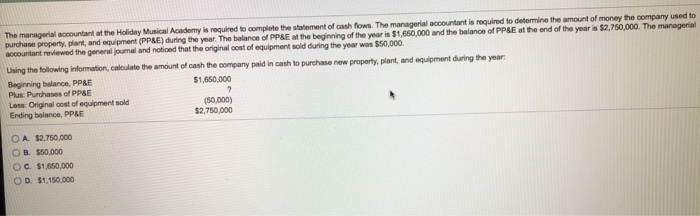

pic 1- Q1

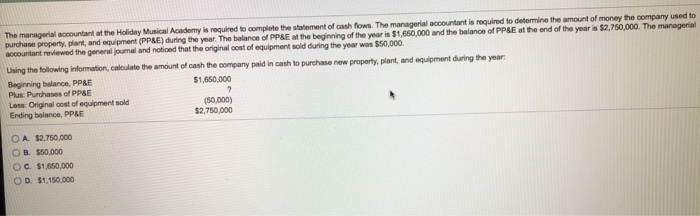

pic 2 - Q2

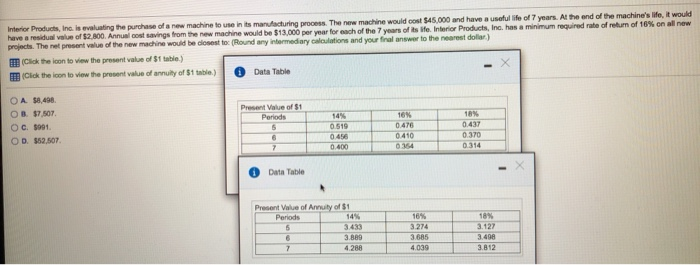

pic 3 - Q3

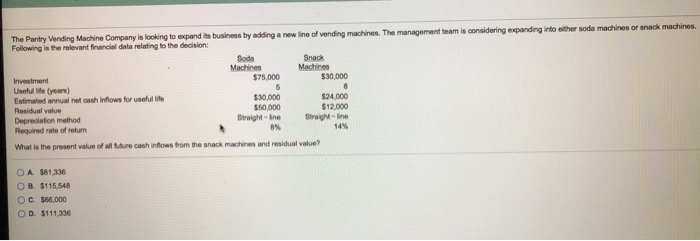

pic 4&5 - Q4

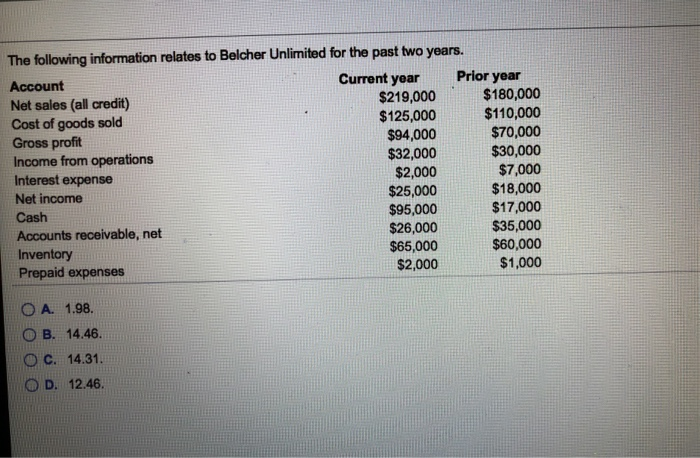

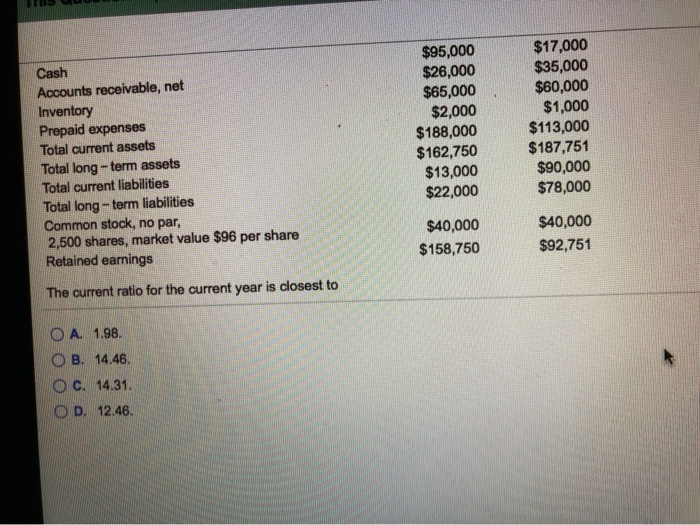

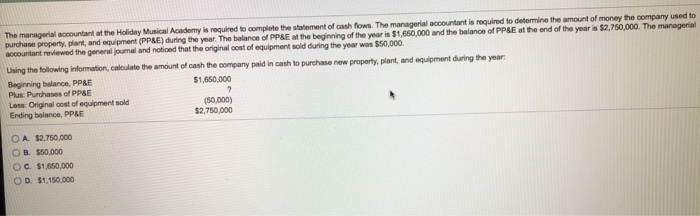

The managerial accountant at the Holiday Musical Academy is required to complete the statement of cash flows. The managerial accountant is required to determine the amount of money the company used to purchase property, plant, and equipment (PPE) during the year. The balance of PPE at the beginning of the year is $1,650,000 and the balance of PP&E at the end of the year is $2,750,000. The managerial accountant reviewed the general journal and noticed that the original cost of equipment sold during the year was $50,000 Using the following information, calculate the amount of cash the company paid in cash to purchase new property, plant, and equipment during the year Beginning balance, PP&E $1,650.000 Plus Purchases of PP&E Low: Original cost of equipment sold (50,000) Ending balance, PPSE $2,750 000 OA $2,750,000 B. $50,000 OC. $1,650,000 OD $1,150,000 Interior Products, Inc. is evaluating the purchase of a new machine to use in its manufacturing process. The new machine would cost $45,000 and have a useful life of 7 years. At the end of the machine's life, it would have a residual value of $2,800. Annual cost savings from the new machine would be $13,000 per year for each of the 7 years of its ife Interior Products, Inc. has a minimum required rate of return of 10% on all new projects. The represent value of the new machine would be closest to found any intermediary calculations and your final answer to the nearest dolar) Click the icon to view the present value of $1 table) (Click the icon to view the present value of