Answered step by step

Verified Expert Solution

Question

1 Approved Answer

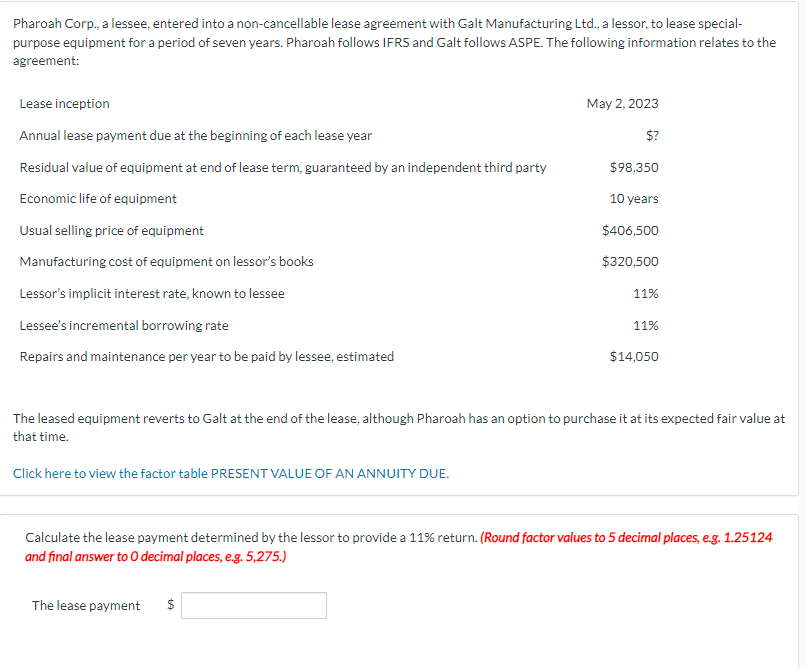

Pharoah Corp., a lessee, entered into a non-cancellable lease agreement with Galt Manufacturing Ltd., a lessor, to lease specialpurpose equipment for a period of seven

Pharoah Corp., a lessee, entered into a non-cancellable lease agreement with Galt Manufacturing Ltd., a lessor, to lease specialpurpose equipment for a period of seven years. Pharoah follows IFRS and Galt follows ASPE. The following information relates to the agreement: The leased equipment reverts to Galt at the end of the lease, although Pharoah has an option to purchase it at its expected fair value at that time. Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE. Calculate the lease payment determined by the lessor to provide a 11% return. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 5,275.) The lease payment $

Pharoah Corp., a lessee, entered into a non-cancellable lease agreement with Galt Manufacturing Ltd., a lessor, to lease specialpurpose equipment for a period of seven years. Pharoah follows IFRS and Galt follows ASPE. The following information relates to the agreement: The leased equipment reverts to Galt at the end of the lease, although Pharoah has an option to purchase it at its expected fair value at that time. Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE. Calculate the lease payment determined by the lessor to provide a 11% return. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 5,275.) The lease payment $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started