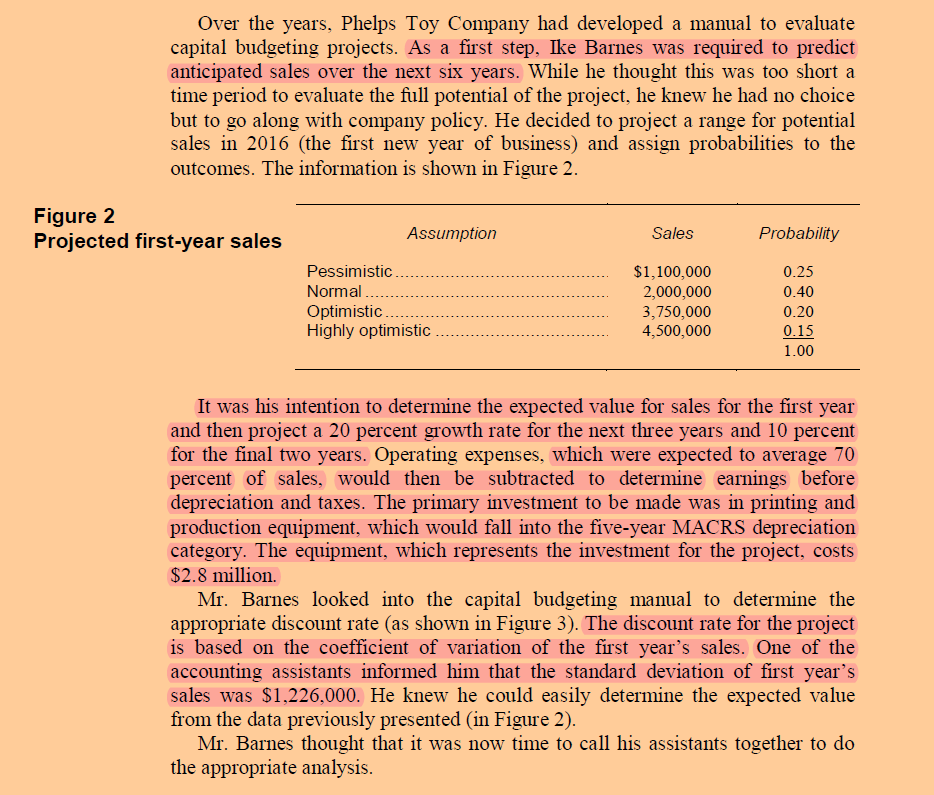

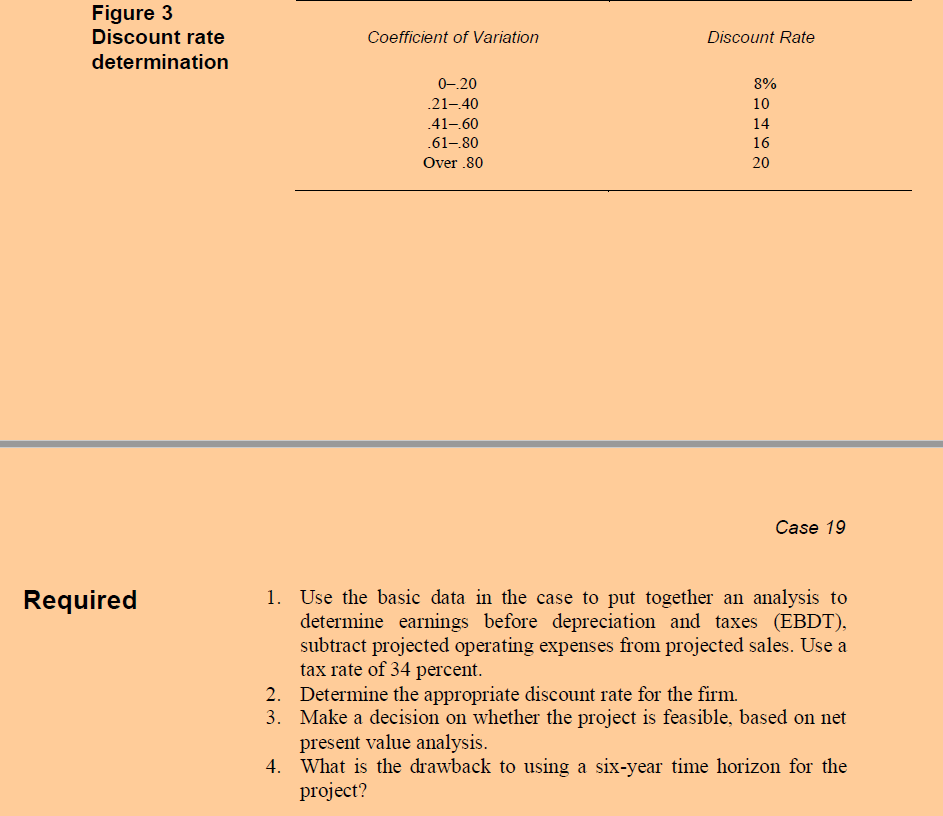

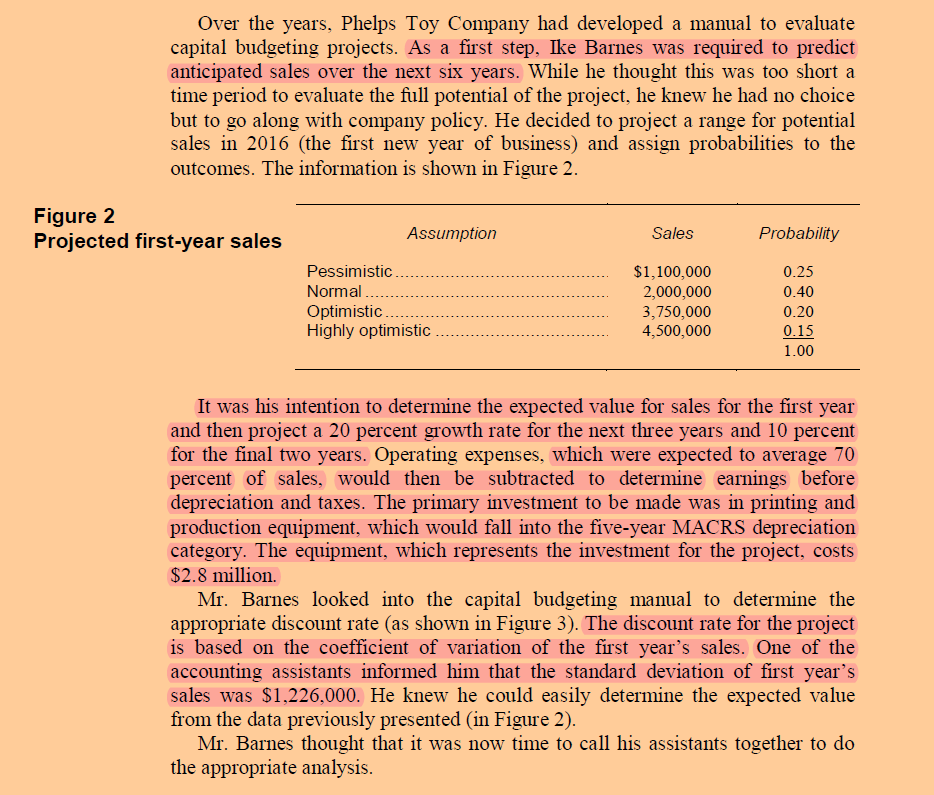

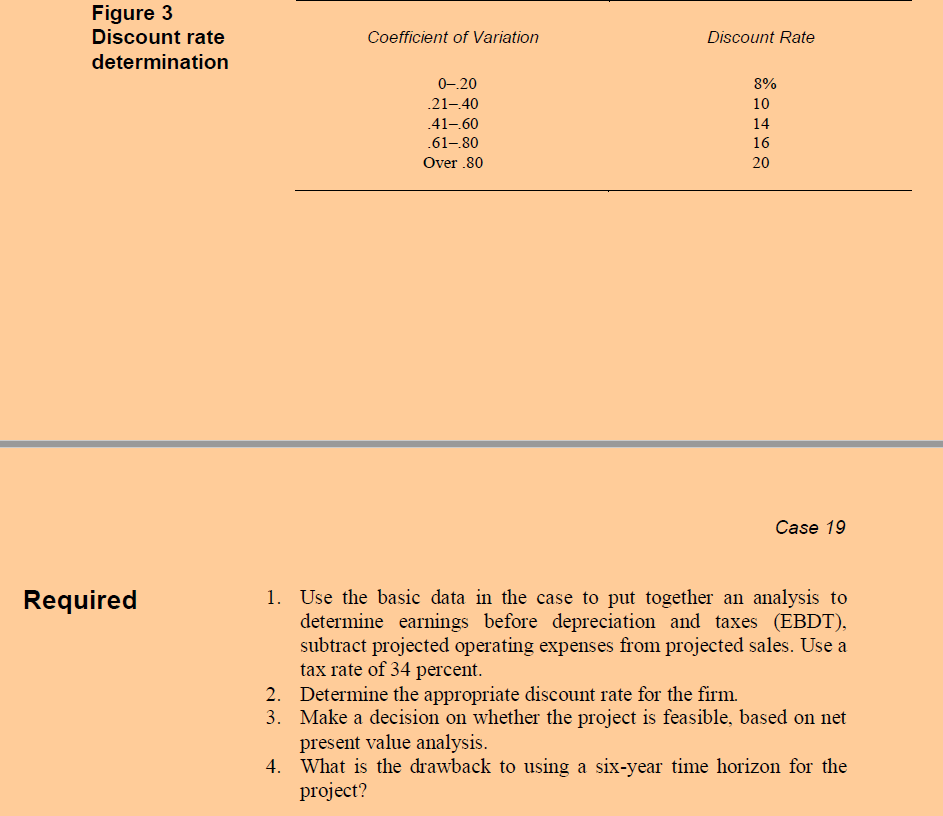

Phelps Toy Company ThePhelpsToyCompanywasconsideringtheadvisabilityofaddinganewproducttoitsline.IkeBarneswasinchargeofnewproductdevelopment.Sincethefoundingofthecompanyin1995,hehadseensalesgrowfrom$150,000ayeartoalmost$40millionin2015.Althoughthefirmhadinitiallystartedoutmanufacturingtoytrucks,ithaddiversifiedintosuchitemsaspuzzles,stuffedanimals,wallposters,miniaturetrains,andboardgames.In2009,itdevelopedthethirdmostpopularboardgamefortheyear,basedonapopulartelevisionquizshow,buttheshowwascanceledtwoyearslater.Nevertheless,thefirmlearneditslessonwellandcontinuedtoproduceboardgamesrelatednotonlytoquizshowsbuttosituationcomediesandevenapopulardetectiveseries.However,byJanuaryof2016,theneedtogeneratenewproductswasbecomingevident.productnotonlyamongyoungstersbutalsoamongadultswhoweretryingtorecapturetheexperienceoftheiryouth.AmarketsurveybyIkesBarnesindicatedthattheToppsChewingGumCompanywasthelargestcompetitorintheindustry.Thecompanyactuallyhadapublicdistributionofitscommonstockin2001.Othermajorsellersin2016wereUpperDeck,Fleer,Leaf,andDonruss.Allproducemillionsofbaseballcardsonanannualbasis.Thecardscanbepurchasedinpacksof1520cardsfor$3.00-$8.00atdrugorconveniencestores*orinboxesof700-800cardsfor$40andup.Theselargerquantitiesofcardswereusuallypurchasedfromsportcardspecialtystoresoratbaseballcardconventions(over1,000suchconventionsthroughoutthecountrytookplaceayear).Indoinghisanalysis,Mr.Barnes For example, the 1968 rookie card of Nolan Ryan was selling for $2,000 in early 2015 . The 1963 Pete Rose rookie card was valued at $500 and, finally, the first Topps card of Mickey Mantle issued in 1952 at 1 cent carried a trading value of $30,000 five decades later. While the card manufacturer did not directly participate in this price appreciation, the hope for such gains in the future keeps youngsters and adults continually active in buying cards as they come out. To convince management that the manufacturing and