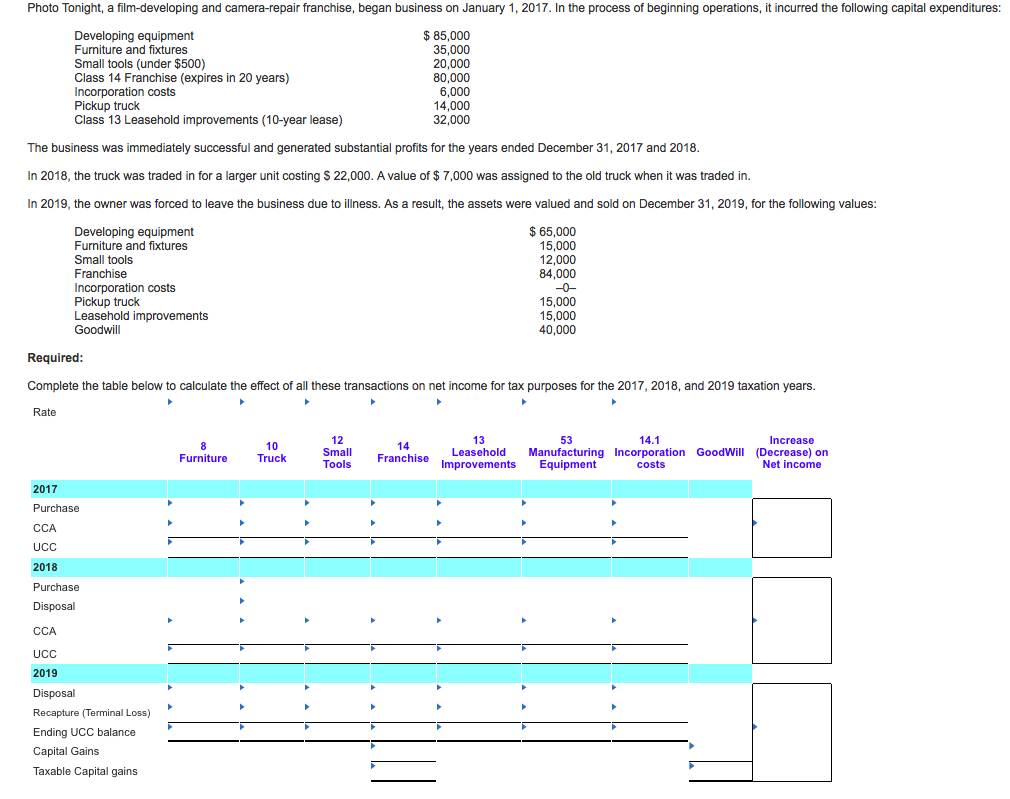

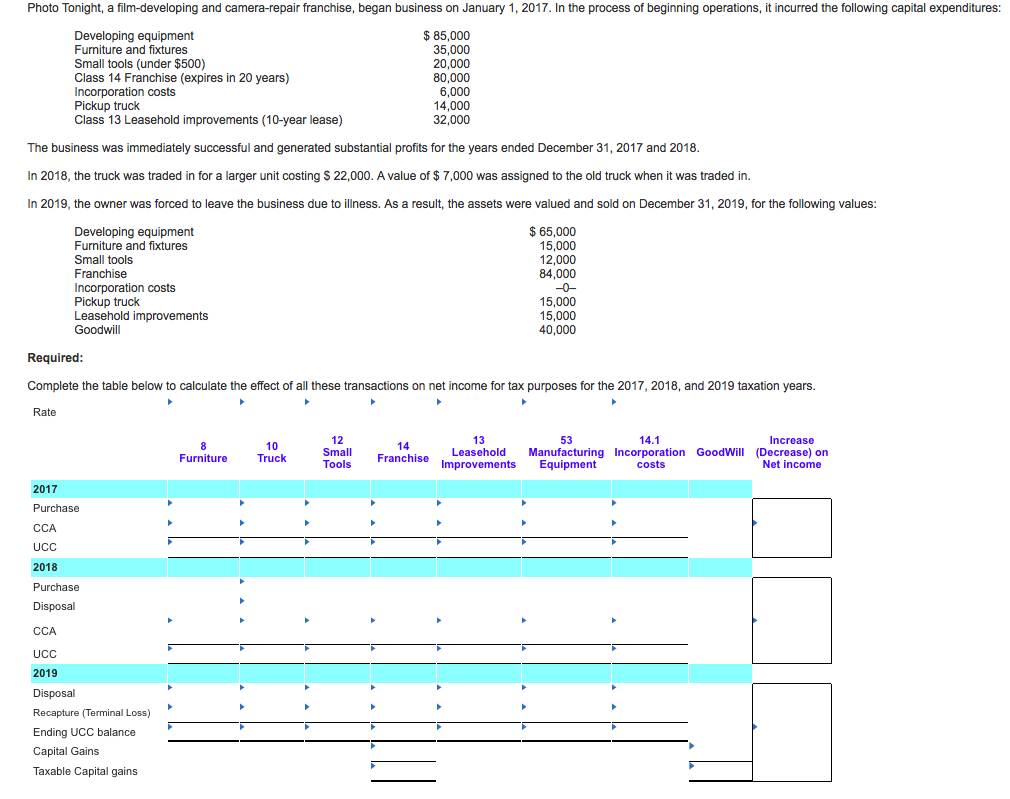

Photo Tonight, a film-developing and camera-repair franchise, began business on January 1, 2017. In the process of beginning operations, it incurred the following capital expenditures: Developing equipment Furniture and fixtures Small tools (under $500) Class 14 Franchise (expires in 20 years) Incorporation costs Pickup truck Class 13 Leasehold improvements (10-year lease) $ 85,000 35,000 20,000 80,000 6,000 14,000 32,000 The business was immediately successful and generated substantial profits for the years ended December 31, 2017 and 2018 In 2018, the truck was traded in for a larger unit costing S 22,000. A value of $ 7,000 was assigned to the old truck when it was traded in. In 2019, the owner was forced to leave the business due to illness. As a result, the assets were valued and sold on December 31, 2019, for the following values $ 65,000 15,000 12,000 84,000 Developing equipment Furniture and fixtures Small tools Franchise Incorporation costs Pickup truck Leasehold improvements Goodwill 15,000 15,000 40,000 Required Complete the table below to calculate the effect of all these transactions on net income for tax purposes for the 2017, 2018, and 2019 taxation years Rate 14.1 12 Small Tools 13 53 Increase 10 Truck 14 Franchise Leasehold Manufacturing Incorporation GoolDecrease) on Improvements Equipment Furniture costs Net income 2017 Purchase CCA UCC 2018 Purchase Disposal CCA UCC 2019 Disposal Recapture (Terminal Loss) Ending UCC