Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pharoah Limited is a Niagara-on-the-Lake, Ontario-based winery producing blended, premium, and ultra-premium wines, which are sold globally. The company has a strong distribution network

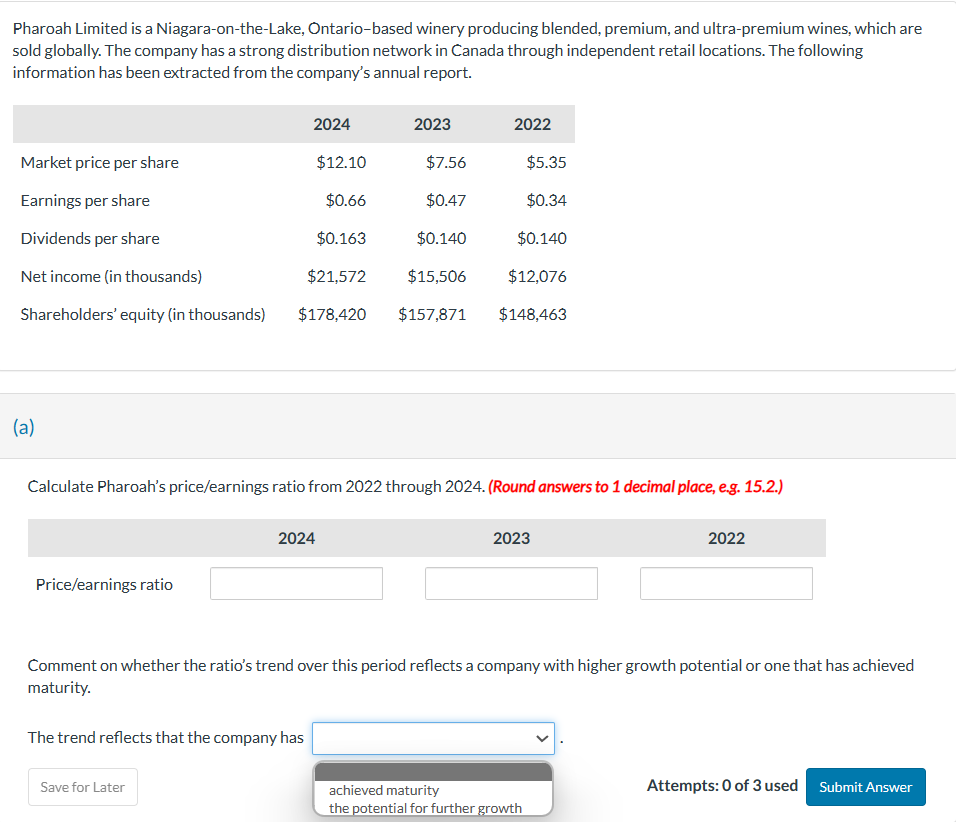

Pharoah Limited is a Niagara-on-the-Lake, Ontario-based winery producing blended, premium, and ultra-premium wines, which are sold globally. The company has a strong distribution network in Canada through independent retail locations. The following information has been extracted from the company's annual report. 2024 2023 2022 Market price per share $12.10 $7.56 $5.35 Earnings per share $0.66 $0.47 $0.34 Dividends per share $0.163 $0.140 $0.140 Net income (in thousands) $21,572 $15,506 $12,076 Shareholders' equity (in thousands) $178,420 $157,871 $148,463 (a) Calculate Pharoah's price/earnings ratio from 2022 through 2024. (Round answers to 1 decimal place, e.g. 15.2.) Price/earnings ratio 2024 2023 2022 Comment on whether the ratio's trend over this period reflects a company with higher growth potential or one that has achieved maturity. The trend reflects that the company has Save for Later achieved maturity Attempts: 0 of 3 used Submit Answer the potential for further growth

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate Pharoahs priceearnings ratio from 2022 through 2024 2022 M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started