Answered step by step

Verified Expert Solution

Question

1 Approved Answer

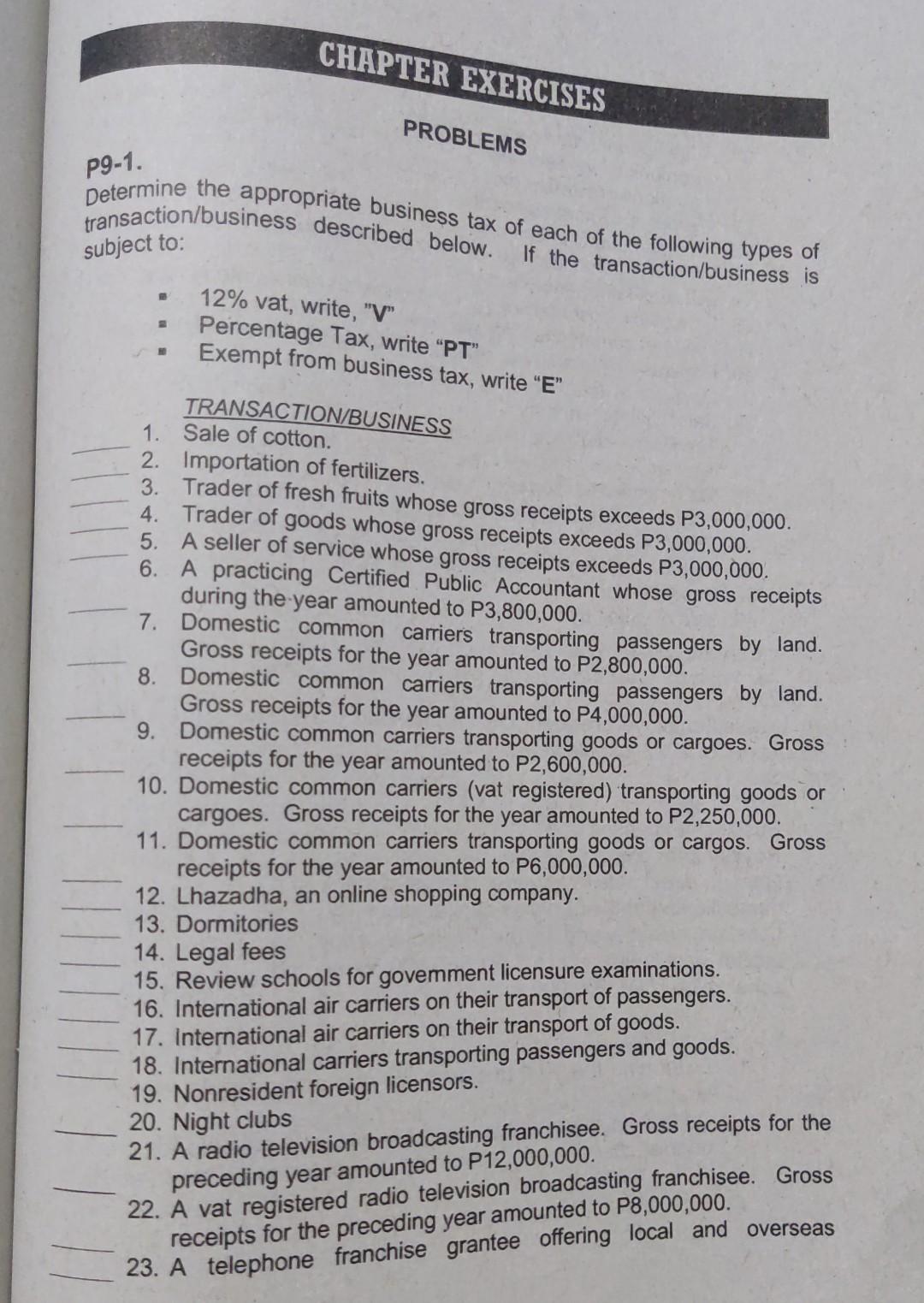

pg-1. Determine the appropriate business tax of each of the following types of transaction/business described below. If the transaction/business is subject to: - 12% vat,

pg-1. Determine the appropriate business tax of each of the following types of transaction/business described below. If the transaction/business is subject to: - 12% vat, write, "V" - Percentage Tax, write "PT" " Exempt from business tax, write "E" TRANSACTION/BUSINESS 1. Sale of cotton. 2. Importation of fertilizers. 3. Trader of fresh fruits whose gross receipts exceeds P3,000,000. 4. Trader of goods whose gross receipts exceeds P3,000,000. 5. A seller of service whose gross receipts exceeds P3,000,000. 6. A practicing Certified Public Accountant whose gross receipts during the year amounted to P3,800,000. 7. Domestic common carriers transporting passengers by land. Gross receipts for the year amounted to P2,800,000. 8. Domestic common carriers transporting passengers by land. Gross receipts for the year amounted to P4,000,000. 9. Domestic common carriers transporting goods or cargoes. Gross receipts for the year amounted to P2,600,000. 10. Domestic common carriers (vat registered) transporting goods or cargoes. Gross receipts for the year amounted to P2,250,000. 11. Domestic common carriers transporting goods or cargos. Gross receipts for the year amounted to P6,000,000. 12. Lhazadha, an online shopping company. 13. Dormitories 14. Legal fees 15. Review schools for govemment licensure examinations. 16. International air carriers on their transport of passengers. 17. International air carriers on their transport of goods. 18. International carriers transporting passengers and goods. 19. Nonresident foreign licensors. 20. Night clubs 21. A radio television broadcasting franchisee. Gross receipts for the preceding year amounted to P12,000,000. 22. A vat registered radio television broadcasting franchisee. Gross receipts for the preceding year amounted to P8,000,000. 23. A telephone franchise grantee offering local and overseas pg-1. Determine the appropriate business tax of each of the following types of transaction/business described below. If the transaction/business is subject to: - 12% vat, write, "V" - Percentage Tax, write "PT" " Exempt from business tax, write "E" TRANSACTION/BUSINESS 1. Sale of cotton. 2. Importation of fertilizers. 3. Trader of fresh fruits whose gross receipts exceeds P3,000,000. 4. Trader of goods whose gross receipts exceeds P3,000,000. 5. A seller of service whose gross receipts exceeds P3,000,000. 6. A practicing Certified Public Accountant whose gross receipts during the year amounted to P3,800,000. 7. Domestic common carriers transporting passengers by land. Gross receipts for the year amounted to P2,800,000. 8. Domestic common carriers transporting passengers by land. Gross receipts for the year amounted to P4,000,000. 9. Domestic common carriers transporting goods or cargoes. Gross receipts for the year amounted to P2,600,000. 10. Domestic common carriers (vat registered) transporting goods or cargoes. Gross receipts for the year amounted to P2,250,000. 11. Domestic common carriers transporting goods or cargos. Gross receipts for the year amounted to P6,000,000. 12. Lhazadha, an online shopping company. 13. Dormitories 14. Legal fees 15. Review schools for govemment licensure examinations. 16. International air carriers on their transport of passengers. 17. International air carriers on their transport of goods. 18. International carriers transporting passengers and goods. 19. Nonresident foreign licensors. 20. Night clubs 21. A radio television broadcasting franchisee. Gross receipts for the preceding year amounted to P12,000,000. 22. A vat registered radio television broadcasting franchisee. Gross receipts for the preceding year amounted to P8,000,000. 23. A telephone franchise grantee offering local and overseas

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started