Answered step by step

Verified Expert Solution

Question

1 Approved Answer

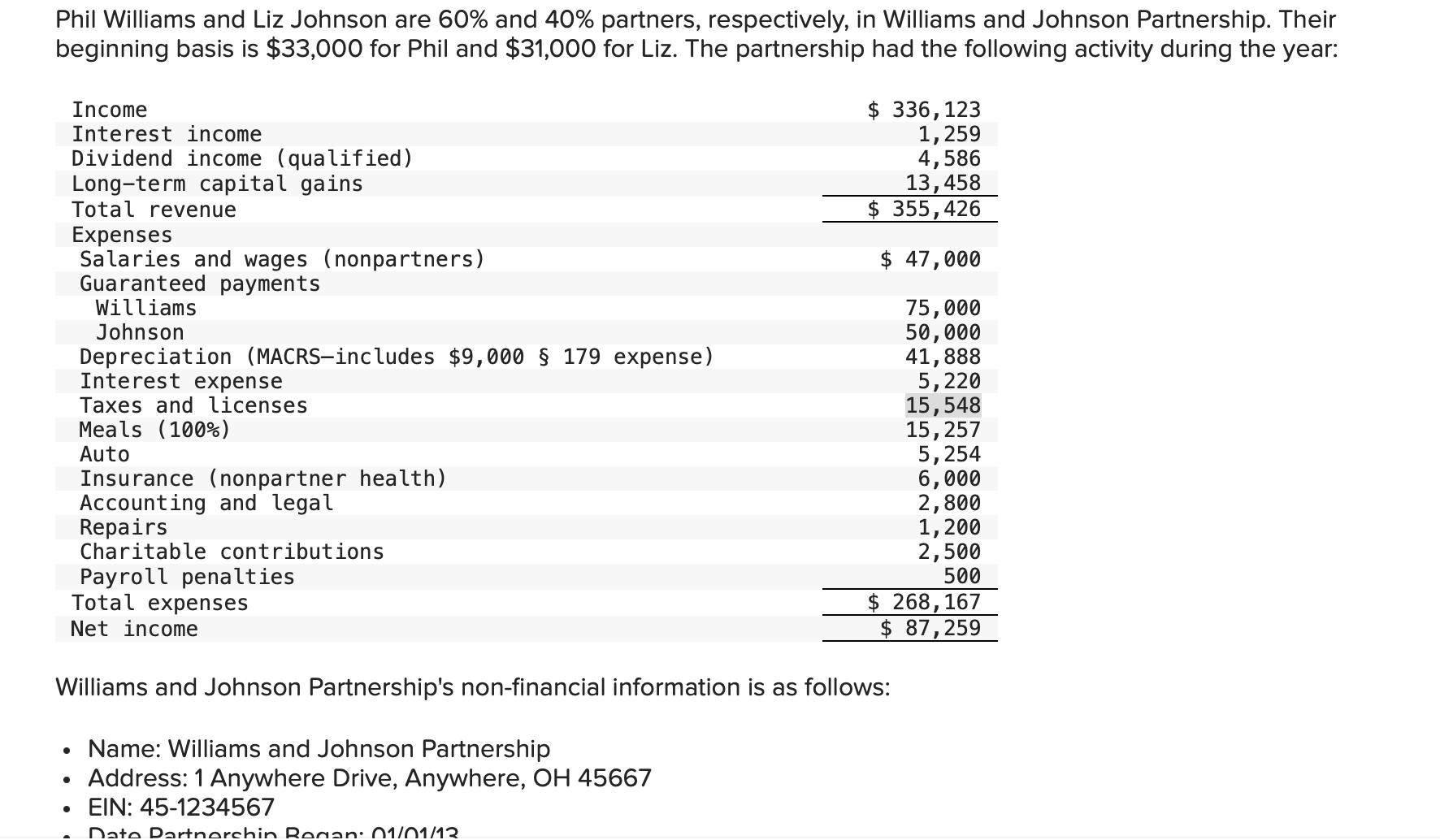

Phil Williams and Liz Johnson are 60% and 40% partners, respectively, in Williams and Johnson Partnership. Their beginning basis is $33,000 for Phil and

