Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For each of the above items, prepare the journal entry to record the subsequent cash transaction in July and September . Pharoah Paintball records adjusting

For each of the above items, prepare the journal entry to record the subsequent cash transaction in July and September .

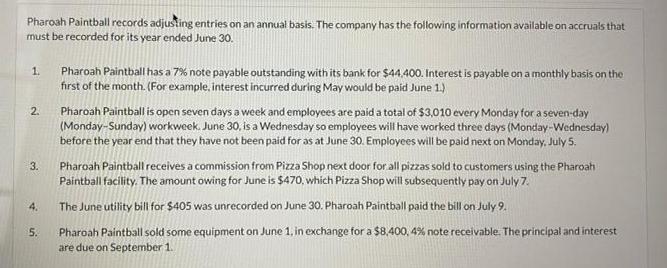

Pharoah Paintball records adjusting entries on an annual basis. The company has the following information available on accruals that must be recorded for its year ended June 30. 1. 2. 3. 4. 5. Pharoah Paintball has a 7% note payable outstanding with its bank for $44,400. Interest is payable on a monthly basis on the first of the month. (For example, interest incurred during May would be paid June 1.) Pharoah Paintball is open seven days a week and employees are paid a total of $3,010 every Monday for a seven-day (Monday-Sunday) workweek. June 30, is a Wednesday so employees will have worked three days (Monday-Wednesday) before the year end that they have not been paid for as at June 30. Employees will be paid next on Monday, July 5. Pharoah Paintball receives a commission from Pizza Shop next door for all pizzas sold to customers using the Pharoah Paintball facility. The amount owing for June is $470, which Pizza Shop will subsequently pay on July 7. The June utility bill for $405 was unrecorded on June 30. Pharoah Paintball paid the bill on July 9. Pharoah Paintball sold some equipment on June 1, in exchange for a $8,400, 4% note receivable. The principal and interest are due on September 1.

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Accrued Interest Payable Debit Interest Expense 29...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started