Question

Pick one transaction from the Chapter 2 Serial Problem on pg. 94 & 95 and explain what accounts will be debited and what accounts will

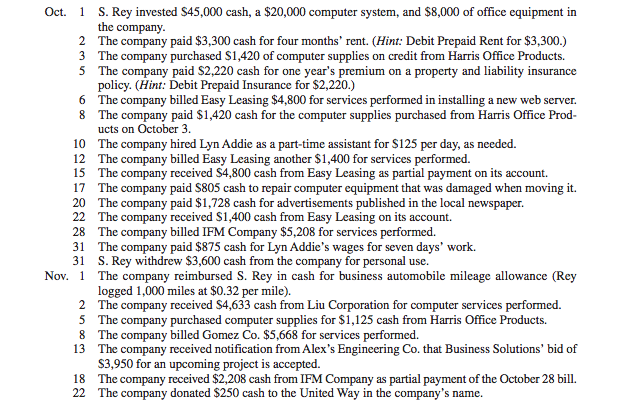

Pick one transaction from the Chapter 2 Serial Problem on pg. 94 & 95 and explain what accounts will be debited and what accounts will be credited. Make sure to identify the transaction and you cannot post the same transaction as another classmate. Make sure to use the chart of accounts . See the example below for the correct presentation. Correct classmates that are incorrect if needed. Remember your post must be made by Friday of the deadline week. Respond to your classmates by Sunday night at midnight of the deadline week.

SP2 transaction S. Rey invested $45,000 cash, a $20,000 computer system, and $8,000 of office equipment in the company.

My answer: Debit (increase) Cash $45,000; Debit (increase) Computer Equipment $20,000; Debit (increase) Office Equipment $8,000; Credit (increase) S. Rey, Capital $73,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started