Answered step by step

Verified Expert Solution

Question

1 Approved Answer

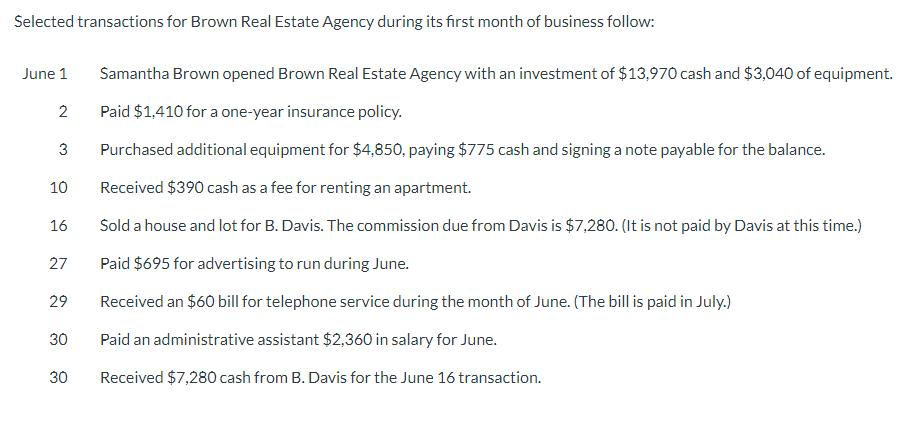

Selected transactions for Brown Real Estate Agency during its first month of business follow: June 1 Samantha Brown opened Brown Real Estate Agency with

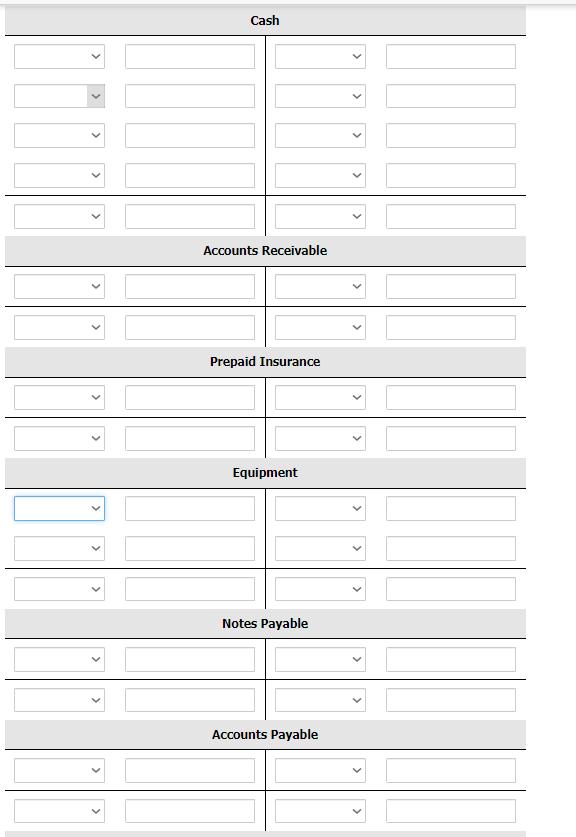

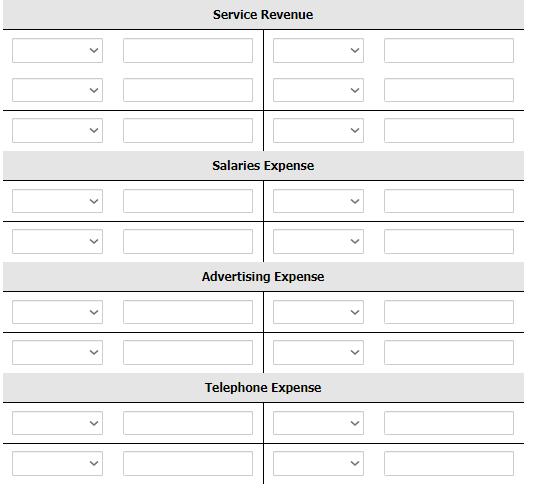

Selected transactions for Brown Real Estate Agency during its first month of business follow: June 1 Samantha Brown opened Brown Real Estate Agency with an investment of $13,970 cash and $3,040 of equipment. Paid $1,410 for a one-year insurance policy. Purchased additional equipment for $4,850, paying $775 cash and signing a note payable for the balance. Received $390 cash as a fee for renting an apartment. Sold a house and lot for B. Davis. The commission due from Davis is $7,280. (It is not paid by Davis at this time.) Paid $695 for advertising to run during June. Received an $60 bill for telephone service during the month of June. (The bill is paid in July.) Paid an administrative assistant $2,360 in salary for June. 30 Received $7,280 cash from B. Davis for the June 16 transaction. 2 3 10 16 27 29 30 > Cash Accounts Receivable Prepaid Insurance Equipment Notes Payable Accounts Payable > Service Revenue Salaries Expense Advertising Expense Telephone Expense

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started