Answered step by step

Verified Expert Solution

Question

1 Approved Answer

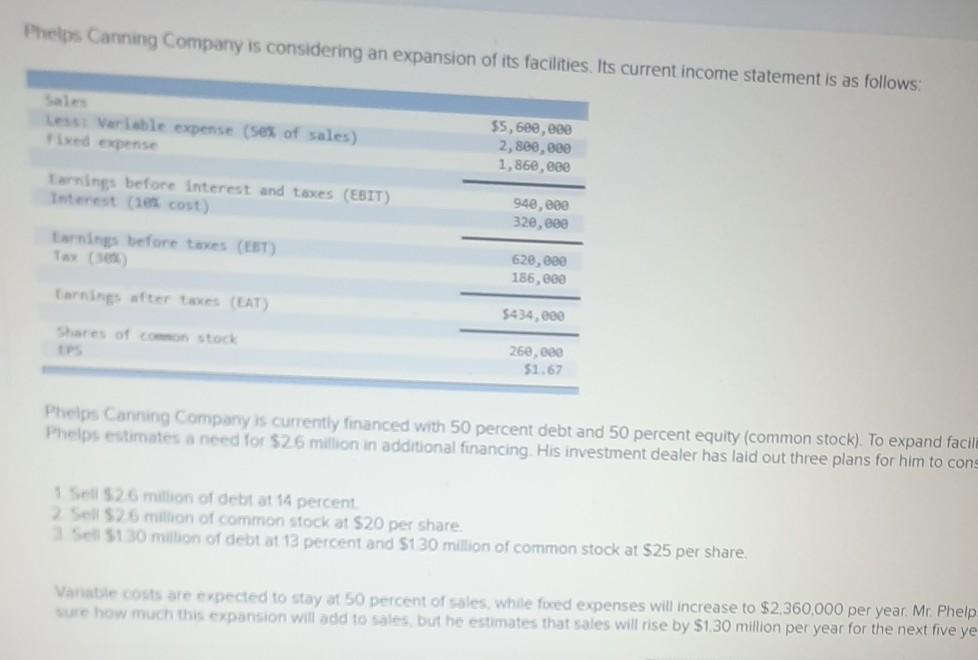

Phelps Canning Company is considering an expansion of its facilities. Its current income statement is as follows: LESS Variable expense (sex of sales) 55,680,000 2,800,000

Phelps Canning Company is considering an expansion of its facilities. Its current income statement is as follows: LESS Variable expense (sex of sales) 55,680,000 2,800,000 1,860,000 Earnings before interest and taxes (EBIT) Interest (10x cost). 940,000 320,000 Earnings before taxes (EST) 620,000 186,000 Earning after tres (LAT) 5434,000 260, ce 51.67 Phelps Canning Company is currently financed with 50 percent debt and 50 percent equity (common stock). To expand facile Phelps estimates a need for $26 million in additional financing. His investment dealer has laid out three plans for him to con 1 Set 526 million of debt at 14 percent Sell 525 million of common stock at $20 per share Set 51 30 million of debt at 13 percent and $130 million of common stock at $25 per share Variable costs are expected to stay at 50 percent of sales while foxed expenses will increase to $2,360,000 per year. Mr. Phelp sure how much this expansion will add to sales but he estimates that sales will rise by $1.30 million per year for the next five ye Phelps Canning Company is considering an expansion of its facilities. Its current income statement is as follows: LESS Variable expense (sex of sales) 55,680,000 2,800,000 1,860,000 Earnings before interest and taxes (EBIT) Interest (10x cost). 940,000 320,000 Earnings before taxes (EST) 620,000 186,000 Earning after tres (LAT) 5434,000 260, ce 51.67 Phelps Canning Company is currently financed with 50 percent debt and 50 percent equity (common stock). To expand facile Phelps estimates a need for $26 million in additional financing. His investment dealer has laid out three plans for him to con 1 Set 526 million of debt at 14 percent Sell 525 million of common stock at $20 per share Set 51 30 million of debt at 13 percent and $130 million of common stock at $25 per share Variable costs are expected to stay at 50 percent of sales while foxed expenses will increase to $2,360,000 per year. Mr. Phelp sure how much this expansion will add to sales but he estimates that sales will rise by $1.30 million per year for the next five ye

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started