annuity of 51 table.) Data Table OA $0,496 OB. $7,507 OC. $991 OD 352,507 Present Value of $1 Periods 5 6 7 14% 0510 168 0.476 0.410 0.354 18 0.437 0.370 0.314 0.400 Data Table 10% Present Value of Anuity of $1 Periods 5 3433 6 3.889 7 4.288 16% 3.274 3.685 4.039 18% 3.127 3.498 3.812 The Pantry Vending Machine Company is looking to expand its business by adding a new line of vending machines. The management team is considering expanding into other soda machines or snack machines. Following is the relevant financial data relating to the decision Soda Snack Machines Machines Investment $75,000 $30,000 Useful life (years) Estimated annual ret cash inflows for useful life $30,000 $24.000 Residual value $50,000 $12.000 Depreciation method Straight-ine Straight line Required rate of retum 0% 14% What is the present value of all tre cash infows from the snack machines and residual value? O A $81,336 B. $115,548 OC. 500,000 OD $111.336 OO Prior year The following information relates to Belcher Unlimited for the past two years. Account Current year Net sales (all credit) $219,000 Cost of goods sold $125,000 Gross profit $94,000 Income from operations $32,000 Interest expense $2,000 Net income $25,000 Cash $95,000 Accounts receivable, net $26,000 Inventory $65,000 Prepaid expenses $2,000 $180,000 $110,000 $70,000 $30,000 $7,000 $18,000 $17,000 $35,000 $60,000 $1,000 A. 1.98. B. 14.46. C. 14.31. D. 12.46. Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Total long-term assets Total current liabilities Total long-term liabilities Common stock, no par, 2,500 shares, market value $96 per share Retained earnings $95,000 $26,000 $65,000 $2,000 $188,000 $162,750 $13,000 $22,000 $17,000 $35,000 $60,000 $1,000 $113,000 $187,751 $90,000 $78,000 $40,000 $158,750 $40,000 $92,751 The current ratio for the current year is closest to O A. 1.98. OB 14.46. O C. 14.31. OD. 12.46