selling of baseball cards was a suitable activity for his firm, Mr. Barnes had to make a thorough capital budgeting analysis for the executive committee of Phelps Toy Company. The Analysis In evaluating the market potential, Mr. Barnes determined that there was no way he could firmly predict the market penetration potential for a new set of baseball cards. The sales for the set, which would be called Baseball Stars, would depend on the quality of the final product as well as the effectiveness of the promotional activities. There is also the danger of a number of errors when a set is initially issued. With approximately 750 carcs in the set, there is the possibility of misquoting batting averages, misspelling names, and so on. When Fleer and Donruss introduced their new sets in 1995, they were highly criticized by collectors for the numerous errors. Mr. Barnes hoped to avoid this fate for the Baseball Stars set by making heavy expenditures on quality control. He also intended to hire a number of employees from other card companies so he would have experienced people who could identify potential problems at a very early stage. Over the years, Phelps Toy Company had developed a manual to evaluate capital budgeting projects. As a first step, Ike Barnes was required to predict anticipated sales over the next six years. While he thought this was too short a time period to evaluate the full potential of the project, he knew he had no choice but to go along with company policy. He decided to project a range for potential sales in 2016 (the first new year of business) and assign probabilities to the outcomes. The information is shown in Figure 2. Figure 2 Projected first-year sales It was his intention to determine the expected value for sales for the first year and then project a 20 percent growth rate for the next three years and 10 percent for the final two years. Operating expenses, which were expected to average 70 percent of sales, would then be subtracted to determine earnings before depreciation and taxes. The primary investment to be made was in printing and production