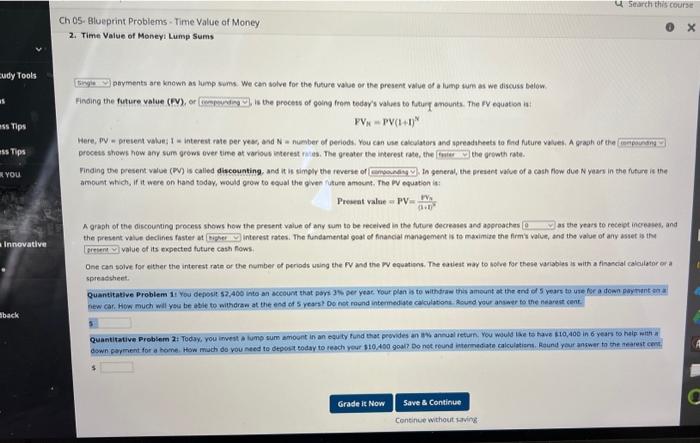

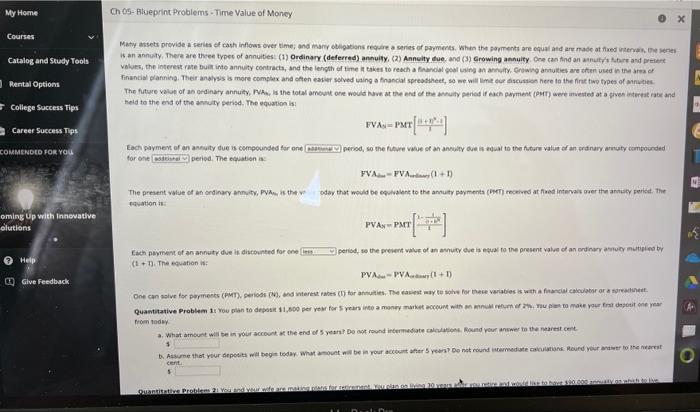

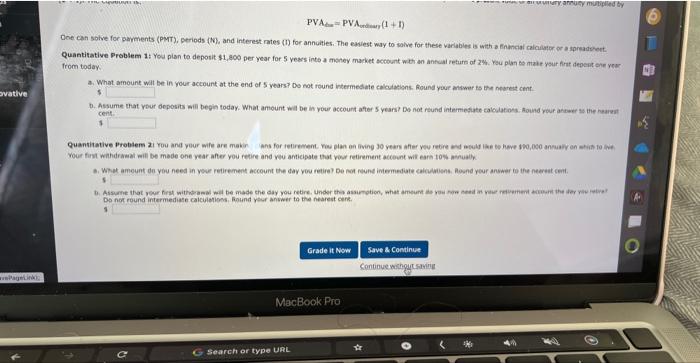

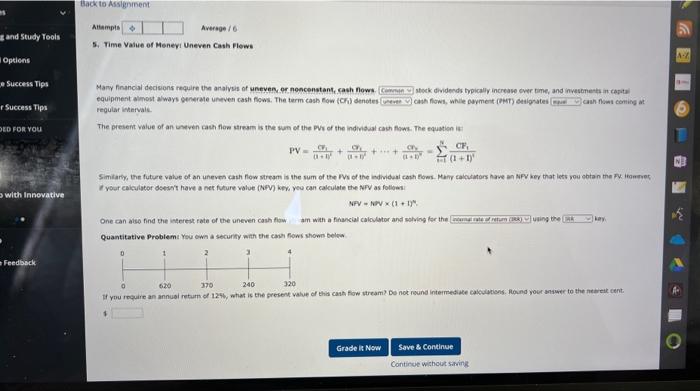

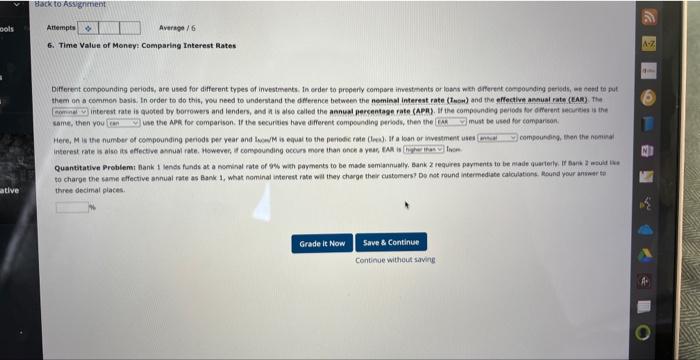

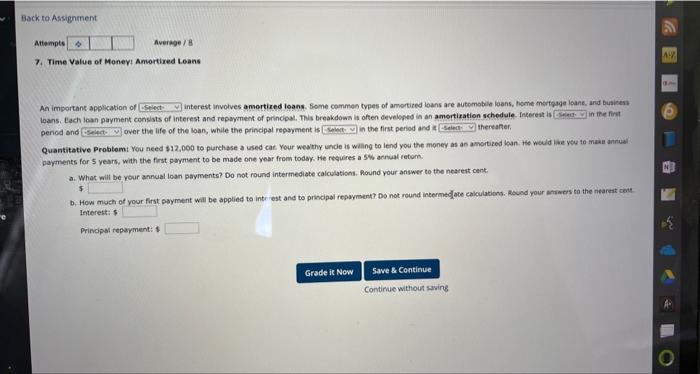

phyments are known as lump sums. We cen solve for the future value of the present value of a hump turn as we discuss balow Finoing the future value (FV), of is the process of going foom tedsy's values to fotury amounts. The PY equation ia: YVM=PV(1+1)N Here, pV = pretent volue: I - interest rate per yes, and N = number of periods. You can ise calculaters and spreadaheets to find fieure values. A sraah of the procets shows how any sum grows over time at various irterest 1 is th. The greater the interest rate, the the growth rate. Finding the present value (FW) is called discounting, and it is timply the reverse of amoust ntich, if it were on hand today, wouls grow to ecual the given future amount. The Fir equation is: Present value ar PY=(1+E2)2Wx A oraph of the discourting process shows how the present. value of any wam to be received in the future deceases and agproathes the present value deciines faster at interest rates. The fundamental goat of fnancial management is to maximize the firmis value, and the value of any asset is the value of its expected future cash fows. One cen tolve for either the interest rate or the number of periods using the PV and the W equations. The eatiest may to sotre for these variabies is with a financal calilator of a spreactheet. 5 nquation in: PVAN=PST[111x1] (t+1). The equation ia: PVAs =PVAarawp(t+1) trancosex Doe can solve for parments (PMT), periods (N), and interest rates (1) for annuities. The eaviest way to walve for these variabies is with a fn whicial calailator of a spreaderert. from today 3. What arnount wit be in your account at the end of 5 years? Do eot round intermedate calculatisns. found your momer is the nestest cent. 5 . cent 1 1 De not mound intermediase calciletions, Round yeor antwer to the nearest cent. 5 5. Time Value of Meneyi Uneven Cash Flews The present value of an