Answered step by step

Verified Expert Solution

Question

1 Approved Answer

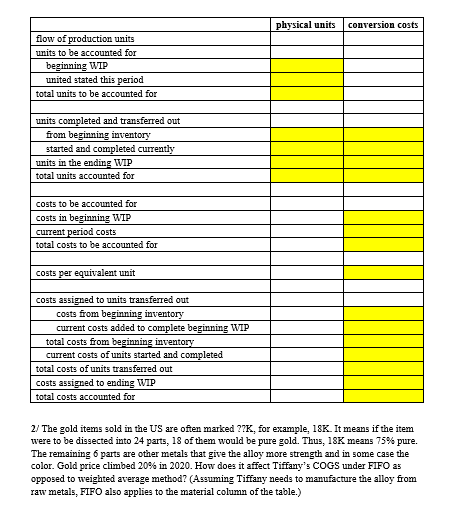

physical units conversion costs flow of production units units to be accounted for beginning WIP united stated this period total units to be accounted

physical units conversion costs flow of production units units to be accounted for beginning WIP united stated this period total units to be accounted for units completed and transferred out from beginning inventory started and completed currently units in the ending WIP total units accounted for costs to be accounted for costs in beginning WIP current period costs total costs to be accounted for costs per equivalent unit costs assigned to units transferred out costs from beginning inventory current costs added to complete beginning WIP total costs from beginning inventory current costs of units started and completed total costs of units transferred out costs assigned to ending WIP total costs accounted for 2/ The gold items sold in the US are often marked ??K, for example, 18K. It means if the item were to be dissected into 24 parts, 18 of them would be pure gold. Thus, 18K means 75% pure. The remaining 6 parts are other metals that give the alloy more strength and in some case the color. Gold price climbed 20% in 2020. How does it affect Tiffany's COGS under FIFO as opposed to weighted average method? (Assuming Tiffany needs to manufacture the alloy from raw metals, FIFO also applies to the material column of the table.) Requirement #3 4 pts: Discuss what SG&A includes for each company. Hint: For Tiffany, SG&A information is on page marked "K-61". For Canada Goose, it is on page 51. 4 pts: Canada Goose has one more line item listed above operating income. What is it? Because it is listed along with SG&A, it is not part of the manufacturing cost. If Canada Goose were to make short-term production plans, would that line item have any effect on the decision-making process? 5 pts: A huge portion of Tiffany's SG&A is associated with Advertising, Marketing, Public and Media Relations Costs. What are those costs in 2019, 2018, and 2017 in dollar amount and as the percentage of net sales? If we want to assign these costs to "Jewelry collections", "Engagement jewelry", "Designer Jewelry", and "All other", how would you assign? (Hint: Look at the page marked K-60.) Requirement #4 11 pts: Jewelry requires multiple procedures to create. Sometimes it takes more than one period. If Tiffany uses FIFO method, can you help their accountant figure out the following information? At the beginning of the month, an artist has two unfinished items from the previous month. The items are considered 60% complete. And the costs incurred so far are $300. During this month, additional costs of $1,200 are incurred, and three new items are started. At the end of the month. the artist has one unfinished item which is considered 20% complete.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started