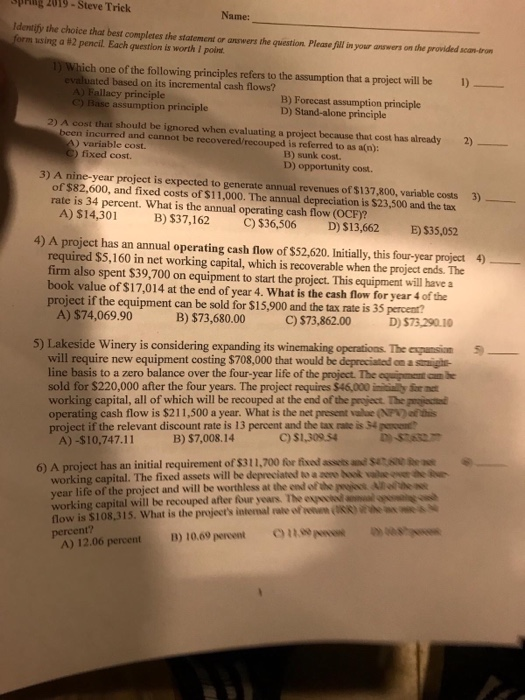

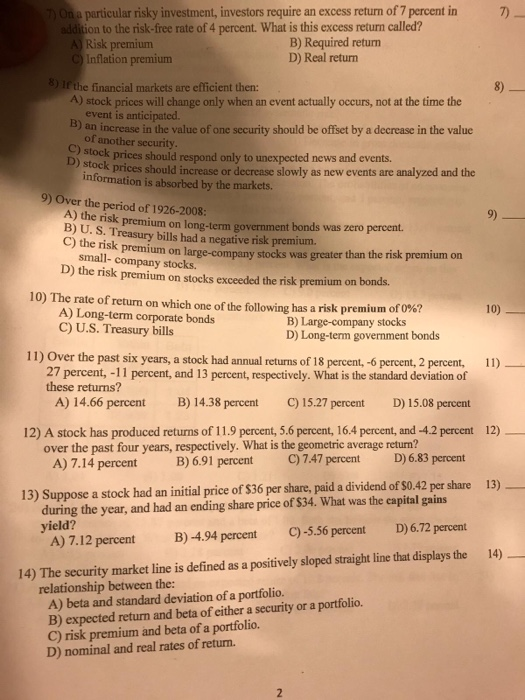

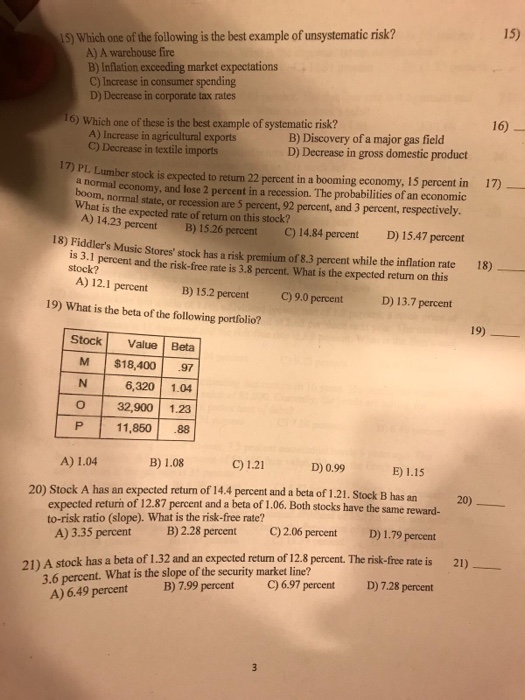

phiNg 2019-Steve Trick Name: Identify the choice that best completes the statement or answers t orm asing a #2 pencil. Each question is worth 1 point. the question. Please fill in your answers on the provided scanarom ich one of the following principles refers to the assumption that a project will be evaluated based on its incremental cash flows? A) Fallacy principle C) Base assumption principle 1) B) Forecast assumption principle D) Stand-alone principle 2) A cost that should be ignored when evaluating a project because that cost has already been incurred and cannot be recovered/recouped is referred to as a(n): ) variable cost. fixed cost. 2) B) sunk cost. D) opportunity cost. 3) A nine-year project is expected to generate annual revenues of $137,800, variable costs 3) of $82,600, and fixed costs of $11,000. The annual depreciation is $23,500 and the tax rate is 34 percent. What is the annual operating cash flow (OCF)? A) $14,301 B) S37,162 C) $36,506 D) $13,662 E) S35,052 4) A project has an annual operating cash flow of $52,620. Initially, this four-year project 4) required $5,160 in net working capital, which is recoverable when the project ends. The firm also spent $39,700 on equipment to start the project. This equipment will have a book value of $17,014 at the end of year 4. What is the cash flow for year 4 of the project if the equipment can be sold for $15,900 and the tax rate is 35 percent? A) $74,069.90 B) $73,680.00 C)S73,862.00 D) $73,29.10 5) Lakeside Winery is considering expanding its winemaking operations. The epunsionS will require new equipment costing $708,000 that would be depreciated on a stnighe line basis to a zero balance over the four-year life of the project. The oquigment can be sold for $220,000 after the four years. The project requires $46,000 iniiality for net working capital, all of which will be recouped at the end of the praject. The jct operating cash flow is $211,500 a year. What is the net present value (NPN) of this project if the relevant discount rate is 13 percent and the tax rate is 34 pecent A) -$10,747.11 C) $1,309.54 B) $7,008.14 6)Aproject has an initial requirement of$311,700 for fixed assets miseseine working capital. The fixed assets will be depreciated to a aere book valke oser he ive life of the project and will be worthless at the end of the pejus Alolhe ne working capital will be recouped after four years. The flow is $108,315. What is the project's intemal rate of'ewK)N HEN nt? A) 12.06 percent B) 10.69 pervent nsvs - Ona particular risky investment, investors require an excess return of 7 percent in ddition to the risk-free rate of 4 percent. What is this excess return called? Risk premiunm Inflation premium B) Required return D) Real return lf the financial markets are efficient then: A) stock prices will change only when an event actually occurs, not at the time the event is anticipated. an increase in the value of one security should be offset by a decrease in the value 8) of another security prices should respond only to unexpected news and events. prices should increase or decrease slowly as new events are analyzed and the information is absorbed by the markets. D) stock 