Question

Phuket Beach Hotel Analysis How do I calculate the decrease in net room revenue? I know the answers are YR 1=1.65 million, YR 2=1.683 million,

Phuket Beach Hotel Analysis

How do I calculate the decrease in net room revenue? I know the answers are

YR 1=1.65 million, YR 2=1.683 million, YR 3= 1,767,125, YR 4=1,855,500

But I'm not sure how the amounts were calculated.

Please see additional information below.

Mike Campbell, General Manager of Phuket Beach Hotel, paced his office and considered an

offer made by Planet Karaoke Pub. Planet Karaoke Pub was expanding fast in Thailand. It

was looking for a venue in Patong beach area for setting up another outlet, and

was eyeing an

unused space owned by the Hotel. At this point, the space was located on the second floor of

the main building and was very much under-utilised. It was reserved for the construction of

an alley linking to a new wing for the hotel, which would not be completed until two years

later.

Planet Karaoke Pub offered to sign a four-year lease agreement with the hotel for renting part

of the unused space. It proposed to pay:

?

a monthly rental fee of 170,000 baht for the first two years; and

?

thereafter, a 5% increment for the next two years.

In order to accommodate the hotel?s expansion plan, Planet Karaoke Pub required only 70%

of the unused space, which had a size of 3,000 sq. feet. This would allow the hotel to keep

the remaining space for the creation of an alley two years later.

It was envisaged that the proposed pub would not affect the hotel?s future expansion plan.

Nevertheless, Mike was still a bit perplexed about the decision facing him. Similar

development proposals had previously been rejected by the board of directors.

One of the old

proposals, which involved converting the space into a cigar and champagne bar, had been

rejected by the board because it required a long payback period. Another proposal for the

creation of a spa was discarded due to its low return on investment. Given that the present

capital budgeting system ranked projects according to payback period and average return on

investment, Mike decided to seek a careful analysis of the offer from the Pub.

1

That evening, Mike asked to meet with

Kornkrit Manming, the hotel?s Financial Controller,

to discuss the offer from Planet Karaoke

Mike Campbell, General Manager of Phuket Beach Hotel, paced his office and considered an

offer made by Planet Karaoke Pub. Planet Karaoke Pub was expanding fast in Thailand. It

was looking for a venue in Patong beach area for setting up another outlet, and

was eyeing an

unused space owned by the Hotel. At this point, the space was located on the second floor of

the main building and was very much under-utilised. It was reserved for the construction of

an alley linking to a new wing for the hotel, which would not be completed until two years

later.

Planet Karaoke Pub offered to sign a four-year lease agreement with the hotel for renting part

of the unused space. It proposed to pay:

?

a monthly rental fee of 170,000 baht for the first two years; and

?

thereafter, a 5% increment for the next two years.

In order to accommodate the hotel?s expansion plan, Planet Karaoke Pub required only 70%

of the unused space, which had a size of 3,000 sq. feet. This would allow the hotel to keep

the remaining space for the creation of an alley two years later.

It was envisaged that the proposed pub would not affect the hotel?s future expansion plan.

Nevertheless, Mike was still a bit perplexed about the decision facing him. Similar

development proposals had previously been rejected by the board of directors.

One of the old

proposals, which involved converting the space into a cigar and champagne bar, had been

rejected by the board because it required a long payback period. Another proposal for the

creation of a spa was discarded due to its low return on investment. Given that the present

capital budgeting system ranked projects according to payback period and average return on

investment, Mike decided to seek a careful analysis of the offer from the Pub.

1

That evening, Mike asked to meet with

Kornkrit Manming, the hotel?s Financial Controller,

to discuss the offer from Planet Karaoke

Phucket Beach Hotel Case Analysis

Mike Campbell, General Manager of Phuket Beach Hotel, paced his office and considered an

offer made by Planet Karaoke Pub. Planet Karaoke Pub was expanding fast in Thailand. It

was looking for a venue in Patong beach area for setting up another outlet, and

was eyeing an

unused space owned by the Hotel. At this point, the space was located on the second floor of

the main building and was very much under-utilised. It was reserved for the construction of

an alley linking to a new wing for the hotel, which would not be completed until two years

later.

Planet Karaoke Pub offered to sign a four-year lease agreement with the hotel for renting part

of the unused space. It proposed to pay:

?

a monthly rental fee of 170,000 baht for the first two years; and

?

thereafter, a 5% increment for the next two years.

In order to accommodate the hotel?s expansion plan, Planet Karaoke Pub required only 70%

of the unused space, which had a size of 3,000 sq. feet. This would allow the hotel to keep

the remaining space for the creation of an alley two years later.

It was envisaged that the proposed pub would not affect the hotel?s future expansion plan.

Nevertheless, Mike was still a bit perplexed about the decision facing him. Similar

development proposals had previously been rejected by the board of directors.

One of the old

proposals, which involved converting the space into a cigar and champagne bar, had been

rejected by the board because it required a long payback period. Another proposal for the

creation of a spa was discarded due to its low return on investment. Given that the present

capital budgeting system ranked projects according to payback period and average return on

investment, Mike decided to seek a careful analysis of the offer from the Pub.

1

That evening, Mike asked to meet with

Kornkrit Manming, the hotel?s Financial Controller,

to discuss the offer from Planet Karaoke

Mike Campbell, General Manager of Phuket Beach Hotel, paced his office and considered an

offer made by Planet Karaoke Pub. Planet Karaoke Pub was expanding fast in Thailand. It

was looking for a venue in Patong beach area for setting up another outlet, and

was eyeing an

unused space owned by the Hotel. At this point, the space was located on the second floor of

the main building and was very much under-utilised. It was reserved for the construction of

an alley linking to a new wing for the hotel, which would not be completed until two years

later.

