Question

Phipps Car Rentals Ltd commenced operations on 1 July 2016. At this time it purchased 4 cars at a cost of $30,000 each , and

Phipps Car Rentals Ltd commenced operations on 1 July 2016. At this time it purchased 4 cars at a cost of $30,000 each, and proceeded to rent these on a short-term basis to people visiting Canberra. Accounting operating profit before tax was as follows:

| 2016/7 | $250,000 |

| 2017/8 | $350,000 |

| 2018/9 | $450,000 |

For taxation purposes the cars are depreciable at 15% p.a. whilst for accounting purposes they a depreciable at 10% p.a., both straight line. The tax rate for the years 2016/7 is 30%. After the commencement of the year 2017/8 it is announced that the tax rate decreases to 27.5% and this applies for the 2017/8 year onwards

2016/7 - When establishing Phipps in 2016/7, costs of $5,000 were incurred which are non-deductable for tax purposes. To minimise his tax payments in this financial year, Phipps prepays interest of $9,000 relating to the next month.

2017/8

Phipps is fined $10,000 for the non-payment of superannuation on account of employees (this is not tax deductible).

2018/9

Phipps recognises the provision for long service leave of $5,000 as an expense. Additionally, Phipps believes that the cars are still worth $25,000 each and revalues the cars to this value at the end of the financial year. Phipps has a policy of not selling cars. Rather as they get older, the cars are rented to less discerning markets and ultimately to backpackers.

Required

Prepare journal entries to record the tax expense and related changes in the deferred tax balances for years 2016/7-2018/9 in accordance with AASB112 Income Taxes.

ANSWER:

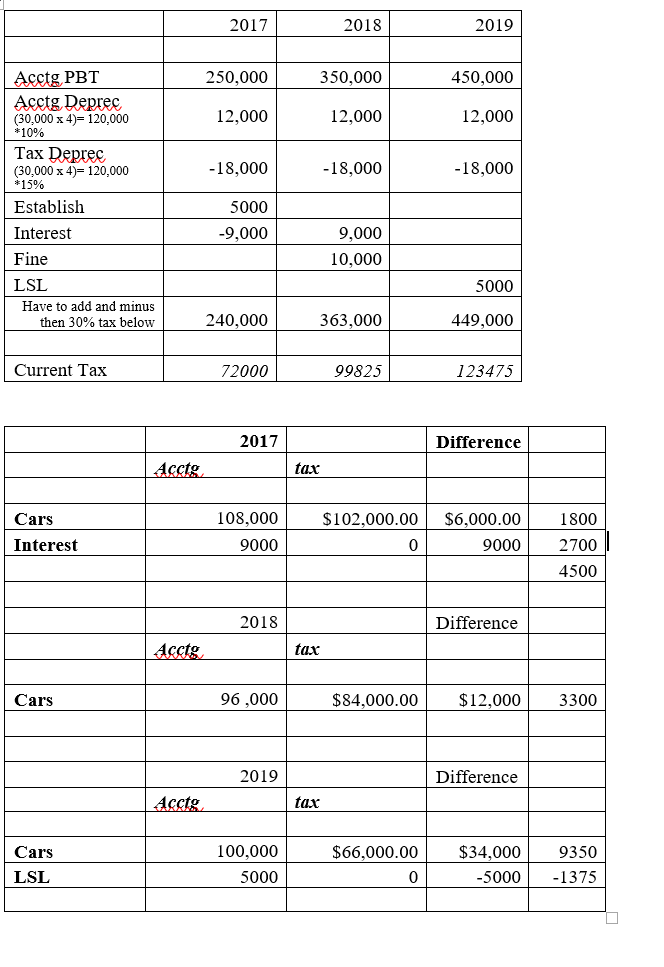

| 2017 | 2018 | 2019 |

| |||||

|

| ||||||||

| Acctg PBT | 250,000 | 350,000 | 450,000 |

| ||||

| Acctg Deprec (30,000 x 4)= 120,000 *10% | 12,000 | 12,000 | 12,000 |

| ||||

| Tax Deprec (30,000 x 4)= 120,000 *15% | -18,000 | -18,000 | -18,000 |

| ||||

| Establish | 5000 |

| ||||||

| Interest | -9,000 | 9,000 |

| |||||

| Fine | 10,000 |

| ||||||

| LSL | 5000 |

| ||||||

| Have to add and minus then 30% tax below | 240,000 | 363,000 | 449,000 |

| ||||

|

| ||||||||

| Current Tax | 72000 | 99825 | 123475 |

| ||||

|

| ||||||||

I would like a full break down as to how the figures were calculated, these are correct answers from textbook not what has been posted as an answer to a similar question

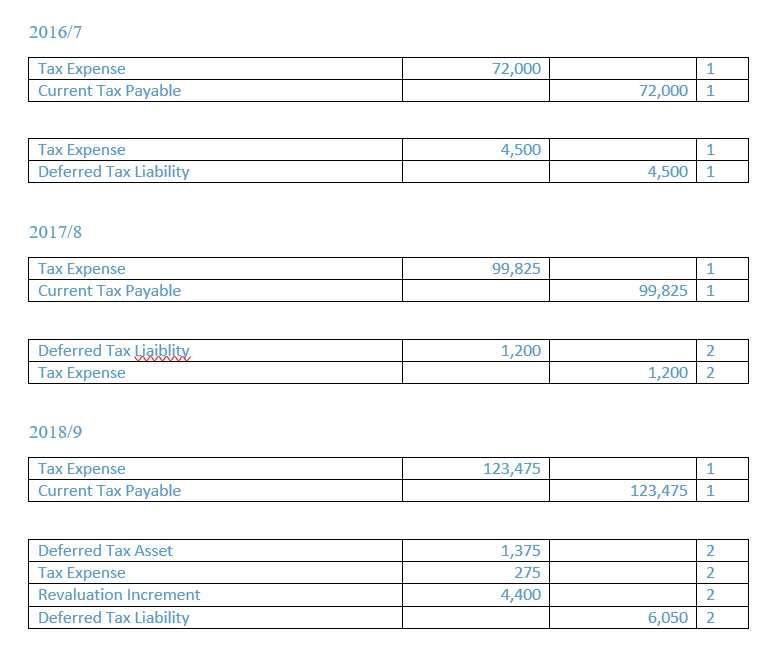

2017 2018 2019 250,000 350,000 450,000 Acctg PBT Acctg Deprec (30,000 x 4)= 120,000 12,000 12,000 12,000 *10% Tax Deprec -18,000 -18,000 -18,000 (30,000 x 4)= 120,000 *15% Establish 5000 9,000 Interest -9,000 Fine 10,000 LSL 5000 Have to add and minus 240,000 363,000 449,000 then 30% tax below 99825 Current Tax 72000 123475 2017 Difference Accte tax 108,000 $102,000.00 $6,000.00 Cars 1800 Interest 9000 9000 2700 4500 2018 Difference Accts tax Cars 96 ,000 $84,000.00 $12,000 3300 2019 Difference Acctg tax 100,000 $66,000.00 $34,000 Cars 9350 -5000 LSL 5000 -1375 2016/7 Tax Expense Current Tax Payable 72,000 72,000 1 4,500 Tax Expense Deferred Tax Liability 4,500 | 1 2017/8 Tax Expense Current Tax Payable 99,825 99,825| 1 Deferred Tax Liaiblity Tax Expense 1,200 1,200 | 2 2018/9 Tax Expense 123,475 Current Tax Payable 123,475| 1 Deferred Tax Asset 1,375 Tax Expense 275 Revaluation Increment 4,400 Deferred Tax Liability 6,050 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started