Answered step by step

Verified Expert Solution

Question

1 Approved Answer

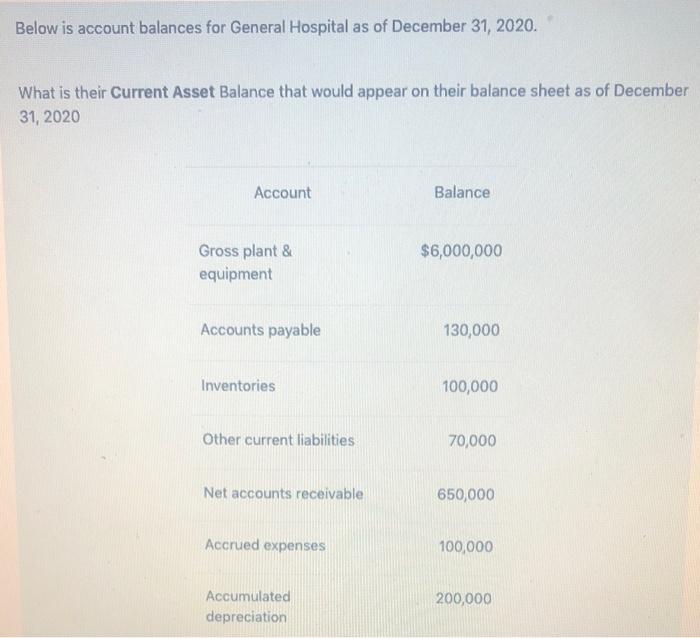

picture 2 goes with the question on picture 3 What is the difference between historical cost and replacement cost? Historical cost is what a specific

