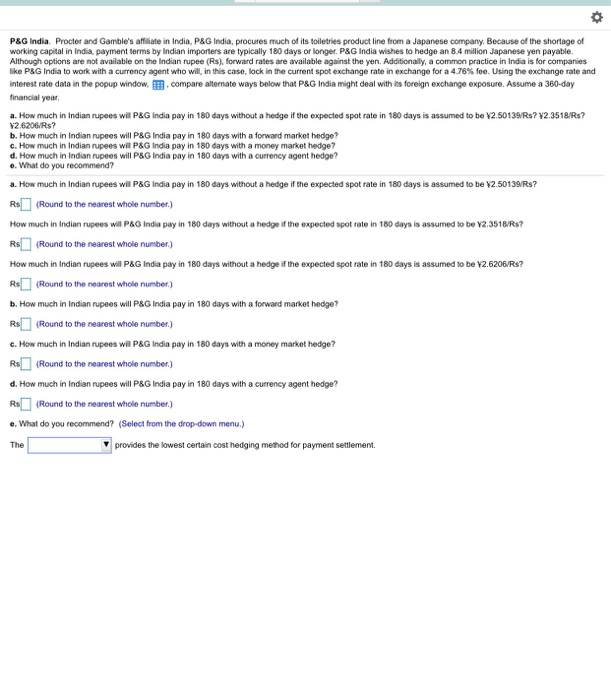

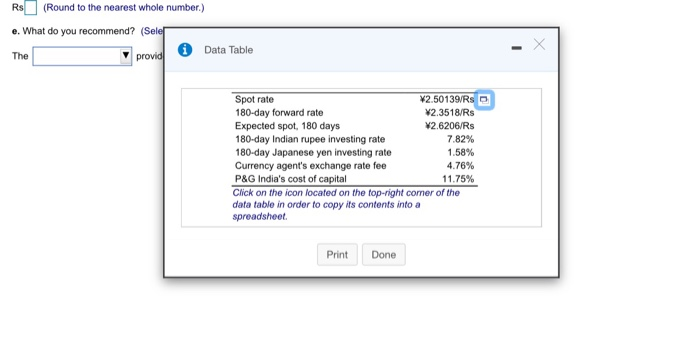

P&G India. Procter and Gamble's affiliate in India, P&G India, procures much of its toiletries product line from a Japanese company, Because of the shortage of working capital in India, payment terms by indian importers are typically 180 days or longer. P&G India wishes to hedge an 8.4 million Japanese yen payable. Although options are not available on the Indian rupee (Rs), forward rates are available against the yen. Additionally, a common practice in India is for companies like P&G India to work with a currency agent who will in this case, lock in the current spot exchange rate in exchange for a 4.76% fee. Using the exchange rate and interest rate data in the popup window. .compare alternate ways below that P&G India might deal with its foreign exchange exposure. Assume a 360-day financial year a. How much in Indian rupees will P&G India pay in 180 days without a hedge if the expected spot rate in 180 days is assumed to be 42.50139/Rs? 2.3518/Rs? 42.62063RS? b. How much in Indian rupees will P&G India pay in 180 days with a forward market hedge? c. How much in Indian rupees wil P&G India pay in 180 days with a money market hedge? d. How much in Indian rupees will P&G India pay in 180 days with a currency agent hedoo? e. What do you recommend? a. How much in Indian rupees will P&G India pay in 180 days without a hedge if the expected spot rate in 180 days is assumed to be Y2.50139 RS? Rs (Round to the nearest whole number.) How much in Indian rupees will P& India pay in 180 days without a hedge if the expected spot rate in 180 days is assumed to be Y2.3518/Rs? RS (Round to the nearest whole number.) How much in Indian rupees wil P&G India pay in 180 days without a hedge if the expected spot rate in 180 days is assumed to be Y2.6206/RS? Rs_(Round to the nearest whole number) b. How much in Indian rupees will P&G India pay in 180 days with a forward market hedge? RS (Round to the nearest whole number.) c. How much in Indian rupees wil P&G India pay in 180 days with a money market hedge? Rs (Round to the nearest whole number.) d. How much in Indian rupees will P&G India pay in 180 days with a currency agent hedge? RS (Round to the nearest whole number.) e. What do you recommend? (Select from the drop-down menu.) The provides the lowest certain cost hedging method for payment settlement Rs (Round to the nearest whole number.) e. What do you recommend? (Seler The provid 0 Data Table Spot rate 2.50139/Rs 180-day forward rate V2.3518/Rs Expected spot, 180 days 12.6206/RS 180-day Indian rupee investing rate 7.82% 180-day Japanese yen investing rate 1.58% Currency agent's exchange rate fee 4.76% P&G India's cost of capital 11.75% Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet Print Done