uneven cash flen strears is the soen of the PVr of the indivisal cach fows. The equation is: trour caiculator desin't have a net future value (NPV) keri yeu can calculate the NPV as fotlowi One can aiso find the wherest rete of the uneven cash fow am with a financial calovator and solving for the ying the Quantitative Problemt You own a securify anth the cape fowi shown belew 6. Time Value of Money: Comparing Interest Aates them on a common bosis. In order to do this, you need to understand the diference between the neminal interest rate (Twom) and the effective annual rate (EAR). Tte came, then you (ise the APh for comparison. If the securties have different compownting periods, then the must te used for comparison. compounsty, then the neriea) interest rate is alse its effective arnual rate. However, t conpounding ocours more than once o year, tha is to charge the came effective annual rate as Banks 1, what nominal intereut rate will they charge ther customen? Do not round intermedute caloulations. Robund your ansest te three decimal places. 7. Tinse Value of Money Amortired Loans An important application of interest involves amortired loans. Some commen types of amotired loans are automobit loans, home martage loant, and busizes loans. Each loan payment consists of interest and repayment of principal. TNis breakdown in often developed in an amertixation schedule. Inkereat is peniod and over the life of the loan, while the principal repayment is in the first period and is thereanter. Quantitative Problemi You need $12,000 to purchase a used cac. Your westhy sncie is wiang to lend you the money as an anortized loan. the wold like yeu to makil antinal payments for 5 years, with the first payment to be made one year from today. He requires a 5% arnual retum. a. What will be your annual loan payments? Do not round intermediate caloulations. Round your answer to the nearest cent. 5 b. How mach of vour first payment will be applied to inte est and to principal repayment? Do not round intermedote caiculations. Roved your asmes ta the neareat cett Interest: 5 Principal repayment: 1