Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pharoah Jewelry Co. uses gold in the production of its products. Pharoah anticipates that it will need to purchase 90 ounces of gold in

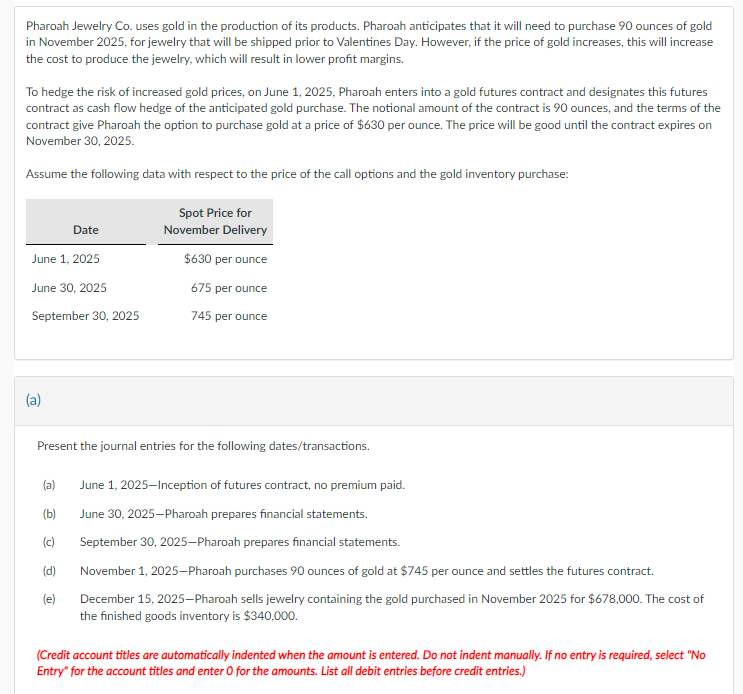

Pharoah Jewelry Co. uses gold in the production of its products. Pharoah anticipates that it will need to purchase 90 ounces of gold in November 2025, for jewelry that will be shipped prior to Valentines Day. However, if the price of gold increases, this will increase the cost to produce the jewelry, which will result in lower profit margins. To hedge the risk of increased gold prices, on June 1, 2025, Pharoah enters into a gold futures contract and designates this futures contract as cash flow hedge of the anticipated gold purchase. The notional amount of the contract is 90 ounces, and the terms of the contract give Pharoah the option to purchase gold at a price of $630 per ounce. The price will be good until the contract expires on November 30, 2025. Assume the following data with respect to the price of the call options and the gold inventory purchase: Date Spot Price for November Delivery June 1, 2025 $630 per ounce June 30, 2025 675 per ounce September 30, 2025 745 per ounce (a) Present the journal entries for the following dates/transactions. (a) June 1, 2025-Inception of futures contract, no premium paid. (b) June 30, 2025-Pharoah prepares financial statements. (c) September 30, 2025-Pharoah prepares financial statements. (d) (e) November 1, 2025-Pharoah purchases 90 ounces of gold at $745 per ounce and settles the futures contract. December 15, 2025-Pharoah sells jewelry containing the gold purchased in November 2025 for $678,000. The cost of the finished goods inventory is $340,000. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.)

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a June 1 2025 Inception of futures contract no premium paid No Entry b June 30 2025 Pha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66424297d9c6c_983878.pdf

180 KBs PDF File

66424297d9c6c_983878.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started