Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Phibeon Ntabeni is a consultant to the board of directors of the RSA-based Thompson Foundation. The board asks Ntabeni to recommend an asset allocation

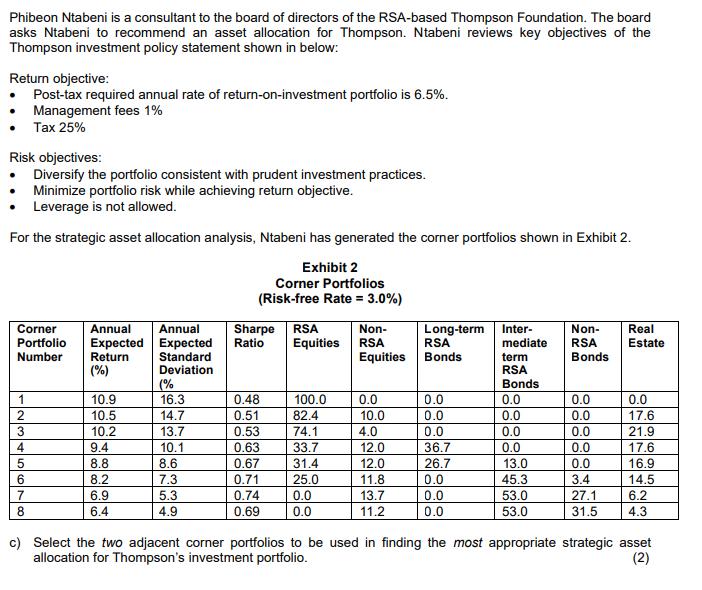

Phibeon Ntabeni is a consultant to the board of directors of the RSA-based Thompson Foundation. The board asks Ntabeni to recommend an asset allocation for Thompson. Ntabeni reviews key objectives of the Thompson investment policy statement shown in below: Return objective: Post-tax required annual rate of return-on-investment portfolio is 6.5%. Management fees 1% Tax 25% Risk objectives: Diversify the portfolio consistent with prudent investment practices. Minimize portfolio risk while achieving return objective. Leverage is not allowed. For the strategic asset allocation analysis, Ntabeni has generated the corner portfolios shown in Exhibit 2. Exhibit 2 Corner Portfolios (Risk-free Rate = 3.0%) Corner Portfolio Number 1 2 3 4 5 6 7 8 Annual Expected Return (%) 10.9 10.5 10.2 9.4 8.8 8.2 6.9 6.4 Annual Expected Standard Deviation (% 16.3 14.7 13.7 10.1 875 8.6 7.3 5.3 4.9 Sharpe Ratio RSA Equities 0.48 100.0 0.51 82.4 0.53 74.1 0.63 33.7 0.67 31.4 0.71 25.0 0.74 0.0 0.69 0.0 Non- RSA Equities 0.0 10.0 4.0 12.0 12.0 11.8 13.7 11.2 Long-term Inter- RSA Bonds 0.0 0.0 0.0 36.7 26.7 0.0 0.0 0.0 Non- mediate RSA Bonds term RSA Bonds 0.0 0.0 0.0 0.0 13.0 45.3 53.0 53.0 Real Estate 0.0 0.0 0.0 17.6 0.0 21.9 0.0 17.6 0.0 16.9 3.4 14.5 27.1 6.2 31.5 4.3 c) Select the two adjacent corner portfolios to be used in finding the most appropriate strategic asset allocation for Thompson's investment portfolio. (2) d) Determine the most appropriate allocation between the two adjacent corner portfolios selected in part (c). e) Determine the percentage of portfolio that would be invested in long-term RSA Bonds, based on the most appropriate strategic asset allocation found in part (d). (3)

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Question ANSWER Part c To achieve a posttax netoffees return on 65 Phibeon must earn a gross absolut...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started