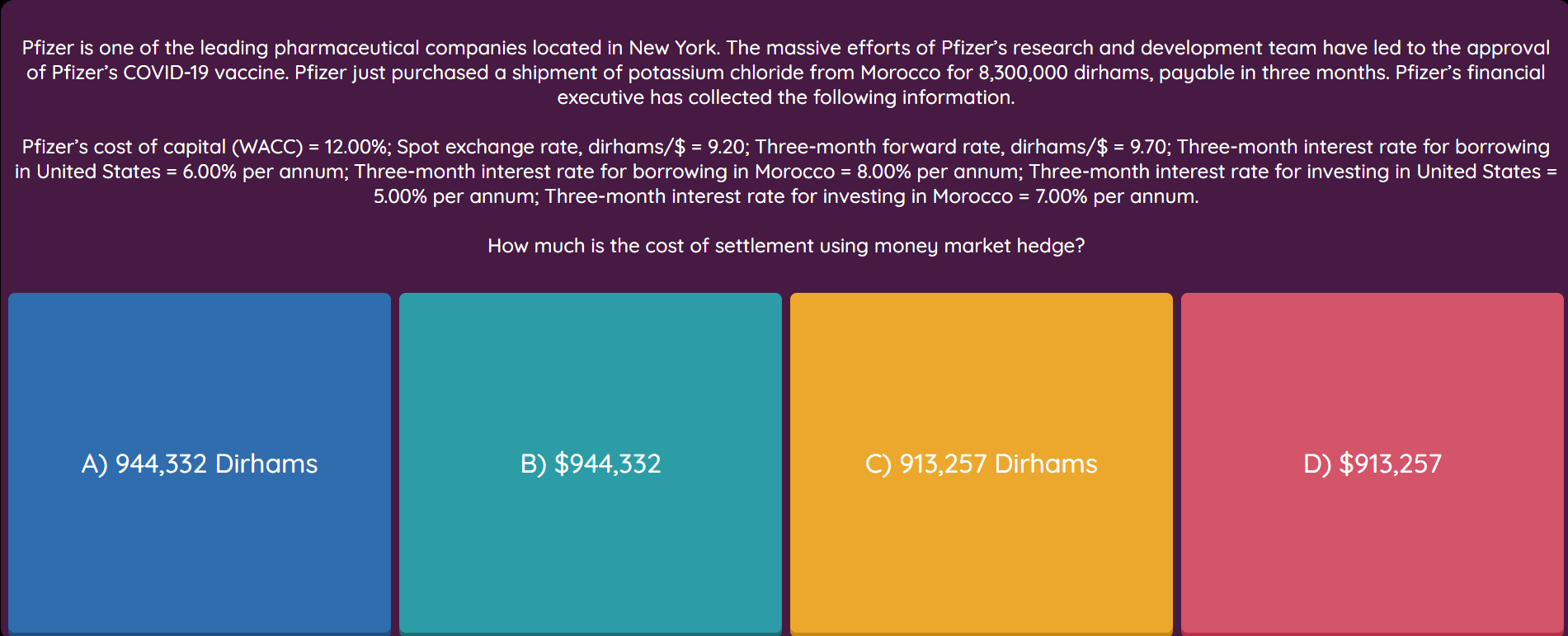

Pfizer is one of the leading pharmaceutical companies located in New York. The massive efforts of Pfizer's research and development team have led to the approval of Pfizer's COVID-19 vaccine. Pfizer just purchased a shipment of potassium chloride from Morocco for 8,300,000 dirhams, payable in three months. Pfizer's financial executive has collected the following information.Pfizer's cost of capital (WACC) = 12.00%; Spot exchange rate, dirhams/$ = 9.20; Three-month forward rate, dirhams/$ = 9.70; Three-month interest rate for borrowing in United States = 6.00% per annum; Three-month interest rate for borrowing in Morocco = 8.00% per annum; Three-month interest rate for investing in United States = 5.00% per annum; Three-month interest rate for investing in Morocco = 7.00% per annum. How much is the cost of settlement using money market hedge? A.944332 Dirhams B.$944332 C.913257 Dirhams D.$913257

Pfizer is one of the leading pharmaceutical companies located in New York. The massive efforts of Pfizer's research and development team have led to the approval of Pfizer's COVID-19 vaccine. Pfizer just purchased a shipment of potassium chloride from Morocco for 8,300,000 dirhams, payable in three months. Pfizer's financial executive has collected the following information.Pfizer's cost of capital (WACC) = 12.00%; Spot exchange rate, dirhams/$ = 9.20; Three-month forward rate, dirhams/$ = 9.70; Three-month interest rate for borrowing in United States = 6.00% per annum; Three-month interest rate for borrowing in Morocco = 8.00% per annum; Three-month interest rate for investing in United States = 5.00% per annum; Three-month interest rate for investing in Morocco = 7.00% per annum. How much is the cost of settlement using money market hedge? A.944332 Dirhams B.$944332 C.913257 Dirhams D.$913257

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started