9) Over the period of 1926-2008: A) the risk premium on long-term government B) U. S. Treasury bills had a negative risk premium. C) the risk small- company stocks. D) the risk premium on stocks exceeded the risk premium on bonds 9) bonds was zero percent. premium on large-company stocks was greater than the risk premium on 10) The rate of return on which one of the following has a risk premiurn of 0%? A) Long-term corporate bonds C) U.S. Treasury bills B) Large-company stocks D) Long-term government bonds 11) Over the past six years, a stock had annual returns of 18 percent, -6 percent, 2 percent, 11) 27 percent,-11 percent, and 13 percent, respectively. What is the standard deviation of these returns? A) 14.66 percent B) 14.38 percent C)15.27 percent D) 15.08 percent 12) A stock has produced returns of 11.9 percent, 5.6 percent, 16.4 percent, and -4.2 percent over the past four years, respectively. What is the geometric average return? A)7, 14 percent B)6.91 percent C)7.47 percent D)6.83 percent 12) 13) Suppose a stock had an initial price of $36 per share, paid a dividend of S0.42 per share during the year, and had an ending share price of $34. What was the capital gains yield? A)7. 12 percent B)-4.94 percent C)556 percent D)6.72 percent 13) 14) The security market line is defined as a positively sloped straight line that displays the relationship between the: A) beta and standard deviation of a portfolio. B) expected return and beta of either a security or a portfolio. C) risk premium and beta of a portfolio. D) nominal and real rates of return. 14) 15) 15) Which one of the following is the best example of unsystematic risk? A) A warehouse fire B) Inflation exceeding market expectations C) Increase in consumer spending D) Decrease in corporate tax rates 16) 16) Which one of these is the best example of systematic risk? A) Increase in agricultural exports C) Decrease in textile imports B) Discovery of a major gas field D) Decrease in gross domestic product 1PLumber stock is expected to return 22 percent in a booming economy. 15 percent in 17)- a normal economy, and lose 2 percent in a recession. The probabilities of an economic boom, normal state, or recession are 5 percent, 92 percent, and 3 percent, respectively. What is the expected rate of return on this stock? A) 14.23 percent B) 15.26 percent C) 14.84 percent D) 15.47 percent 18) Fiddler' s Music Stores' stock has a risk premium of 8.3 percent while the inflation rate 18) s 3.1 percent and the risk-free rate is 3.8 percent. What is the expected return on this stock? A) 12.1 percent B) 15.2 percent C)9.0 percent tD) 13.7 percent 19) What is the beta of the following portfolio? StockValue Beta M $18,400 97 6,320 1.04 O 32,900 1.23 11,850.88 C) 1.21 D) 0.99 B) 1.08 E) 1.15 A) 1.04 20) Stock A has an expected return of 14.4 percent and a beta of 1.21. Stock B has an expected returin of 12.87 percent and a beta of 1.06. Both stocks have the same reward- to-risk ratio (slope). What is the risk-free rate? A) 3.35 percent B)2.28 percentC)2.06 percent D) 1.79 percent 20) 21) A stock has a beta of 1.32 and an expected return of 12.8 percent. The risk-free rate is 3.6 percent. What is the slope of the security market line? A) 6.49 percent 7.99 21) B) 7.99 percent C)6.97 percent D)7.28 percent