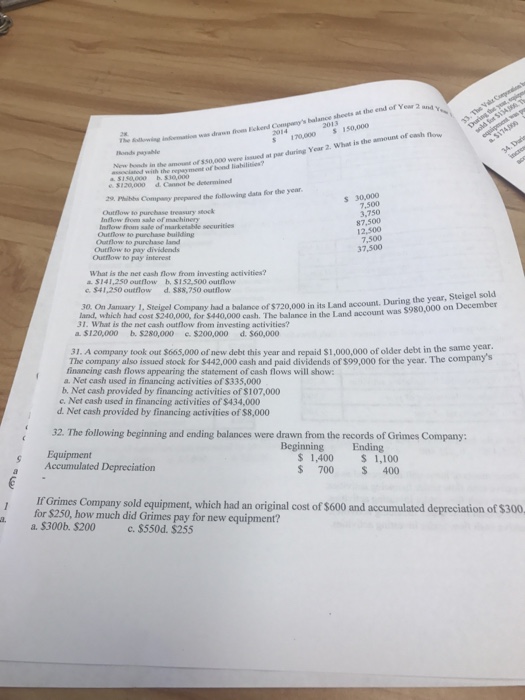

Phibbs Company prepared the following data for the year. What is the net cash flow from investing activities? a. S$41, 250 outflow b, $152, 500 outflow c. $41.250 outflow d, $88, 750 outflow On January 1, Steigel Company had a balance of in its Land During the year, Steigel sold land which had cost $240.000 for 40,000 cash. The balance in the Land account was $980,000 on December What is the net cash outflow from investing activities? a. $120,000 b. $280,000 c. $200.000 d. $60.000 A company took $665,000 of new debt this year and repaid $1,000.000 of older debt in the same year. The company also issued stock for 442.000 cash and paid dividends of $99,000 for the year. The company's financing cash flows appearing the statement of cash flows will show: a. Net cash used in financing activities of $335,000 b. Net cash provided by financing activities of $107,000 c. Net cash used in financing activities of $434,000 d. Net cash provided by financing activities of $8,000 The following beginning and ending balances were drawn from the records of Grimes Company: If Grimes Company sold equipment, which had an original cost of $600 and accumulated depreciation of $300 for $250, how much did for new equipment? a. $300 b. $200 c $550 d. $255 Phibbs Company prepared the following data for the year. What is the net cash flow from investing activities? a. S$41, 250 outflow b, $152, 500 outflow c. $41.250 outflow d, $88, 750 outflow On January 1, Steigel Company had a balance of in its Land During the year, Steigel sold land which had cost $240.000 for 40,000 cash. The balance in the Land account was $980,000 on December What is the net cash outflow from investing activities? a. $120,000 b. $280,000 c. $200.000 d. $60.000 A company took $665,000 of new debt this year and repaid $1,000.000 of older debt in the same year. The company also issued stock for 442.000 cash and paid dividends of $99,000 for the year. The company's financing cash flows appearing the statement of cash flows will show: a. Net cash used in financing activities of $335,000 b. Net cash provided by financing activities of $107,000 c. Net cash used in financing activities of $434,000 d. Net cash provided by financing activities of $8,000 The following beginning and ending balances were drawn from the records of Grimes Company: If Grimes Company sold equipment, which had an original cost of $600 and accumulated depreciation of $300 for $250, how much did for new equipment? a. $300 b. $200 c $550 d. $255