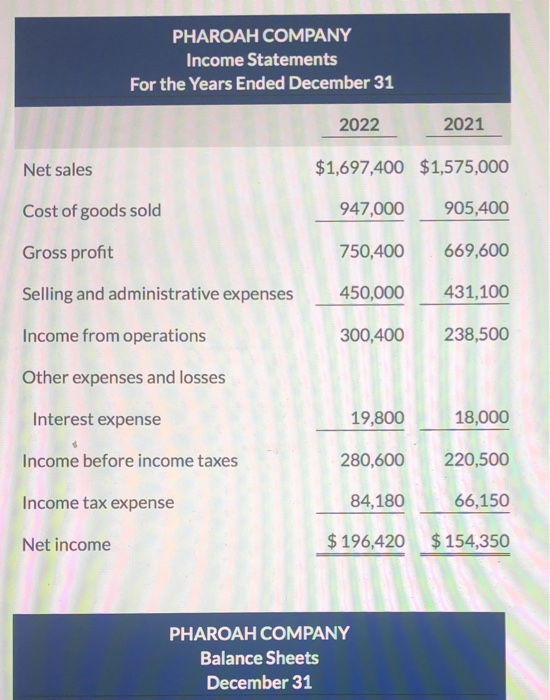

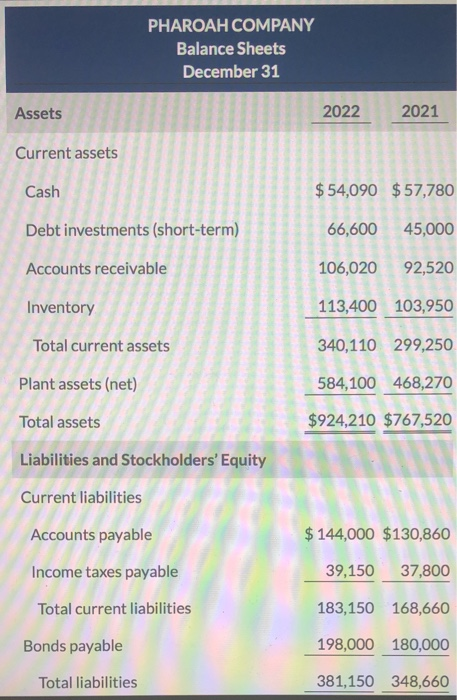

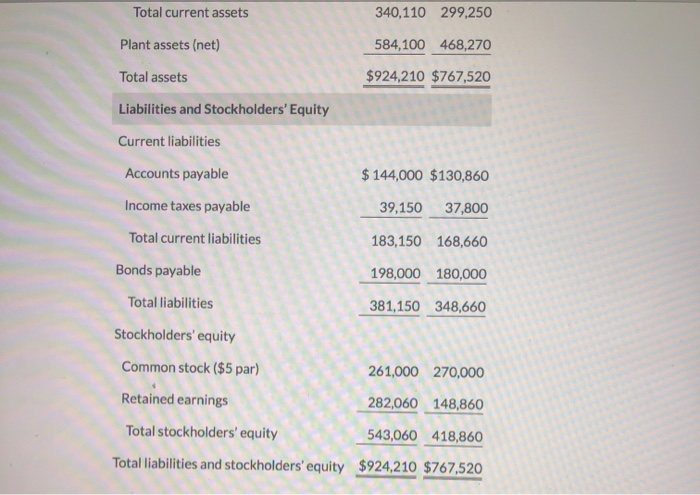

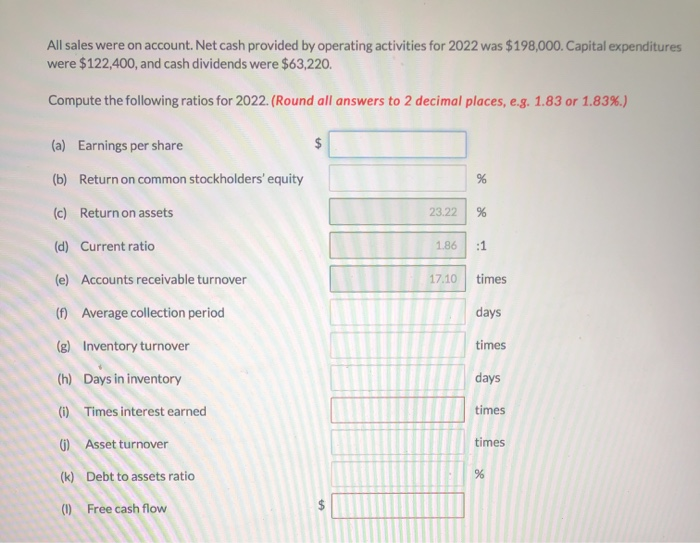

PHAROAH COMPANY Income Statements For the Years Ended December 31 2022 2021 Net sales $1,697,400 $1,575,000 Cost of goods sold 947,000 905,400 Gross profit 750,400 669,600 Selling and administrative expenses 450,000 431,100 Income from operations 300,400 238,500 Other expenses and losses Interest expense 19,800 18,000 Income before income taxes Income tax expense 280,600 84,180 $ 196,420 220,500 66,150 $ 154,350 Net income PHAROAH COMPANY Balance Sheets December 31 PHAROAH COMPANY Balance Sheets December 31 Assets IN 2022 IN IN 2021 Current assets Cash $ 54,090 $ 57,780 Debt investments (short-term) 66,600 45,000 Accounts receivable 106,020 92,520 Inventory 113,400 103,950 Total current assets 340,110 299,250 Plant assets (net) 584,100 468,270 $924,210 $767,520 Total assets TIT Liabilities and Stockholders' Equity Current liabilities Accounts payable $ 144,000 $130,860 Income taxes payable 39,150 37,800 Total current liabilities Bonds payable Total liabilities 183,150 168,660 198,000 180,000 381,150 348,660 Total current assets Plant assets (net) 340,110 299,250 584,100 468,270 $924,210 $767,520 Total assets Liabilities and Stockholders' Current liabilities Accounts payable Income taxes payable $ 144,000 $130,860 39,150 37,800 183,150 168,660 198,000 180,000 Total current liabilities Bonds payable Total liabilities 381,150 348,660 Stockholders' equity 261,000 270,000 282,060 148,860 Common stock ($5 par) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 543,060 418,860 $924,210 $767,520 All sales were on account. Net cash provided by operating activities for 2022 was $198,000. Capital expenditures were $122,400, and cash dividends were $63,220. Compute the following ratios for 2022. (Round all answers to 2 decimal places, e.g. 1.83 or 1.83%.) (a) Earnings per share (b) Return on common stockholders' equity (c) Return on assets (d) Current ratio (e) Accounts receivable turnover 17.10 times (f) Average collection period days times (g) Inventory turnover (h) Days in inventory days (1) Times interest earned times times 0) Asset turnover (k) Debt to assets ratio (1) Free cash flow