Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Philippine Trench Exploration, Inc., a natural gas producer, was granted another area to mine within the Philippines Sea Territory. The company needs to beef

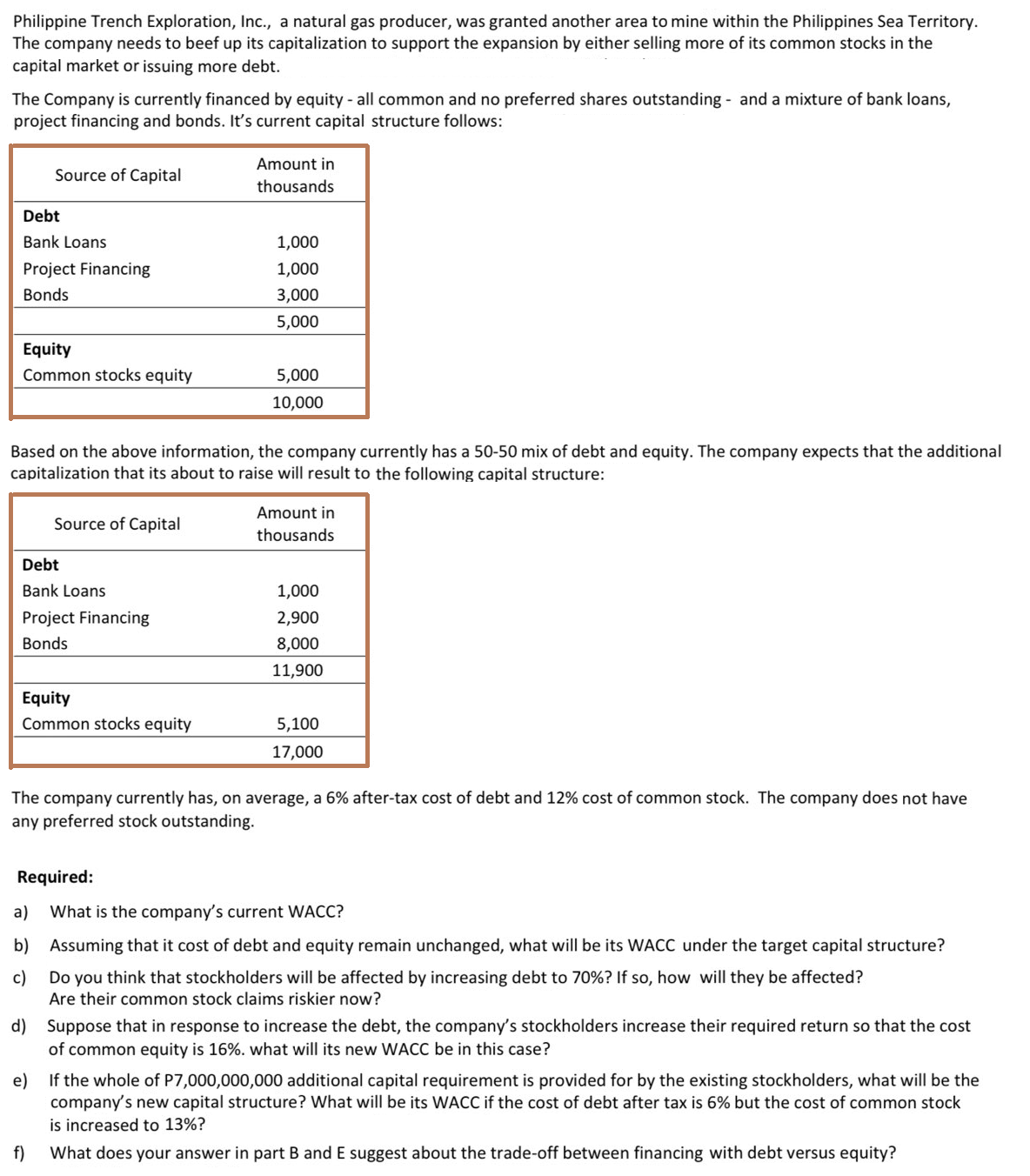

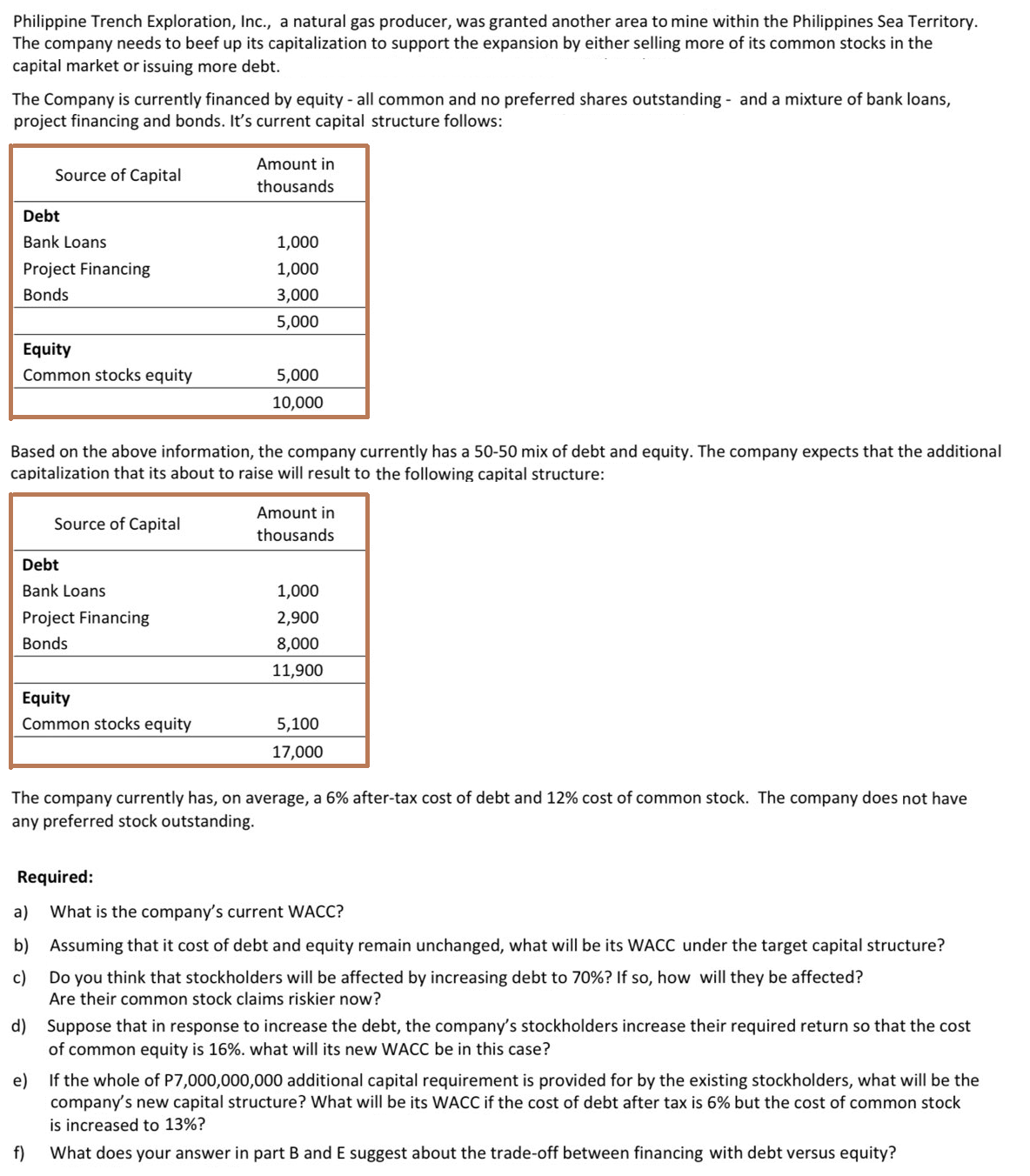

Philippine Trench Exploration, Inc., a natural gas producer, was granted another area to mine within the Philippines Sea Territory. The company needs to beef up its capitalization to support the expansion by either selling more of its common stocks in the capital market or issuing more debt. The Company is currently financed by equity - all common and no preferred shares outstanding and a mixture of bank loans, project financing and bonds. It's current capital structure follows: Source of Capital Amount in thousands Debt Bank Loans 1,000 Project Financing 1,000 Bonds 3,000 5,000 Equity Common stocks equity 5,000 10,000 Based on the above information, the company currently has a 50-50 mix of debt and equity. The company expects that the additional capitalization that its about to raise will result to the following capital structure: Source of Capital Amount in thousands Debt Bank Loans 1,000 Project Financing 2,900 Bonds 8,000 11,900 Equity Common stocks equity 5,100 17,000 The company currently has, on average, a 6% after-tax cost of debt and 12% cost of common stock. The company does not have any preferred stock outstanding. Required: a) What is the company's current WACC? b) Assuming that it cost of debt and equity remain unchanged, what will be its WACC under the target capital structure? c) Do you think that stockholders will be affected by increasing debt to 70%? If so, how will they be affected? Are their common stock claims riskier now? d) Suppose that in response to increase the debt, the company's stockholders increase their required return so that the cost of common equity is 16%. what will its new WACC be in this case? e) If the whole of P7,000,000,000 additional capital requirement is provided for by the existing stockholders, what will be the company's new capital structure? What will be its WACC if the cost of debt after tax is 6% but the cost of common stock is increased