balance Capital Gains Taxable Capital gains Photo Tonight, a film-developing and camera-repair franchise, began business on January 1, 2017. In the process of beginning operations, it incurred the following capital expenditures: Developing equipment Furniture and fixtures Small tools (under $500) Class 14 Franchise (expires in 20 years) Incorporation costs Pickup truck Class 13 Leasehold improvements (10-year lease) $ 85,000 35,000 20,000 80,000 6,000 14,000 32,000 The business was immediately successful and generated substantial profits for the years ended December 31, 2017 and 2018 In 2018, the truck was traded in for a larger unit costing S 22,000. A value of $ 7,000 was assigned to the old truck when it was traded in. In 2019, the owner was forced to leave the business due to illness. As a result, the assets were valued and sold on December 31, 2019, for the following values $ 65,000 15,000 12,000 84,000 Developing equipment Furniture and fixtures Small tools Franchise Incorporation costs Pickup truck Leasehold improvements Goodwill 15,000 15,000 40,000 Required Complete the table below to calculate the effect of all these transactions on net income for tax purposes for the 2017, 2018, and 2019 taxation years Rate 14.1 12 Small Tools 13 53 Increase 10 Truck 14 Franchise Leasehold Manufacturing Incorporation GoolDecrease) on Improvements Equipment Furniture costs Net income 2017 Purchase CCA UCC 2018 Purchase Disposal CCA UCC 2019 Disposal Recapture (Terminal Loss) Ending UCC balance Capital Gains Taxable Capital gains