Answered step by step

Verified Expert Solution

Question

1 Approved Answer

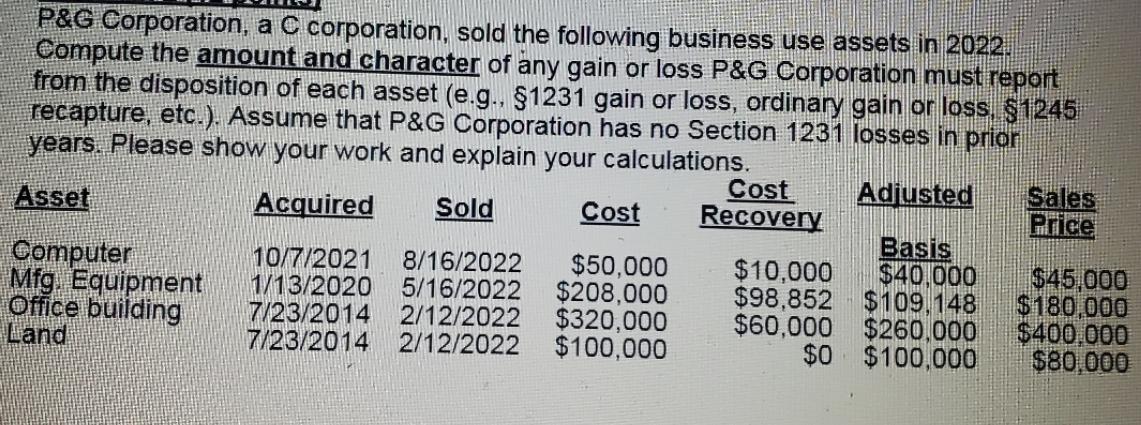

P&G Corporation, a C corporation, sold the following business use assets in 2022. Compute the amount and character of any gain or loss P&G

P&G Corporation, a C corporation, sold the following business use assets in 2022. Compute the amount and character of any gain or loss P&G Corporation must report from the disposition of each asset (e.g., 1231 gain or loss, ordinary gain or loss, 1245 recapture, etc.). Assume that P&G Corporation has no Section 1231 losses in prior years. Please show your work and explain your calculations. Asset Acquired Sold Cost 8/16/2022 $50,000 10/7/2021 1/13/2020 5/16/2022 $208,000 7/23/2014 2/12/2022 $320,000 7/23/2014 2/12/2022 $100,000 Computer Mfg. Equipment Office building Land Cost Recovery Adjusted Basis $10,000 $40,000 $98,852 $109,148 $60,000 $260,000 $0 $100,000 Sales Price $45,000 $180,000 $400.000 $80,000

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Gains and losses are the result of selling capital assets held for investment purposes such as stock...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started