to 13%? f) What does your answer in part B and E suggest about the trade-off between financing with debt versus equity? Philippine Trench Exploration, Inc., a natural gas producer, was granted another area to mine within the Philippines Sea Territory. The company needs to beef up its capitalization to support the expansion by either selling more of its common stocks in the capital market or issuing more debt. The Company is currently financed by equity - all common and no preferred shares outstanding and a mixture of bank loans, project financing and bonds. It's current capital structure follows: Source of Capital Amount in thousands Debt Bank Loans 1,000 Project Financing 1,000 Bonds 3,000 5,000 Equity Common stocks equity 5,000 10,000 Based on the above information, the company currently has a 50-50 mix of debt and equity. The company expects that the additional capitalization that its about to raise will result to the following capital structure: Source of Capital Amount in thousands Debt Bank Loans 1,000 Project Financing 2,900 Bonds 8,000 11,900 Equity Common stocks equity 5,100 17,000 The company currently has, on average, a 6% after-tax cost of debt and 12% cost of common stock. The company does not have any preferred stock outstanding. Required: a) What is the company's current WACC? b) Assuming that it cost of debt and equity remain unchanged, what will be its WACC under the target capital structure? c) Do you think that stockholders will be affected by increasing debt to 70%? If so, how will they be affected? Are their common stock claims riskier now? d) Suppose that in response to increase the debt, the company's stockholders increase their required return so that the cost of common equity is 16%. what will its new WACC be in this case? e) If the whole of P7,000,000,000 additional capital requirement is provided for by the existing stockholders, what will be the company's new capital structure? What will be its WACC if the cost of debt after tax is 6% but the cost of common stock is increased to 13%? f) What does your answer in part B and E suggest about the trade-off between financing with debt versus equity?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started