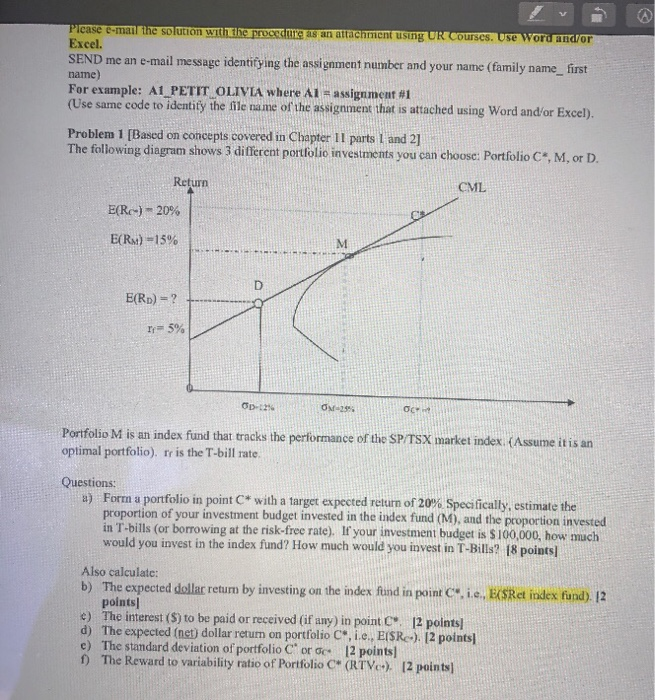

Picase e-mail the solution with the procedures an attachment using UR Courses. Use Word and/or Excel. SEND me an e-mail message identifying the assignment number and your name (family name_first name) For example: A1_PETIT OLIVIA where Als assignment #1 (Use same code to identity the file name of the assignment that is attached using Word and/or Excel). Problem 1 [Based on concepts covered in Chapter 11 parts 1 and 2] The following diagram shows 3 different portfolio investments you can choose: Portfolio C, M, or D. Return CML E(R) - 20% E(RM) -15% E(Rp) = ? . Iy5 01-12 Portfolio M is an index fund that tracks the performance of the SP/TSX market index. (Assume it is an optimal portfolio). rr is the T-bill rate, Questions: a) Forma portfolio in point C* with a target expected return of 20% Specifically, estimate the proportion of your investment budget invested in the index fund (M), and the proportion invested in T-bills (or borrowing at the risk-free rate). If your investment budget is $100,000, how much would you invest in the index fund? How much would you invest in T-Bills? 18 points Also calculate b) The expected dollar return by investing on the index fund in point C ie., ESRct index fund). 12 points) c) The interest (S) to be paid or received (if any) in point C 12 points d) The expected (het) dollar return on portfolio C. i.e., ESR.) 12 points c) The standard deviation of portfolio Corc 12 points] 1) The Reward to variability ratio of Portfolio C" (RTYc+), 12 points g) RTV 12 points h) Form a portfolio in Point D with a target standard deviation op of 12% Specifically, estimate the percent of your investment budget invested in M index fund) and the percent invested in T-bills (or borrowing at the risk-free rate). If your investment budget is $100,000, how much would you invest in the index fund? How much would you invest in T-Bills? [6 points 1) The expected (percent) return on the portfolio in point D E(Rp). 12 points J) The expected dollar return by investing on the index fund in point D. i.e., E(SRetindex fund), 12 points) k) The interest (S) to be paid or received (if any) in point D. 2 points) 1) The expected dollar retum on portfolio D, i.e., E(SR). 12 points m) RTVD. 12 points n) Which of the three investment alternatives would you choose (D, M or C*)? Why? 12 points]