equipment, which would fall into the five-year MACRS depreciation category. The equipment, which represents the investment for the project, costs $2.8 million. Mr. Barnes looked into the capital budgeting manual to determine the appropriate discount rate (as shown in Figure 3). The discount rate for the project is based on the coefficient of variation of the first year's sales. One of the accounting assistants informed him that the standard deviation of first year's sales was $1,226,000. He knew he could easily determine the expected value from the data previously presented (in Figure 2 ). Mr. Barnes thought that it was now time to call his assistants together to do the appropriate analysis. 1. Use the basic data in the case to put together an analysis to determine earnings before depreciation and taxes (EBDT), subtract projected operating expenses from projected sales. Use a tax rate of 34 percent. 2. Determine the appropriate discount rate for the firm. 3. Make a decision on whether the project is feasible, based on net present value analysis. 4. What is the drawback to using a six-year time horizon for the project? Phelps Toy Company ThePhelpsToyCompanywasconsideringtheadvisabilityofaddinganewproducttoitsline.IkeBarneswasinchargeofnewproductdevelopment.Sincethefoundingofthecompanyin1995,hehadseensalesgrowfrom$150,000ayeartoalmost$40millionin2015.Althoughthefirmhadinitiallystartedoutmanufacturingtoytrucks,ithaddiversifiedintosuchitemsaspuzzles,stuffedanimals,wallposters,miniaturetrains,andboardgames.In2009,itdevelopedthethirdmostpopularboardgamefortheyear,basedonapopulartelevisionquizshow,buttheshowwascanceledtwoyearslater.Nevertheless,thefirmlearneditslessonwellandcontinuedtoproduceboardgamesrelatednotonlytoquizshowsbuttosituationcomediesandevenapopulardetectiveseries.However,byJanuaryof2016,theneedtogeneratenewproductswasbecomingevident.productnotonlyamongyoungstersbutalsoamongadultswhoweretryingtorecapturetheexperienceoftheiryouth.AmarketsurveybyIkesBarnesindicatedthattheToppsChewingGumCompanywasthelargestcompetitorintheindustry.Thecompanyactuallyhadapublicdistributionofitscommonstockin2001.Othermajorsellersin2016wereUpperDeck,Fleer,Leaf,andDonruss.Allproducemillionsofbaseballcardsonanannualbasis.Thecardscanbepurchasedinpacksof1520cardsfor$3.00-$8.00atdrugorconveniencestores*orinboxesof700-800cardsfor$40andup.Theselargerquantitiesofcardswereusuallypurchasedfromsportcardspecialtystoresoratbaseballcardconventions(over1,000suchconventionsthroughoutthecountrytookplaceayear).Indoinghisanalysis,Mr.Barnes For example, the 1968 rookie card of Nolan Ryan was selling for $2,000 in early 2015 . The 1963 Pete Rose rookie card was valued at $500 and, finally, the first Topps card of Mickey Mantle issued in 1952 at 1 cent carried a trading value of $30,000 five decades later. While the card manufacturer did not directly participate in this price appreciation, the hope for such gains in the future keeps youngsters and adults continually active in buying cards as they come out. To convince management that the manufacturing and selling of baseball cards was a suitable activity for his firm, Mr. Barnes had to make a thorough capital budgeting analysis for the executive committee of Phelps Toy Company. The Analysis In evaluating the market potential, Mr. Barnes determined that there was no way he could firmly predict the market penetration potential for a new set of baseball cards. The sales for the set, which would be called Baseball Stars, would depend on the quality of the final product as well as the effectiveness of the promotional activities. There is also the danger of a number of errors when a set is initially issued. With approximately 750 carcs in the set, there is the possibility of misquoting batting averages, misspelling names, and so on. When Fleer and Donruss introduced their new sets in 1995, they were highly criticized by collectors for the numerous errors. Mr. Barnes hoped to avoid this fate for the Baseball Stars set by making heavy expenditures on quality control. He also intended to hire a number of employees from other card companies so he would have experienced people who could identify potential problems at a very early