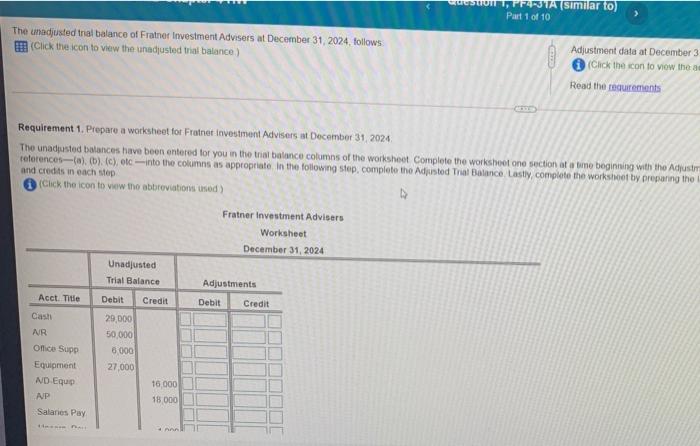

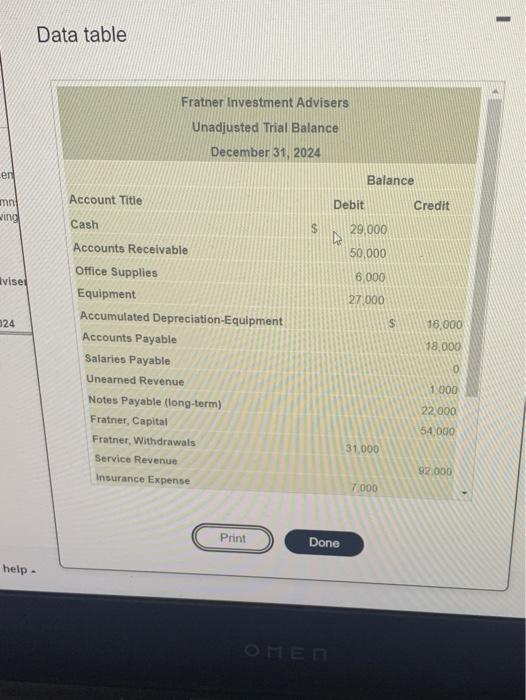

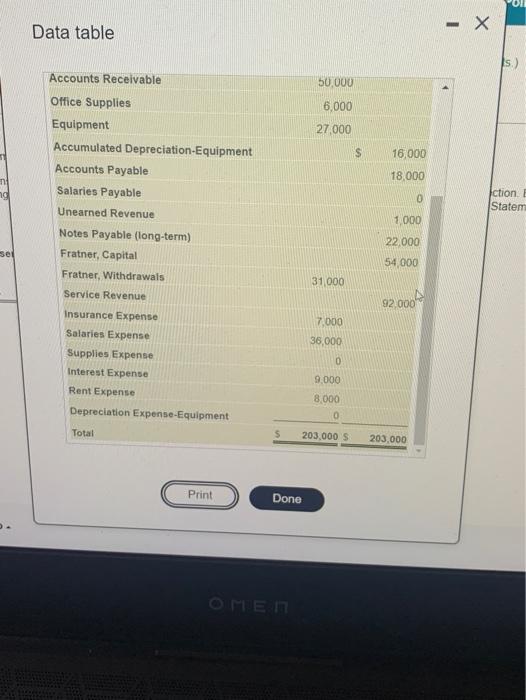

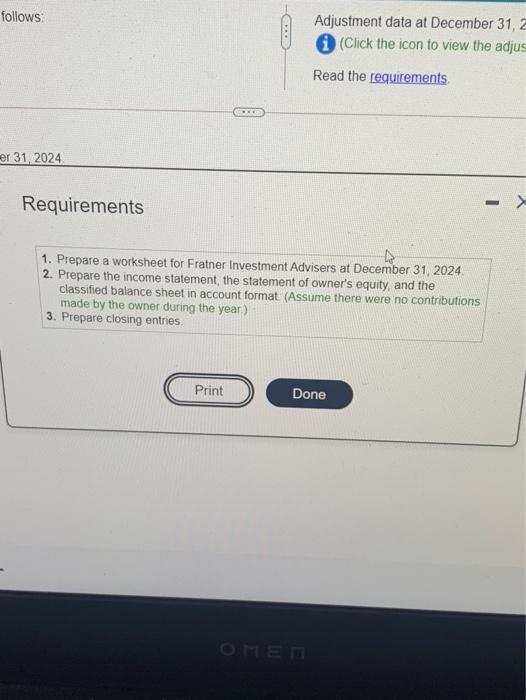

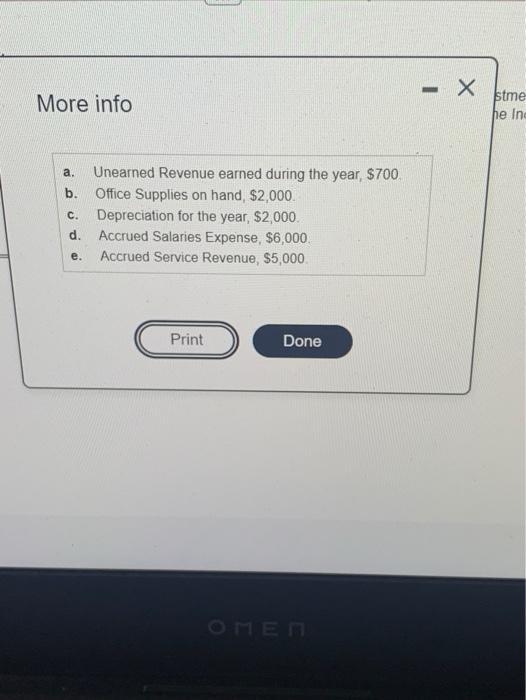

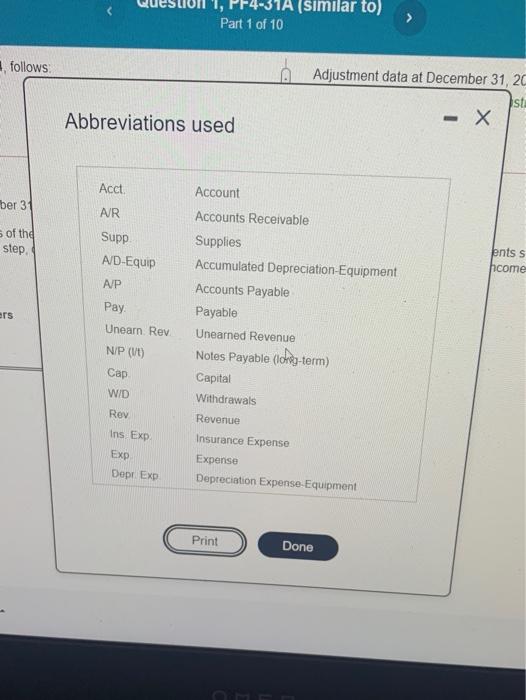

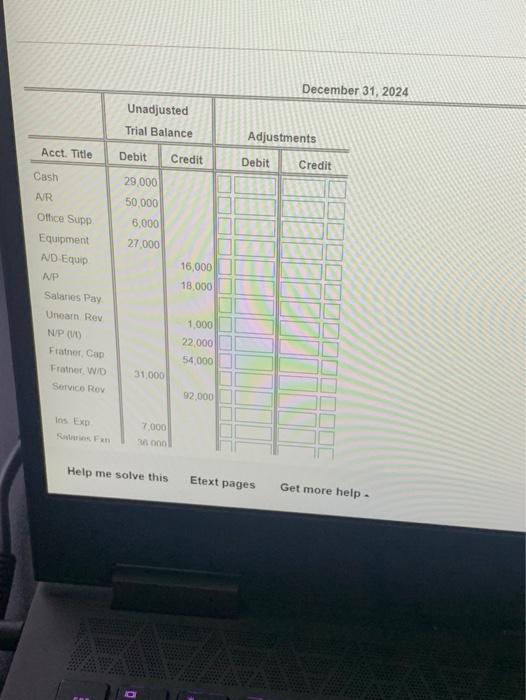

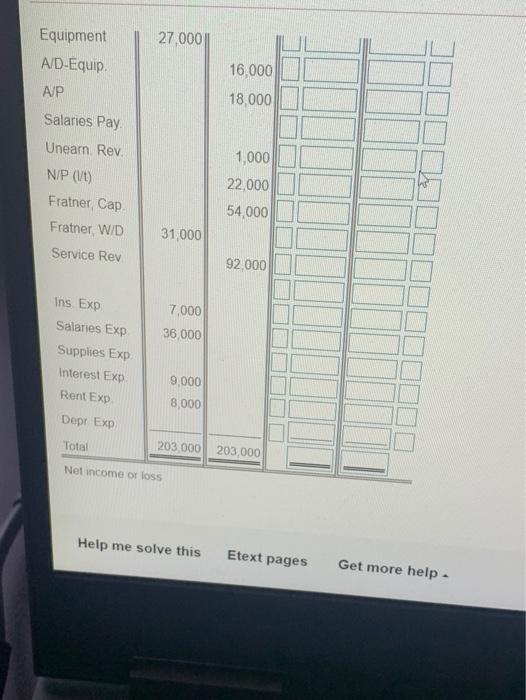

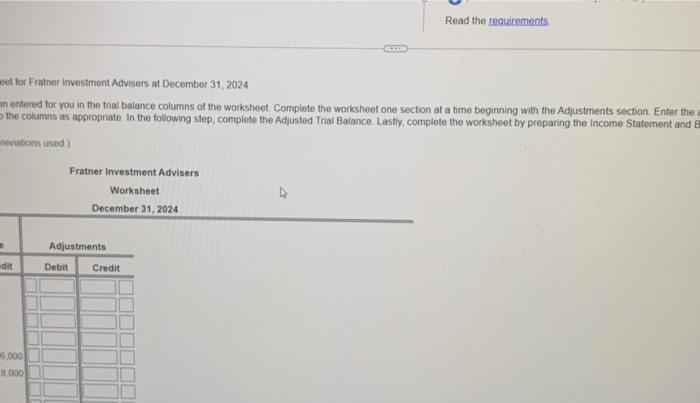

PFPUTA (similar to Part 1 of 10 The unadjusted trial balance of Fratner Investment Advisers at December 31, 2024. follows: Click the icon to view the unadjusted trial balance) Adjustment data December 3 (Click the icon to viow the Read the requirements Requirement 1. Prepare a worksheet for Fratnet investment Advisers at December 31, 2024 The unadjusted balances have been entered for you in the trial balance columns of the worksheet Complete the workshoot one section at a time beginning with the Adjust tetorences-(a), (b), (c), oc - nto the columns as appropriate. In the following step, complete the digested Trial Balance Lastly, complete the workshoot by preparing the and credits in each step (Click the icon to view the abbreviations used) Fratner Investment Advisers Worksheet December 31, 2024 Unadjusted Trial Balance Adjustments Acct. Title Credit Debit Credit Cash AR Office Supp Equipment ND Equip AP Salaries Pay Debit 29.000 50,000 6000 27.000 16 000 18.000 1 Data table Fratner Investment Advisers Unadjusted Trial Balance December 31, 2024 ent Account Title Balance Debit Credit 29,000 ing 50,000 Ivisel 6.000 27 000 524 S 16.000 Cash