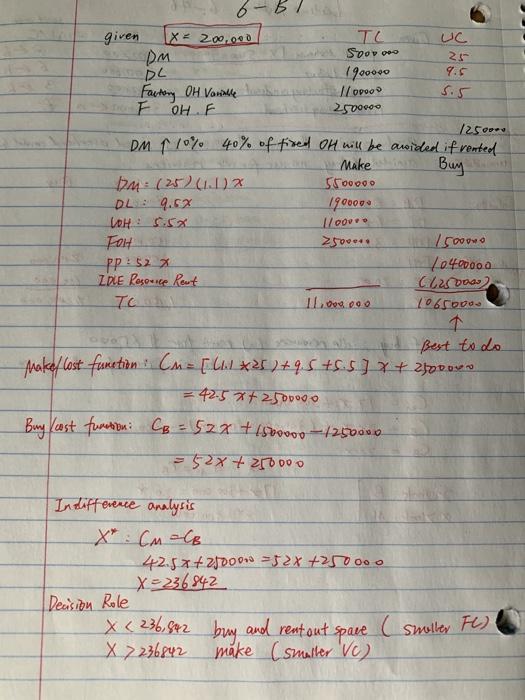

photo #2&3 are similar other questions answer

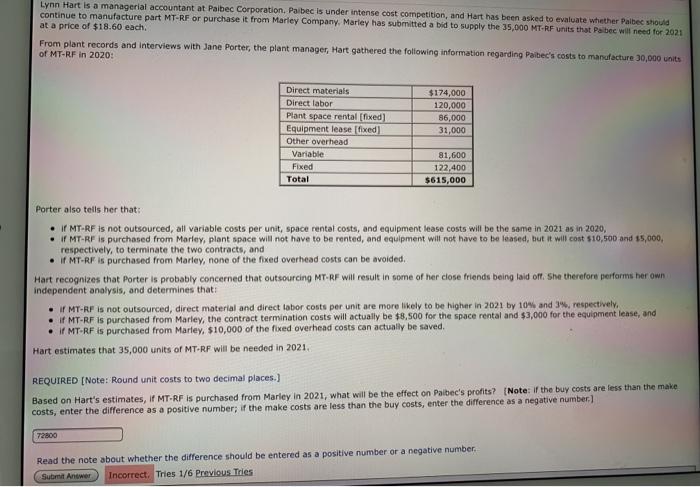

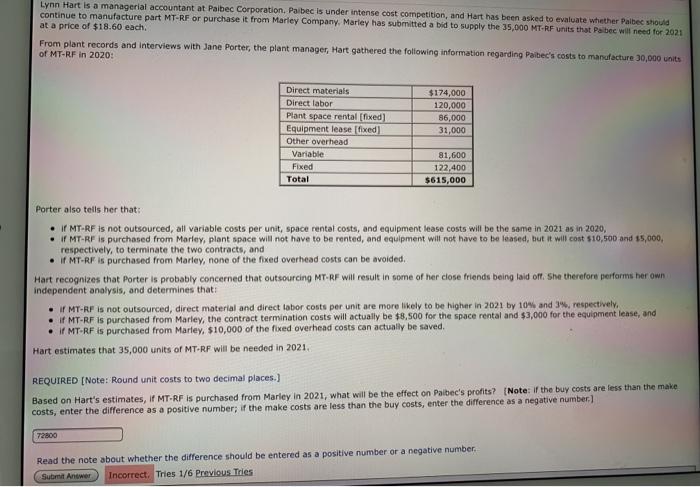

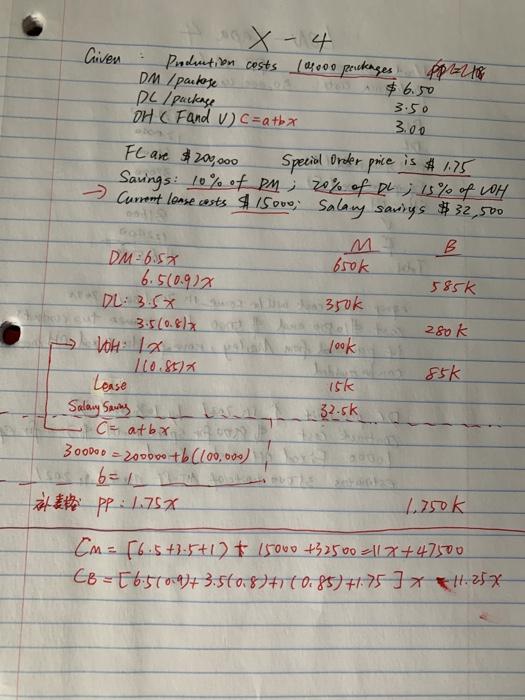

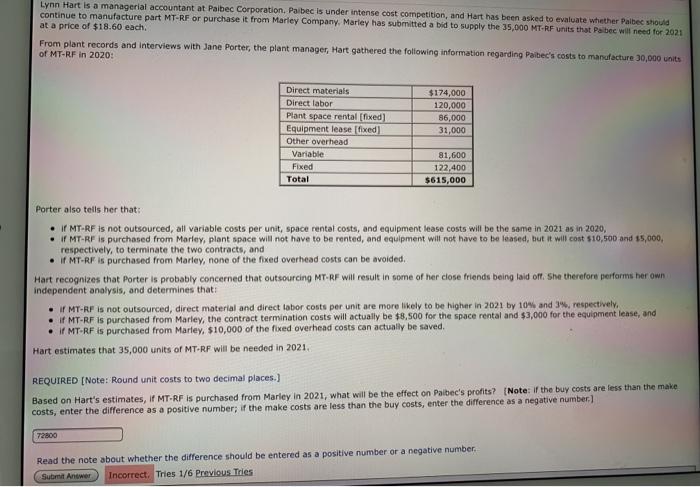

Lynn Hart is a managerial accountant at Palbec Corporation. Paibec is under intense cost competition, and Hart has been asked to evaluate whether Palbec should continue to manufacture part MT-RF or purchase it from Marley Company. Marley has submitted a bid to supply the 35,000 MT-RF units that Pabec will need for 2021 at a price of $18.60 each. From plant records and interviews with Jane Porter, the plant manager, Hart gathered the following information regarding Paibec's costs to manufacture 30,000 units of MT-RF in 2020: Direct materials Direct labor Plant space rental (fixed) Equipment lease fixed] Other overhead Variable Fixed Total $174,000 120,000 86,000 31,000 81,600 122,400 $615,000 Porter also tells her that: MT-RF is not outsourced, all variable costs per unit, space rental costs, and equipment lease costs will be the same in 2021 as in 2020, MT-RF is purchased from Marley, plant space will not have to be rented, and equipment will not have to be leased, but it will cost $10,500 and 15,000. respectively, to terminate the two contracts, and If MT-RF is purchased from Marley, none of the fixed overhead costs can be avoided. Hart recognizes that Porter is probably concerned that outsourcing MT. RF will result in some of her close friends being taid off. She therefore performs her own independent analysis, and determines that: IMT-RF is not outsourced, direct material and direct labor costs per unit are more likely to be higher in 2021 by 10% and 3%, respectively, If MT-RF is purchased from Marley, the contract termination