Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Philker Corporation issues 2,000,000 shares of $1 par common stock with a current market value of $150 per share to acquire 80 percent voting stock

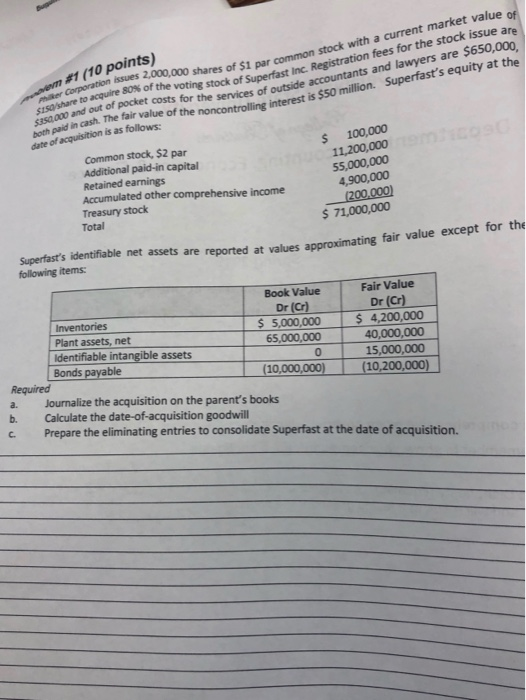

Philker Corporation issues 2,000,000 shares of $1 par common stock with a current market value of $150 per share to acquire 80 percent voting stock of Superfast Inc. Registration fees for the stock issue are 350,000 and out of pocket costs for the services of outside accountants and lawyers are $650,000, both paid in cash. The fair value of the noncontrolling interest is $50,000,000. Superfasts equity at the date of acquisition is as follows:

shares of $1 par common stock with a current market value voting stock of Superfast Inc. Registration fees for the stock issue are #1 (10 points) ssues toacquire 80% of the accountants and lawyers are $650,000 and out of pocket costs for the services of outside the noncontrolling interest is $50 million. Superfast's equity at the both paid in cash. The fair value of date of acquisition is as follows 100,000 11,200,000 55,000,000 4,900,000 Common stock, $2 par Additional paid-in capital Retained earnings Accumulated other comprehensive income Treasury stock Total 71,000,000 are reported at values approximating fair value except for the Superfast's identifiable net assets following items Book Value Fair Value Dr (Cr) 65,000,000 (10,000,000) Dr (Cr) $5,000,0004,200,000 Plant assets, net Identifiable intangible assets Bonds payable 40,000,000 15,000,000 (10,200,000) Required a. Journalize the acquisition on the parent's books b. Calculate the date-of-acquisition goodwill c. Prepare the eliminating entries to consolidate Superfast at the date of acquisition. shares of $1 par common stock with a current market value voting stock of Superfast Inc. Registration fees for the stock issue are #1 (10 points) ssues toacquire 80% of the accountants and lawyers are $650,000 and out of pocket costs for the services of outside the noncontrolling interest is $50 million. Superfast's equity at the both paid in cash. The fair value of date of acquisition is as follows 100,000 11,200,000 55,000,000 4,900,000 Common stock, $2 par Additional paid-in capital Retained earnings Accumulated other comprehensive income Treasury stock Total 71,000,000 are reported at values approximating fair value except for the Superfast's identifiable net assets following items Book Value Fair Value Dr (Cr) 65,000,000 (10,000,000) Dr (Cr) $5,000,0004,200,000 Plant assets, net Identifiable intangible assets Bonds payable 40,000,000 15,000,000 (10,200,000) Required a. Journalize the acquisition on the parent's books b. Calculate the date-of-acquisition goodwill c. Prepare the eliminating entries to consolidate Superfast at the date of acquisition Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started