Accounts Receivable Office Supplies Equipment Accumulated Depreciation Equipment Accounts Payable Salaries Payable Unearned Revenue Notes Payable (long-term) Fratner, Capital Fratner, Withdrawals Service Revenue Insurance Expense 18.000 0 1000 22 000 54 000 31,000 92 000 7 000 Print Done help . - - X Data table s.) Accounts Receivable 50.000 6,000 27,000 16 000 en 18.000 ng 0 ction. Statem 1,000 22,000 sel Office Supplies Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries Payable Unearned Revenue Notes Payable (long-term) Fratner, Capital Fratner, Withdrawals Service Revenue Insurance Expense Salaries Expense Supplies Expense Interest Expense Rent Expense Depreciation Expense-Equipment 54 000 31 000 92.000 7,000 36,000 0 9.000 8,000 0 Total 203.000 S 203.000 Print Done OME follows Adjustment data at December 31, 2 (Click the icon to view the adjus Read the requirements er 31, 2024 Requirements -> 1. Prepare a worksheet for Fratner Investment Advisers at December 31, 2024 2. Prepare the income statement, the statement of owner's equity, and the classified balance sheet in account format (Assume there were no contributions made by the owner during the year.) 3. Prepare closing entries Print Done OME - - More info stme he in a. Unearned Revenue earned during the year, $700 b. Office Supplies on hand $2,000. Depreciation for the year, $2,000. d. Accrued Salaries Expense, $6,000 e. Accrued Service Revenue, $5,000 C. Print Done . 