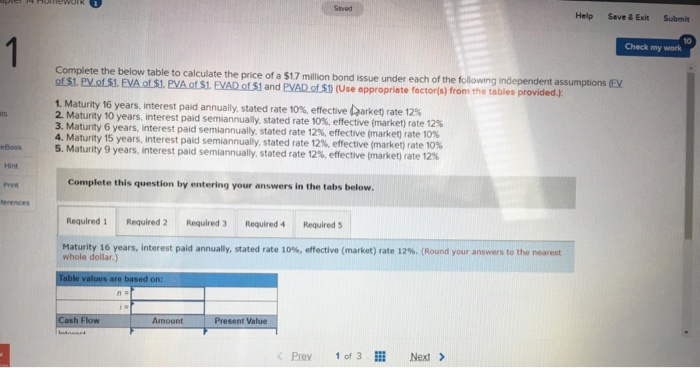

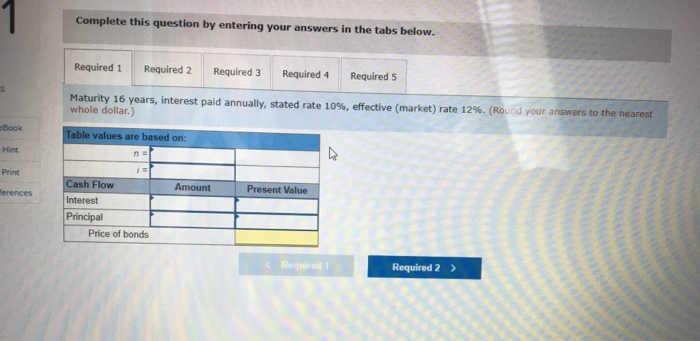

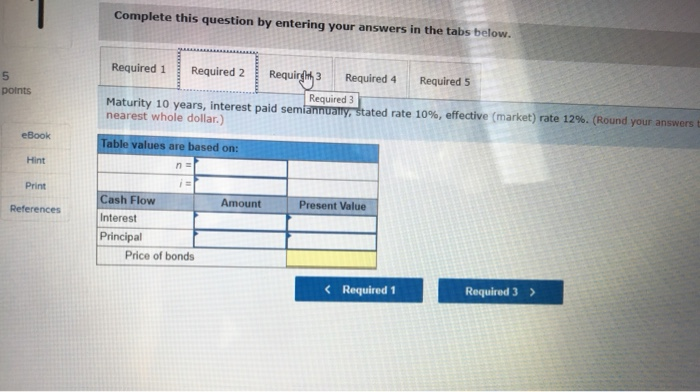

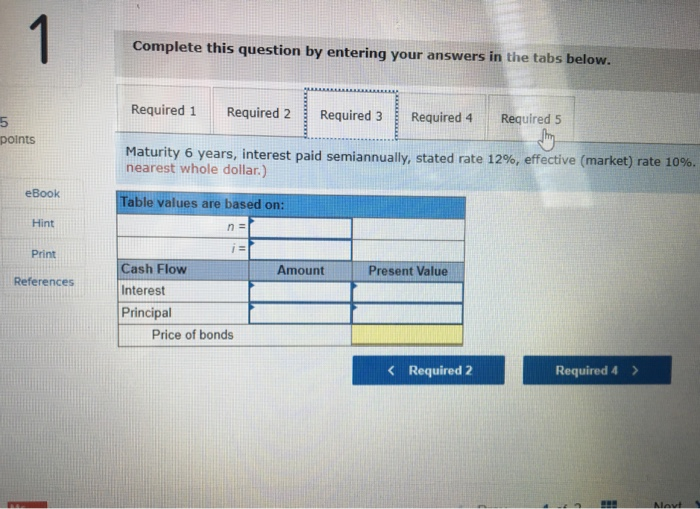

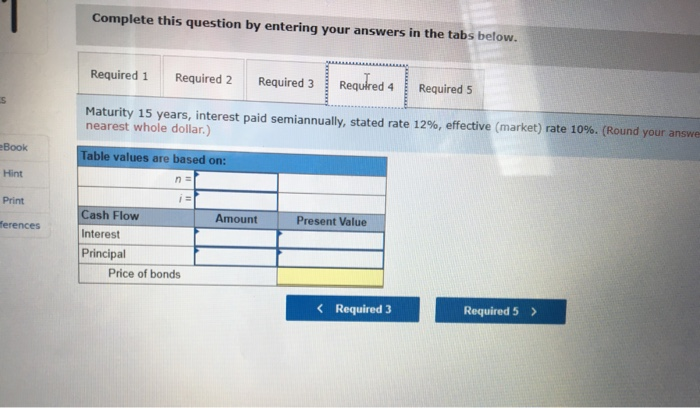

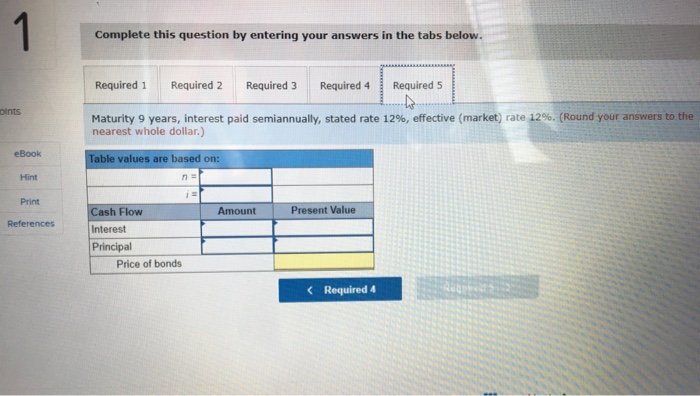

pic 14 UrewOIR Help Save & Exit Submit Check my work Complete the below table to calculate the price of a $17 million bond issue under each of the following independent assumptions (EV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1 (Use appropriate factor(s) from the tables provided.): 1. Maturity 16 years, interest paid annually stated rate 10%, effective arket) rate 12% 2. Maturity 10 years, Interest paid semiannually stated rate 10% effective market) rate 12% 3. Maturity 6 years, interest paid semiannually stated rate 12%, effective market) rate 10% 4. Maturity 15 years, interest paid semiannually stated rate 12%, effective market) rate 10% 5. Maturity 9 years, interest paid semiannually stated rate 12%, effective market) rate 12% Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Maturity 16 years, interest paid annually, stated rate 10%, effective market) rate 12%. (Round your answers to the nearest whole dollar) Table values are based on: Cash Flow Amount Present Value Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Maturity 16 years, interest paid annually, stated rate 10%, effective market) rate 12%. (Round your answers to the nearest whole dollar) Book Table values are based on: Hint Print Amount Present Value rence Cash Flow Interest Principal Price of bonds Required 2 > Complete this question by entering your answers in the tabs below. points Required 1 Required 2 Requirgl 3 Required 4 Required 5 Required 3 Maturity 10 years, interest paid semiannuatry, stated rate 10%, effective market) rate 12%. (Round your answers nearest whole dollar.) eBook Table values are based on: Hint Print Amount References Present Value Cash Flow Interest Principal Price of bonds Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 points Maturity 6 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. nearest whole dollar.) eBook Table values are based on: Hint Print Amount Present Value References Cash Flow Interest Principal Price of bonds Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 oints Maturity 9 years, interest paid semiannually, stated rate 12%, effective (market rate 12%, (Round your answers to the nearest whole dollar.) eBook Table values are based on: Hint Print Amount Present Value References Cash Flow Interest Principal Price of bonds