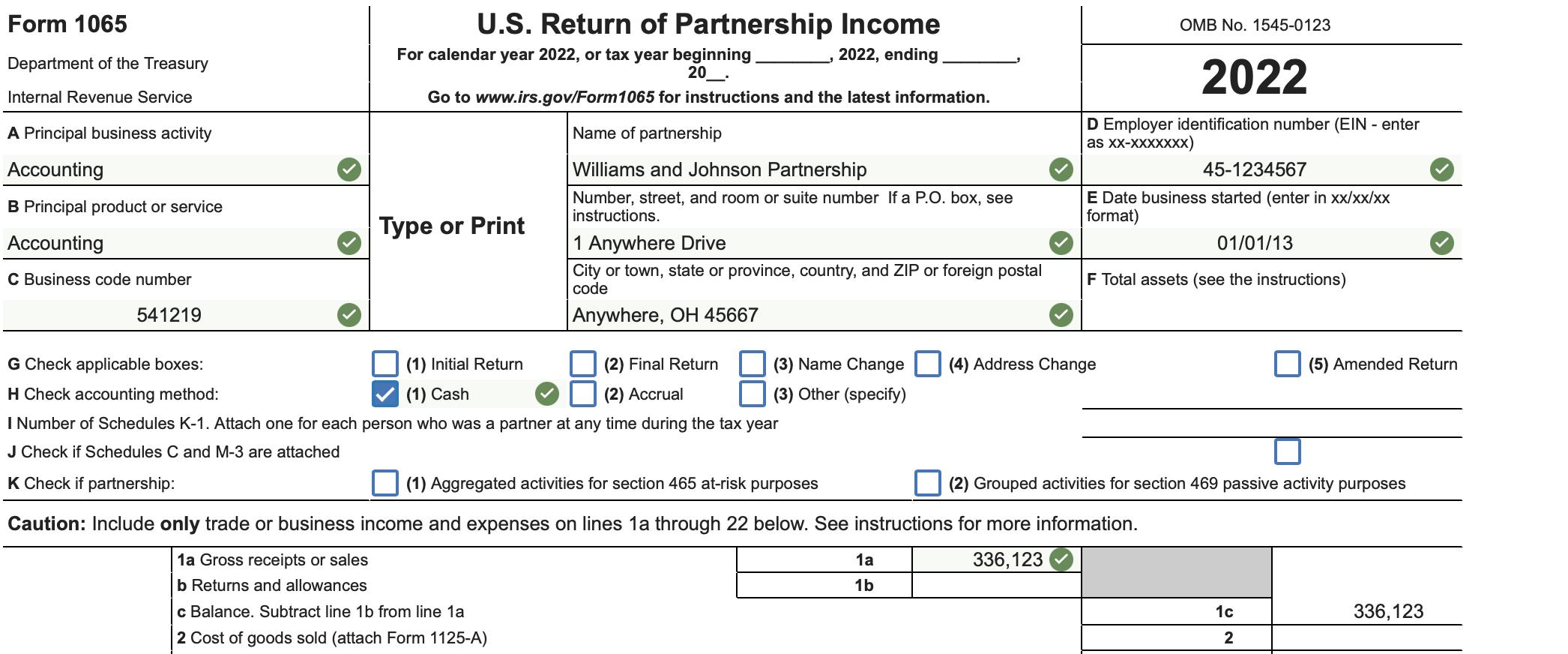

Phil Williams and Liz Johnson are 60% and 40% partners, respectively, in Williams and Johnson Partnership. Their beginning basis is $33,000 for Phil and $31,000 for Liz. The partnership had the following activity during the year: Income Interest income Dividend income (qualified) Long-term capital gains Total revenue Expenses Salaries and wages (nonpartners) Guaranteed payments Williams Johnson Depreciation (MACRS-includes $9,000 179 expense) Interest expense Taxes and licenses Meals (100%) $ 336,123 1,259 4,586 13,458 $ 355,426 $ 47,000 75,000 50,000 41,888 5,220 15,548 15,257 5,254 6,000 2,800 1,200 2,500 500 $ 268,167 $ 87,259 Auto Insurance (nonpartner health) Accounting and legal Repairs Charitable contributions Payroll penalties Total expenses Net income Williams and Johnson Partnership's non-financial information is as follows: Name: Williams and Johnson Partnership Address: 1 Anywhere Drive, Anywhere, OH 45667 EIN: 45-1234567 Date Partnershin Regan: 01/01/13 Form 1065 Department of the Treasury Internal Revenue Service A Principal business activity Accounting B Principal product or service Accounting C Business code number 541219 U.S. Return of Partnership Income For calendar year 2022, or tax year beginning 20_- 2022, ending Go to www.irs.gov/Form 1065 for instructions and the latest information. Type or Print Name of partnership Williams and Johnson Partnership Number, street, and room or suite number If a P.O. box, see instructions. 1 Anywhere Drive City or town, state or province, country, and ZIP or foreign postal code Anywhere, OH 45667 OMB No. 1545-0123 2022 D Employer identification number (EIN - enter as XX-XXXXXXX) 45-1234567 E Date business started (enter in xx/xx/xx format) 01/01/13 F Total assets (see the instructions) G Check applicable boxes: H Check accounting method: (1) Initial Return (1) Cash (2) Final Return (2) Accrual (3) Name Change (4) Address Change (3) Other (specify) I Number of Schedules K-1. Attach one for each person who was a partner at any time during the tax year J Check if Schedules C and M-3 are attached K Check if partnership: (1) Aggregated activities for section 465 at-risk purposes (5) Amended Return (2) Grouped activities for section 469 passive activity purposes Caution: Include only trade or business income and expenses on lines 1a through 22 below. See instructions for more information. 1a Gross receipts or sales b Returns and allowances c Balance. Subtract line 1b from line 1a 2 Cost of goods sold (attach Form 1125-A) 1a 1b 336,123 1c 336,123 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started