PHILIPPINE TAXATION (REFER TO 2023 TAX SCHEDULE IF NEEDED)

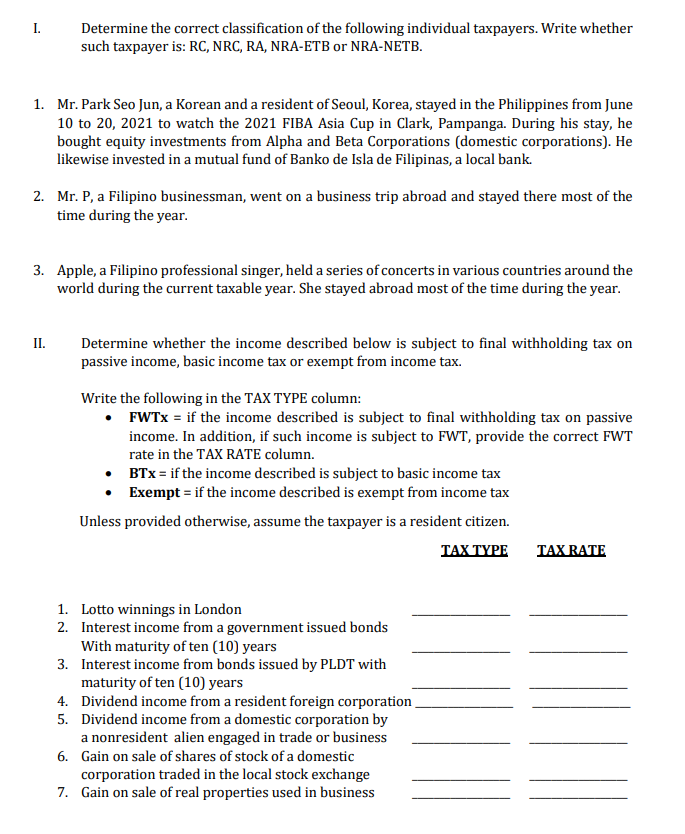

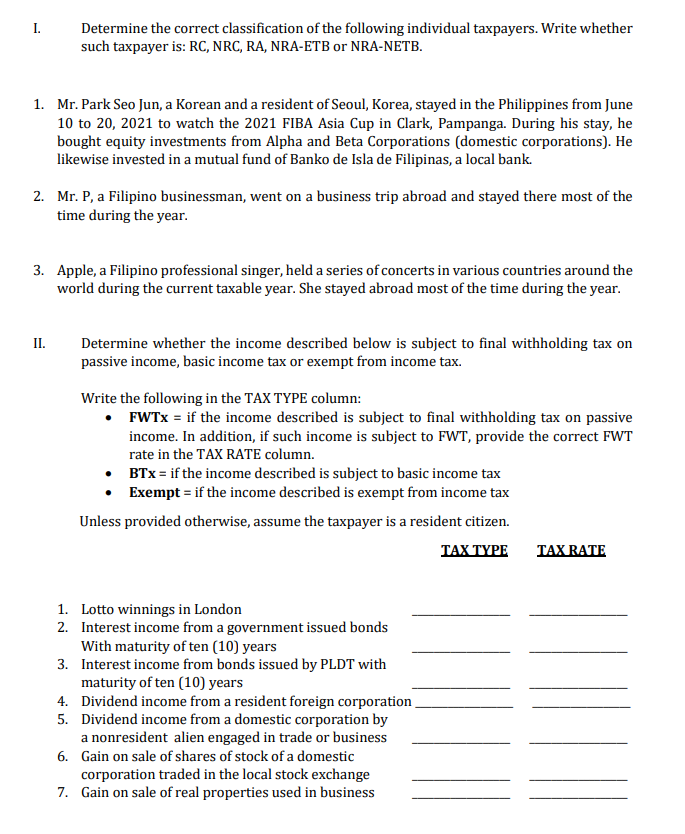

I. Determine the correct classification of the following individual taxpayers. Write whether such taxpayer is: RC, NRC, RA, NRA-ETB or NRA-NETB. 1. Mr. Park Seo Jun, a Korean and a resident of Seoul, Korea, stayed in the Philippines from June 10 to 20, 2021 to watch the 2021 FIBA Asia Cup in Clark, Pampanga. During his stay, he bought equity investments from Alpha and Beta Corporations (domestic corporations). He likewise invested in a mutual fund of Banko de Isla de Filipinas, a local bank. 2. Mr. P, a Filipino businessman, went on a business trip abroad and stayed there most of the time during the year. 3. Apple, a Filipino professional singer, held a series of concerts in various countries around the world during the current taxable year. She stayed abroad most of the time during the year. II. Determine whether the income described below is subject to final withholding tax on passive income, basic income tax or exempt from income tax. Write the following in the TAX TYPE column: - FWTx= if the income described is subject to final withholding tax on passive income. In addition, if such income is subject to FWT, provide the correct FWT rate in the TAX RATE column. - BTx= if the income described is subject to basic income tax - Exempt = if the income described is exempt from income tax Unless provided otherwise, assume the taxpayer is a resident citizen. I. Determine the correct classification of the following individual taxpayers. Write whether such taxpayer is: RC, NRC, RA, NRA-ETB or NRA-NETB. 1. Mr. Park Seo Jun, a Korean and a resident of Seoul, Korea, stayed in the Philippines from June 10 to 20, 2021 to watch the 2021 FIBA Asia Cup in Clark, Pampanga. During his stay, he bought equity investments from Alpha and Beta Corporations (domestic corporations). He likewise invested in a mutual fund of Banko de Isla de Filipinas, a local bank. 2. Mr. P, a Filipino businessman, went on a business trip abroad and stayed there most of the time during the year. 3. Apple, a Filipino professional singer, held a series of concerts in various countries around the world during the current taxable year. She stayed abroad most of the time during the year. II. Determine whether the income described below is subject to final withholding tax on passive income, basic income tax or exempt from income tax. Write the following in the TAX TYPE column: - FWTx= if the income described is subject to final withholding tax on passive income. In addition, if such income is subject to FWT, provide the correct FWT rate in the TAX RATE column. - BTx= if the income described is subject to basic income tax - Exempt = if the income described is exempt from income tax Unless provided otherwise, assume the taxpayer is a resident citizen