stage. Over the years, Phelps Toy Company had developed a manual to evaluate capital budgeting projects. As a first step, Ike Barnes was required to predict anticipated sales over the next six years. While he thought this was too short a time period to evaluate the full potential of the project, he knew he had no choice but to go along with company policy. He decided to project a range for potential sales in 2016 (the first new year of business) and assign probabilities to the outcomes. The information is shown in Figure 2. Figure 2 Projected first-year sales It was his intention to determine the expected value for sales for the first year and then project a 20 percent growth rate for the next three years and 10 percent for the final two years. Operating expenses, which were expected to average 70 percent of sales, would then be subtracted to determine earnings before depreciation and taxes. The primary investment to be made was in printing and production equipment, which would fall into the five-year MACRS depreciation category. The equipment, which represents the investment for the project, costs $2.8 million. Mr. Barnes looked into the capital budgeting manual to determine the appropriate discount rate (as shown in Figure 3). The discount rate for the project is based on the coefficient of variation of the first year's sales. One of the accounting assistants informed him that the standard deviation of first year's sales was $1,226,000. He knew he could easily determine the expected value from the data previously presented (in Figure 2 ). Mr. Barnes thought that it was now time to call his assistants together to do the appropriate analysis. 1. Use the basic data in the case to put together an analysis to determine earnings before depreciation and taxes (EBDT), subtract projected operating expenses from projected sales. Use a tax rate of 34 percent. 2. Determine the appropriate discount rate for the firm. 3. Make a decision on whether the project is feasible, based on net present value analysis. 4. What is the drawback to using a six-year time horizon for the project