Question

PHL company is a U.S. sales company are somewhat affected by the value of the New Zealand dollar (NZ$), because it faces competition from New

PHL company is a U.S. sales company are somewhat affected by the value of the New Zealand dollar (NZ$), because it faces competition from New Zealand exporters. Below are the details of transactions for the PL company throughout the year:

(i) PHL has forecasted sales in the New Zealand dollar revenue invoiced in New Zealand dollars are expected to be NZ$700.

(ii) Its cost of materials is estimated is $200 million from purchase of U.S. materials and NZ$100 million from the purchase of New Zealand materials.

(iii) Fixed cost is estimated at $50 million.

(iv) Variable operating expenses are estimated at 10 percent of total sales after include New Zealand sales which translated to a dollar amount.

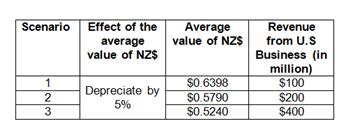

Three scenarios and the expected value for the upcoming scenarios are as follows:

Forecast the net cash flow for PHL Company under each three scenarios.

Scenario Effect of the Average value of NZ$ Revenue from U.S Business (in million) $100 $200 $400 average value of NZ$ $0.6398 Depreciate by 5% $0.5790 $0.5240 23

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started