Answered step by step

Verified Expert Solution

Question

1 Approved Answer

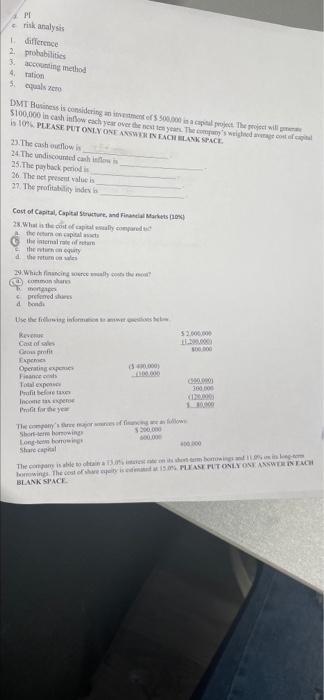

PI e risk analysis 1. difference 2. probabilities 3. accounting method 4. ration 5. equals zero DMT Business is considering an investment of $500,000

PI e risk analysis 1. difference 2. probabilities 3. accounting method 4. ration 5. equals zero DMT Business is considering an investment of $500,000 in a capital project. The project will g $100,000 in cash inflow each year over the next ten years. The company's weighted average cont of capital in 10% PLEASE PUT ONLY ONE ANSWER IN EACH BLANK SPACE. 23.The cash outflow is, 24 The undiscounted cash inflow is 25.The payback period is 26 The net present value i 27. The profitability index is Cost of Capital, Capital Structure, and Financial Markets (3) 28. What is the cost of capital sally compared the return on capital the internal rate of the turn on esity d the return on sales stan 29.Which financing source sally costs them? common shans preferred shares 4 bondi Use the following information to answer questions bel Revenue $2.000.000 Cast of sales 1.200.0000 Gro profit 500.000 Expenses Operating expenses ($40,000) 100.000 Total expens 90990) Profit before taxes 300,000 Income tax exper 120090) 1000 Profit for the year The company's Bree major ses of financing are a fullows Short-term homowing Long-term borrowings Share capital $200,000 600.000 400.000 The company is able to obtain a 13.0% invest teen is short term borrowings and 110% its long-term borrowings. The cost of share equity is edited at 15.0% PLEASE PUT ONLY ONE ANSWER IN EACH BLANK SPACE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started