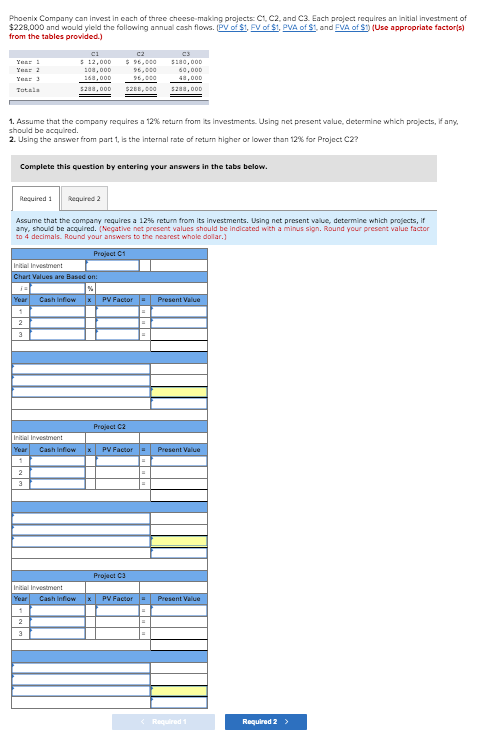

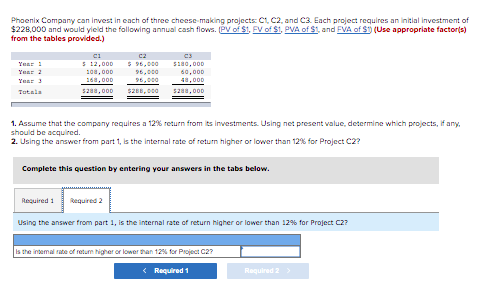

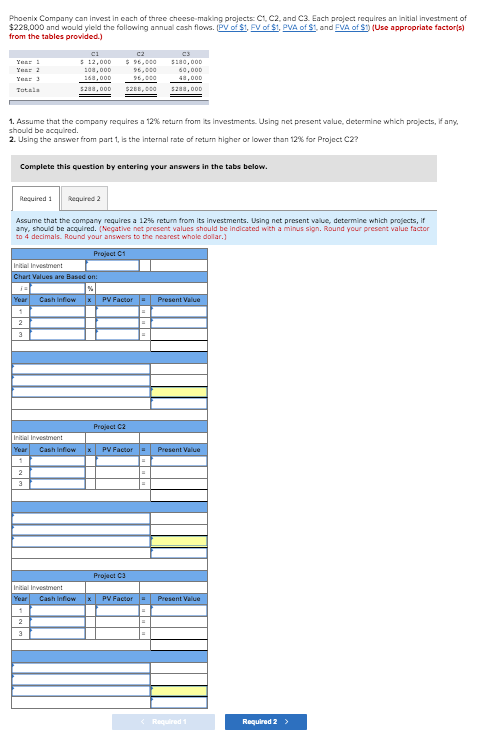

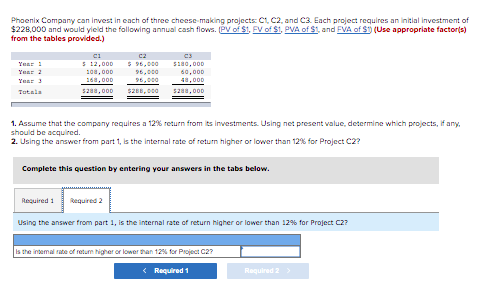

Phoenix Company can invest in each of three cheese-making projects: C1 C2 and C3. Each project requires an initial investment of $228,000 and would yield the following annual cash flows. PV of S1, FV of S1, PVA of St and FVA of S1 (Use appropriate factors) from the tables provided.) ci cs Year $ 12,000 $ 95,000 5180,000 Year 2 108,00D 95.000 60.000 Yes 3 168,000 96.000 40,000 Totale 5200,000 $200,000 5200,000 1. Assume that the company requires a 12% return from its investments. Using net present value, determine which projects, if any. should be acquired. 2. Using the answer from part 1, is the internal rate of return higher or lower than 12% for Project C22 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company requires a 12% return from its investments. Using net present value, determine which projects, ir any, should be acquired. (Negative net present values should be indicated with a minus sign. Round your present value factor to 4 decimals. Round your answers to the nearest whole dollar.) Project C1 Initial investment Chart Values are Based on Year Cash Inflow x PV Factor Present Value 1 2 3 Project C2 PV Factor Present Value inicial Investment Year Cash Inflow 1 2 3 Project ca Initial investment Year Cash Inflow x PV Factor Present Value 2 3 Required: Required 2 > Phoenix Company can invest in cach of three cheese-making projects: Ct C2, and C3. Each project requires an initial investment of $220,000 and would yield the following annual cash flows. PV of St. FV of St. PVA of St. and FVA of S (Use appropriate factors) from the tables provided) Year! Year 2 Year 3 Total ci $ 12.000 100,000 268.000 5283,000 C2 $ 96,000 95,000 96,000 $200,000 5110,000 60,000 40,000 5280,000 1. Assume that the company requires a 12% return from its investments. Using net present value, determine which projects, if any, should be acquired. 2. Using the answer from part 1, is the internal rate of return higher or lower than 12% for Project C2? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Using the answer from part 1, is the internal rate of return higher or lower than 12% for Project C22 is the insemnal rate of return higher or lower than 12% for Project C2?