Question

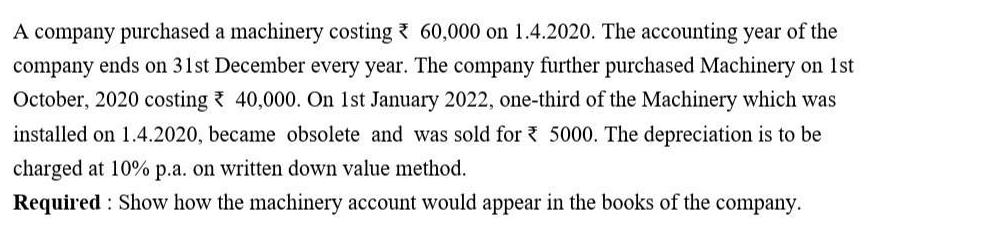

A company purchased a machinery costing 60,000 on 1.4.2020. The accounting year of the company ends on 31st December every year. The company further

A company purchased a machinery costing 60,000 on 1.4.2020. The accounting year of the company ends on 31st December every year. The company further purchased Machinery on 1st October, 2020 costing 40,000. On 1st January 2022, one-third of the Machinery which was installed on 1.4.2020, became obsolete and was sold for 5000. The depreciation is to be charged at 10% p.a. on written down value method. Required: Show how the machinery account would appear in the books of the company.

Step by Step Solution

3.56 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Volume 1

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy

12th Canadian edition

119-49633-5, 1119496497, 1119496330, 978-1119496496

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App