Planet Karaoke Pub offered to sign a four-year lease agreement with the hotel for renting part

of the unused space. It proposed to pay:

?

a monthly rental fee of 170,000 baht for the first two years; and

?

thereafter, a 5% increment for the next two years.

In order to accommodate the hotel?s expansion plan, Planet Karaoke Pub required only 70%

of the unused space, which had a size of 3,000 sq. feet. This would allow the hotel to keep

the remaining space for the creation of an alley two years later.

It was envisaged that the proposed pub would not affect the hotel?s future expansion plan.

Nevertheless, Mike was still a bit perplexed about the decision facing him. Similar

development proposals had previously been rejected by the board of directors.

One of the old

proposals, which involved converting the space into a cigar and champagne bar, had been

rejected by the board because it required a long payback period. Another proposal for the

creation of a spa was discarded due to its low return on investment. Given that the present

capital budgeting system ranked projects according to payback period and average return on

investment, Mike decided to seek a careful analysis of the offer from the Pub.

1

That evening, Mike asked to meet with

Kornkrit Manming, the hotel?s Financial Controller,

to discuss the offer from Planet Karaoke

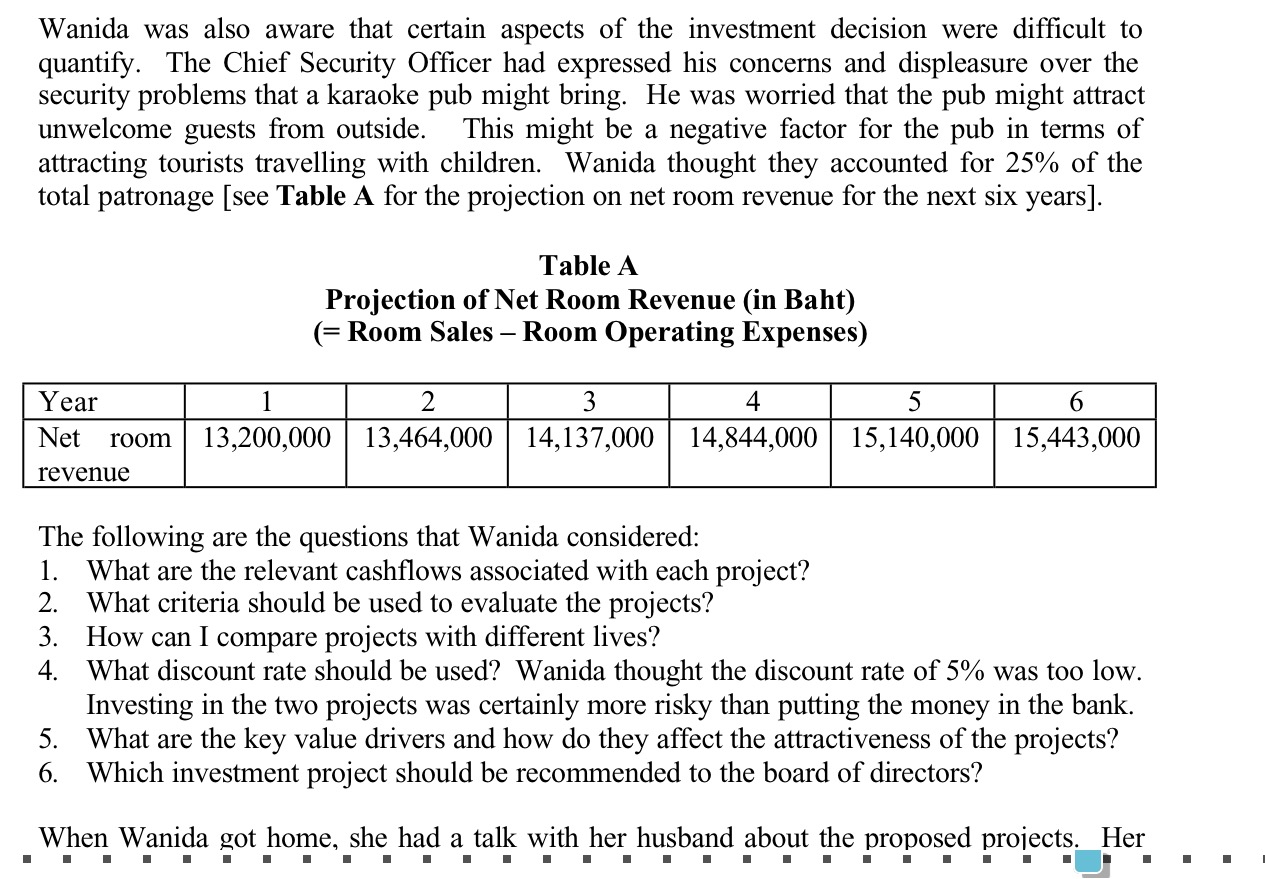

Wanida was also aware that certain aspects of the investment decision were difficult to quantify. The Chief Security Officer had expressed his concerns and displeasure over the security problems that a karaoke pub might bring. He was worried that the pub might attract unwelcome guests from outside. This might be a negative factor for the pub in terms of attracting tourists travelling with children. Wanida thought they accounted for 25% of the total patronage [see Table A for the projection on net room revenue for the next six years]. The following are the questions that Wanida considered: What are the relevant cashflows associated with each project? What criteria should be used to evaluate the projects? How can I compare projects with different lives? What discount rate should be used? Wanida thought the discount rate of 5% was too low. Investing in the two projects was certainly more risky than putting the money in the bank. What are the key value drivers and how do theyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started