Answered step by step

Verified Expert Solution

Question

1 Approved Answer

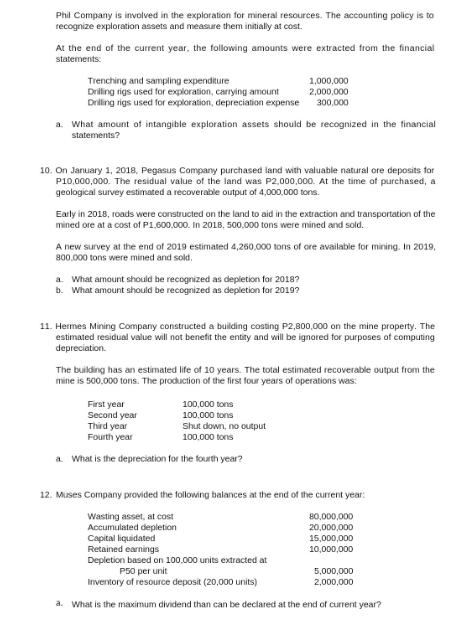

Phil Company is involved in the exploration for mineral resources. The accounting policy is to recognize exploration assets and measure them initially at cost.

Phil Company is involved in the exploration for mineral resources. The accounting policy is to recognize exploration assets and measure them initially at cost. At the end of the current year, the following amounts were extracted from the financial statements: Trenching and sampling expenditure Drilling rigs used for exploration, carrying amount Drilling rigs used for exploration, depreciation expense a. What amount of intangible exploration assets should be recognized in the financial statements? 10. On January 1, 2018, Pegasus Company purchased land with valuable natural ore deposits for P10,000,000. The residual value of the land was P2,000,000. At the time of purchased, a geological survey estimated a recoverable output of 4,000,000 tons. Early in 2018, roads were constructed on the land to aid in the extraction and transportation of the mined ore at a cost of P1.600.000. In 2018, 500,000 tons were mined and sold. 1,000,000 2,000,000 300,000 A new survey at the end of 2019 estimated 4,260,000 tons of ore available for mining. In 2019, 800,000 tons were mined and sold, a. What amount should be recognized as depletion for 2018? b. What amount should be recognized as depletion for 2019? 11. Hermes Mining Company constructed a building costing P2,800,000 on the mine property. The estimated residual value will not benefit the entity and will be ignored for purposes of computing depreciation. The building has an estimated life of 10 years. The total estimated recoverable output from the mine is 500,000 tons. The production of the first four years of operations was: 100,000 tons 100.000 tons Shut down, no output 100.000 tons First year Second year Third year Fourth year a. What is the depreciation for the fourth year? 12. Muses Company provided the following balances at the end of the current year: Wasting asset, at cost Accumulated depletion Capital liquidated Retained earnings Depletion based on 100.000 units extracted at 80,000,000 20,000,000 15,000,000 10,000,000 P50 per unit Inventory of resource deposit (20,000 units) a. What is the maximum dividend than can be declared at the end of current year? 5,000,000 2,000,000

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers a For question 1 the amount of intangible exploration assets to be recognized i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started