4-31A (similar to) Part 1 of 10 follows: A Adjustment data at December 31, 20 St. - X Abbreviations used Acct ber 31 AR s of the step. Supp A/D-Equip ents s hcome AP Account Accounts Receivable Supplies Accumulated Depreciation Equipment Accounts Payable Payable Unearned Revenue Notes Payable (cheg-term) Capital Withdrawals ers Pay Unearn Rev NP () Cap Revenue WID Rev Ins Exp Exp Dopr Exp Insurance Expense Expense Depreciation Expense Equipment Print Done December 31, 2024 Unadjusted Trial Balance Adjustments Acct. Title Debit Credit Debit Credit Cash 29 000 AR 50.000 Ottice Supp 6,000 Equipment 27 000 AD Equip NP Salates Pay Uncat Rev NP (0) Frant Cap Frater WID 31.000 Service Rov 16,000 18.000 1.000 22.000 54.000 92.000 las Exp 7.000 000 Help me solve this Etext pages Get more help 27,000 Equipment A/D-Equip AJP 16,000 18,000 Salaries Pay Unear Rev NIP (1/1) Fratner, Cap Fratner, W/D Service Rev 1,000 22,000 54,000 31,000 92,000 7,000 36,000 Ins Exp Salanes Exp Supplies Exp Interest Exp Rent Exp 9,000 8,000 Depr. Exp Total 203.000 203,000 Net income or loss Help me solve this Etext pages Get more help Read the requirements set for Frotner Investment Advisers at December 31, 2024 an entered for you in the trial balance columns of the worksheet Complete the worksheet one section at a time beginning with the Adjustments section Enter the the columns as appropriate. In the following stop, complete the Adjusted Trial Balance Lastly, complete the worksheet by preparing the income Statement and ceviations used Fratner Investment Advisers Worksheet December 31, 2024 Adjustments dit Debit Credit 0.000 8 000