Question

Phoenix Inc., a cellular communication company, has multiple business units, organized as divisions. Each divisions management is compensated based on the divisions operating income. Division

Phoenix Inc., a cellular communication company, has multiple business units, organized as divisions. Each divisions management is compensated based on the divisions operating income. Division A currently purchases cellular equipment from outside markets and uses it to produce communication systems. Division B produces similar cellular equipment that it sells to outside customersbut not to division A at this time. Division As manager approaches division Bs manager with a proposal to buy the equipment from division B. If it produces the cellular equipment that division A desires, division B will incur variable manufacturing costs of $60 per unit.

Relevant Information about Division B

Sells 100,000 units of equipment to outside customers at $130 per unit

Operating capacity is currently 80%; the division can operate at 100%

Variable manufacturing costs are $70 per unit

Variable marketing costs are $8 per unit

Fixed manufacturing costs are $980,000

Income per Unit for Division A (assuming parts purchased externally, not internally from division B)

| Sales revenue | $ | 320 | ||||

| Manufacturing costs: | ||||||

| Cellular equipment | 80 | |||||

| Other materials | 10 | |||||

| Fixed costs | 40 | |||||

| Total manufacturing costs | 130 | |||||

| Gross margin | 190 | |||||

| Marketing costs: | ||||||

| Variable | 35 | |||||

| Fixed | 15 | |||||

| Total marketing costs | 50 | |||||

| Operating income per unit | $ | 140 | ||||

Required:

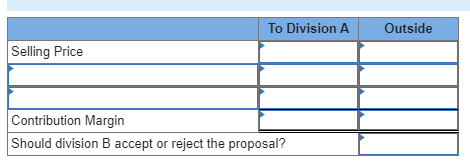

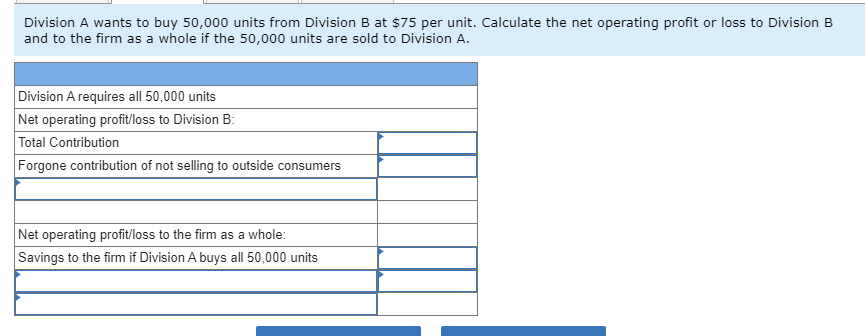

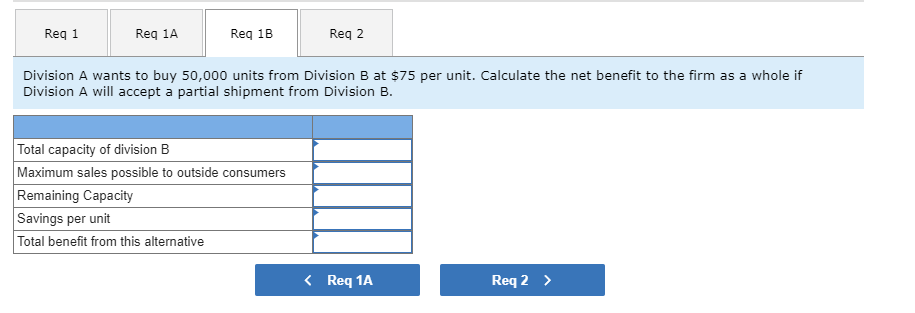

1. Division A wants to buy 50,000 units from Division B at $75 per unit. Should Division B accept or reject the proposal to sell the 50,000 units? (a). Calculate the net operating profit or loss to Division B and to the firm as a whole if the 50,000 units are sold to Division A. (b.) Calculate the net benefit to the firm as a whole if Division A will accept a partial shipment from Division B.

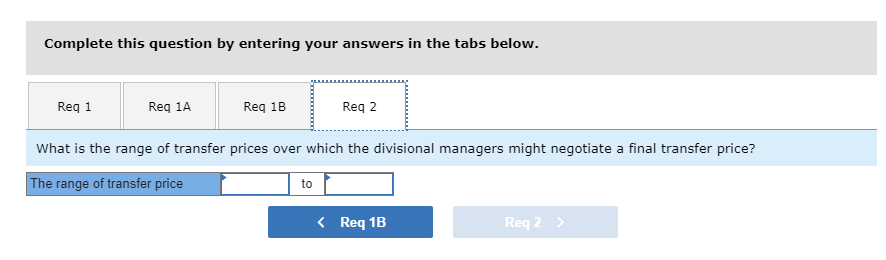

2. What is the range of transfer prices over which the divisional managers might negotiate a final transfer price?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started