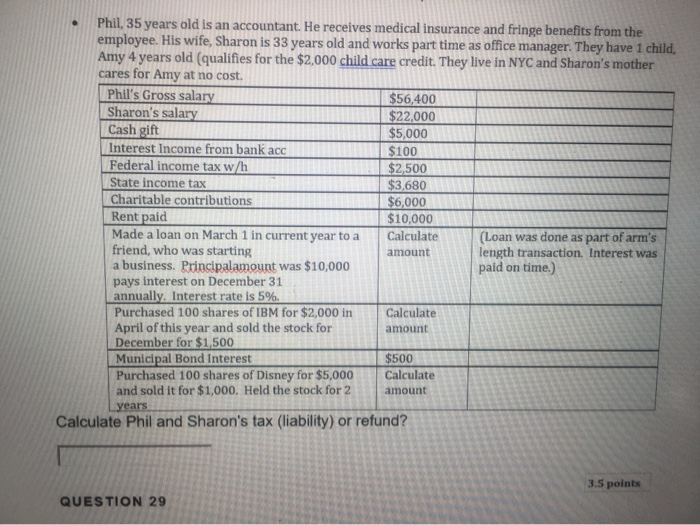

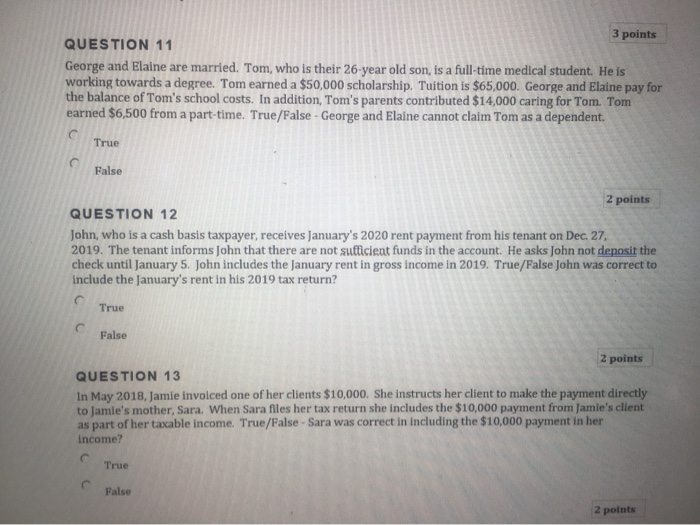

Phil, 35 years old is an accountant. He receives medical insurance and fringe benefits from the employee. His wife, Sharon is 33 years old and works part time as office manager. They have 1 child, Amy 4 years old (qualifies for the $2,000 child care credit. They live in NYC and Sharon's mother cares for Amy at no cost. Phil's Gross salary $56,400 Sharon's salary $22,000 Cash gift $5,000 Interest Income from bank acc $100 Federal income tax w/h $2,500 State income tax $3,680 Charitable contributions $6,000 Rent paid $10,000 Made a loan on March 1 in current year to a Calculate (Loan was done as part of arm's friend, who was starting amount length transaction. Interest was a business. Principalamount was $10,000 paid on time.) pays interest on December 31 annually. Interest rate is 5%. Purchased 100 shares of IBM for $2,000 in Calculate April of this year and sold the stock for amount December for $1,500 Municipal Bond Interest $500 Purchased 100 shares of Disney for $5,000 Calculate and sold it for $1,000. Held the stock for 2 amount years Calculate Phil and Sharon's tax (liability) or refund? 3.5 points QUESTION 29 3 points QUESTION 11 George and Elaine are married. Tom, who is their 26-year old son, is a full-time medical student. He is working towards a degree. Tom earned a $50,000 scholarship. Tuition is $65,000. George and Elaine pay for the balance of Tom's school costs. In addition, Tom's parents contributed $14,000 caring for Tom. Tom earned $6,500 from a part-time. True/False - George and Elaine cannot claim Tom as a dependent. True False 2 points QUESTION 12 John, who is a cash basis taxpayer, receives January's 2020 rent payment from his tenant on Dec. 27, 2019. The tenant informs John that there are not sufficient funds in the account. He asks John not deposit the check until January 5. John includes the January rent in gross income in 2019. True/False John was correct to include the January's rent in his 2019 tax return? True False 2 points QUESTION 13 In May 2018, Jamie invoiced one of her clients $10,000. She instructs her client to make the payment directly to Jamie's mother, Sara, When Sara fles her tax return she includes the $10,000 payment from Jamie's client as part of her taxable income. True/False - Sara was correct in including the $10,000 payment in her income? True False 2 points Phil, 35 years old is an accountant. He receives medical insurance and fringe benefits from the employee. His wife, Sharon is 33 years old and works part time as office manager. They have 1 child, Amy 4 years old (qualifies for the $2,000 child care credit. They live in NYC and Sharon's mother cares for Amy at no cost. Phil's Gross salary $56,400 Sharon's salary $22,000 Cash gift $5,000 Interest Income from bank acc $100 Federal income tax w/h $2,500 State income tax $3,680 Charitable contributions $6,000 Rent paid $10,000 Made a loan on March 1 in current year to a Calculate (Loan was done as part of arm's friend, who was starting amount length transaction. Interest was a business. Principalamount was $10,000 paid on time.) pays interest on December 31 annually. Interest rate is 5%. Purchased 100 shares of IBM for $2,000 in Calculate April of this year and sold the stock for amount December for $1,500 Municipal Bond Interest $500 Purchased 100 shares of Disney for $5,000 Calculate and sold it for $1,000. Held the stock for 2 amount years Calculate Phil and Sharon's tax (liability) or refund? 3.5 points QUESTION 29 3 points QUESTION 11 George and Elaine are married. Tom, who is their 26-year old son, is a full-time medical student. He is working towards a degree. Tom earned a $50,000 scholarship. Tuition is $65,000. George and Elaine pay for the balance of Tom's school costs. In addition, Tom's parents contributed $14,000 caring for Tom. Tom earned $6,500 from a part-time. True/False - George and Elaine cannot claim Tom as a dependent. True False 2 points QUESTION 12 John, who is a cash basis taxpayer, receives January's 2020 rent payment from his tenant on Dec. 27, 2019. The tenant informs John that there are not sufficient funds in the account. He asks John not deposit the check until January 5. John includes the January rent in gross income in 2019. True/False John was correct to include the January's rent in his 2019 tax return? True False 2 points QUESTION 13 In May 2018, Jamie invoiced one of her clients $10,000. She instructs her client to make the payment directly to Jamie's mother, Sara, When Sara fles her tax return she includes the $10,000 payment from Jamie's client as part of her taxable income. True/False - Sara was correct in including the $10,000 payment in her income? True False 2 points