Pickering Heavy Equipment Limited (PHL) would like to determine the lease payment it quotes to the lessee.

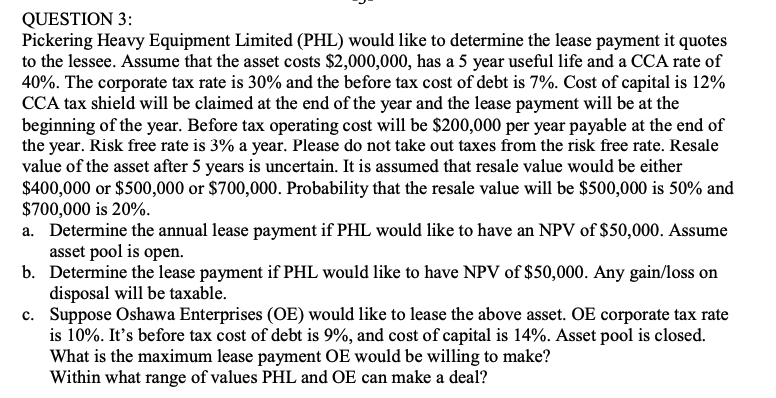

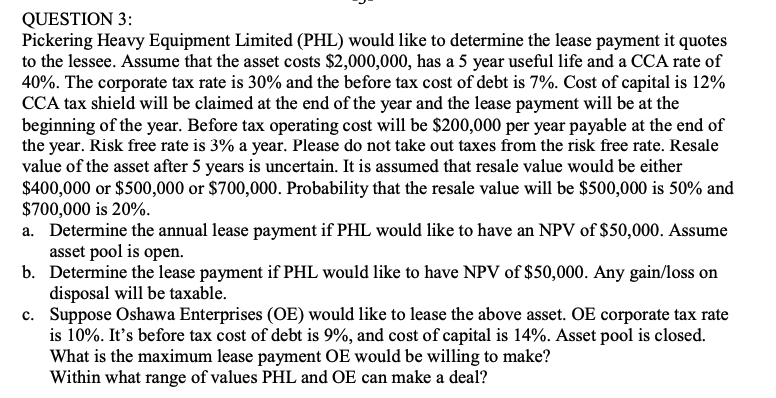

QUESTION 3: Pickering Heavy Equipment Limited (PHL) would like to determine the lease payment it quotes to the lessee. Assume that the asset costs $2,000,000, has a 5 year useful life and a CCA rate of 40%. The corporate tax rate is 30% and the before tax cost of debt is 7%. Cost of capital is 12% CCA tax shield will be claimed at the end of the year and the lease payment will be at the beginning of the year. Before tax operating cost will be $200,000 per year payable at the end of the year. Risk free rate is 3% a year. Please do not take out taxes from the risk free rate. Resale value of the asset after 5 years is uncertain. It is assumed that resale value would be either $400,000 or $500,000 or $700,000. Probability that the resale value will be $500,000 is 50% and $700,000 is 20% a. Determine the annual lease payment if PHL would like to have an NPV of $50,000. Assume asset pool is open. b. Determine the lease payment if PHL would like to have NPV of $50,000. Any gain/loss on disposal will be taxable. c. Suppose Oshawa Enterprises (OE) would like to lease the above asset. OE corporate tax rate is 10%. It's before tax cost of debt is 9%, and cost of capital is 14%. Asset pool is closed. What is the maximum lease payment OE would be willing to make? Within what range of values PHL and OE can make a deal? QUESTION 3: Pickering Heavy Equipment Limited (PHL) would like to determine the lease payment it quotes to the lessee. Assume that the asset costs $2,000,000, has a 5 year useful life and a CCA rate of 40%. The corporate tax rate is 30% and the before tax cost of debt is 7%. Cost of capital is 12% CCA tax shield will be claimed at the end of the year and the lease payment will be at the beginning of the year. Before tax operating cost will be $200,000 per year payable at the end of the year. Risk free rate is 3% a year. Please do not take out taxes from the risk free rate. Resale value of the asset after 5 years is uncertain. It is assumed that resale value would be either $400,000 or $500,000 or $700,000. Probability that the resale value will be $500,000 is 50% and $700,000 is 20% a. Determine the annual lease payment if PHL would like to have an NPV of $50,000. Assume asset pool is open. b. Determine the lease payment if PHL would like to have NPV of $50,000. Any gain/loss on disposal will be taxable. c. Suppose Oshawa Enterprises (OE) would like to lease the above asset. OE corporate tax rate is 10%. It's before tax cost of debt is 9%, and cost of capital is 14%. Asset pool is closed. What is the maximum lease payment OE would be willing to make? Within what range of values PHL and OE can make a deal