costs will actually be $8,500 for the space rental and $3,000 for the equipment lease, and If MT-RF is purchased from Marley, $10,000 of the fixed overhead costs can actually be saved. Hart estimates that 35,000 units of MT-RF will be needed in 2021, REQUIRED (Note: Round unit costs to two decimal places.) Based on Hart's estimates, if MT-RF is purchased from Marley in 2021, what will be the effect on Paibec's profits? (Note: if the buy costs are less than the make costs, enter the difference as a positive number; if the make costs are less than the buy costs, enter the difference as a negative number) 72800 Read the note about whether the difference should be entered as a positive number or a negative number. Submit Answer Incorrect. Thes 1/6 Previous Tres Given X-4 Prodention costs (asooo packages. appella DM pardose $6.50 DC / package 3.50 OH Fand C=a tbx 3.00 FC are $200.000 Special Order is $ 1.75 price Sarings: 10% of PM; 20% of DL ; 15% of LOH Current losse osts $15 ove, Salary savings $32,500 585k 280k DM 6.58 650k 6.510.912 DL: 3.58 un alun 350k 3.560.817 LH 1x palad med look 120.85% Lease isk Salary Sawing 32.5k Ca atbx 300000 - 20000 tb (100,000) 85k 2 pp: 1.750 1.750k Cm = 56.5 +3.5+1) + 15000 +32500 11x+47500 CB =[657004+ 3.500.8)+770.85) +175] x H.25% given x = 200.000 TC . om Soov o 25 DL ( 190000 9.5 Factory Of Variable Il poo F OHF 2500000 125 DM ( 10% 40% of fired OH will be avoided if rented Make Linn Buy 12M (25) (1.1) 5500000 DL: 9.6% 19000we LH: 5.5x 1/ogoro F 2500 I soooo PP:52 70400000 ZDE Rospulce Rout C625000 TC IL 0000 10650000 1 Best to do Makef Cost furetion : Cm- [WW *2)+95 +5.5] x + 25000 = 42.5 %+2500000 Buy last forebitni Cg = 52% +1500000 1250000 = 52x + 250000 Indifference analysis X CM =C6 42.5%+20000 =52% +210000 X=236842 1 Decision Role x