picture 2 goes with the question on picture 3

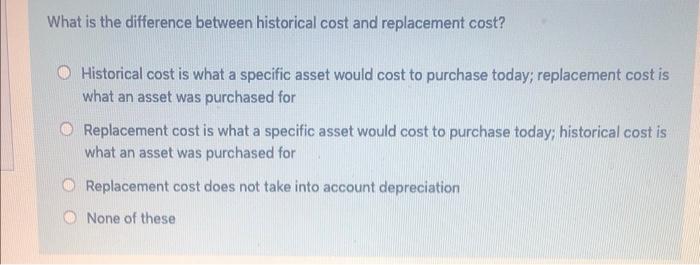

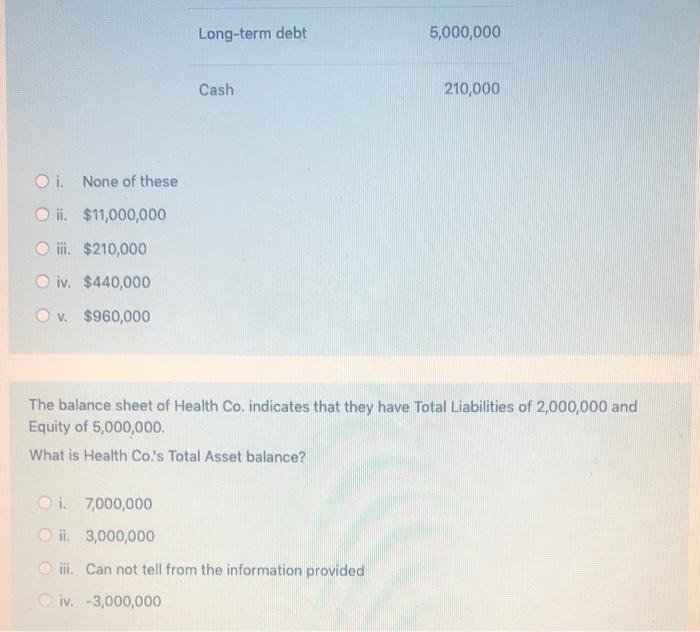

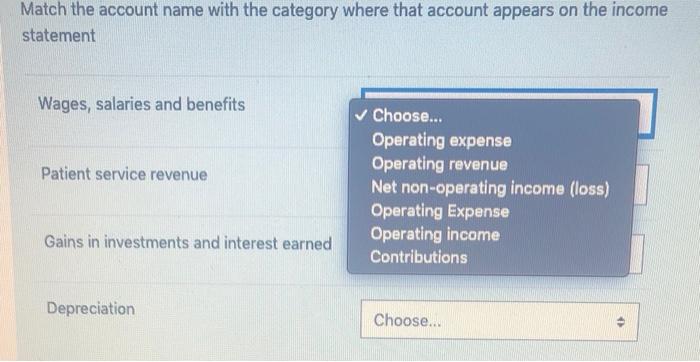

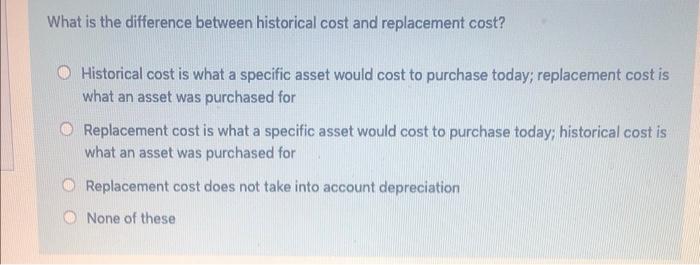

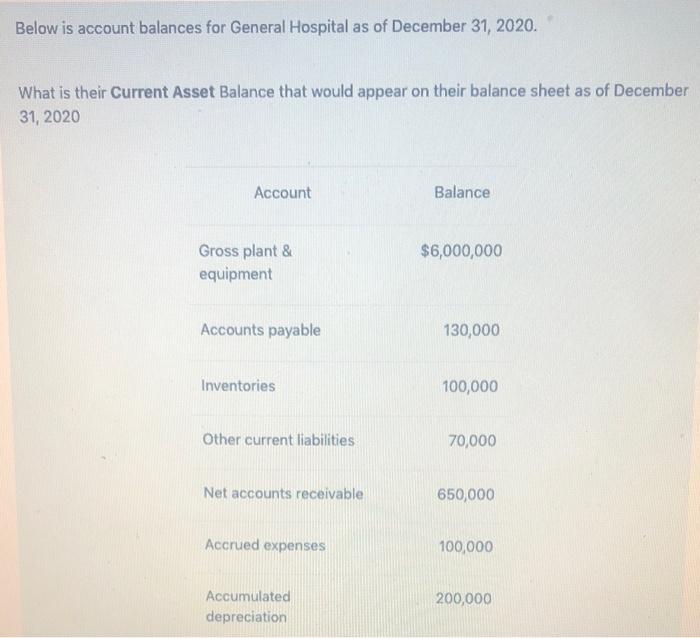

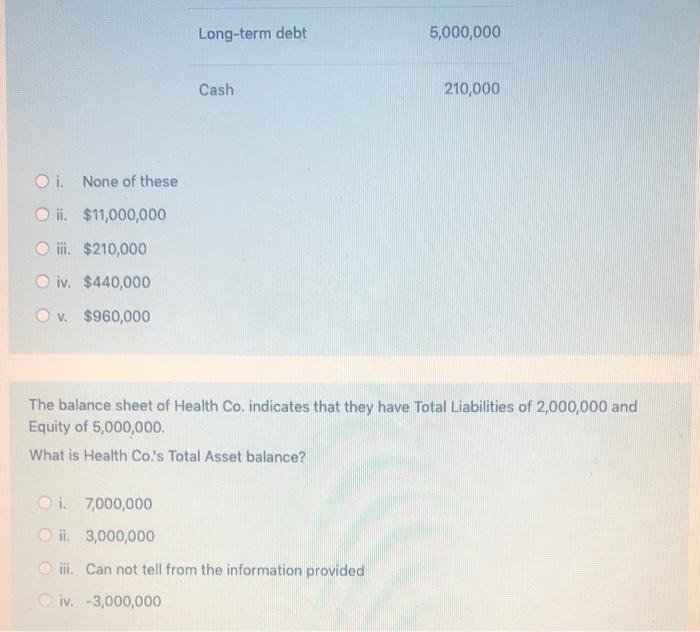

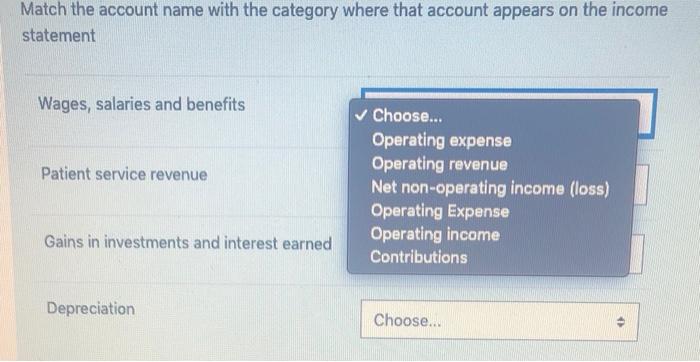

What is the difference between historical cost and replacement cost? Historical cost is what a specific asset would cost to purchase today; replacement cost is what an asset was purchased for Replacement cost is what a specific asset would cost to purchase today, historical cost is what an asset was purchased for Replacement cost does not take into account depreciation None of these Below is account balances for General Hospital as of December 31, 2020. What is their Current Asset Balance that would appear on their balance sheet as of December 31, 2020 Account Balance $6,000,000 Gross plant & equipment Accounts payable 130,000 Inventories 100,000 Other current liabilities 70,000 Net accounts receivable 650,000 Accrued expenses 100,000 200,000 Accumulated depreciation Long-term debt 5,000,000 Cash 210,000 Oi. None of these ii. $11,000,000 ii. $210,000 iv. $440,000 O v. $960,000 The balance sheet of Health Co. indicates that they have Total Liabilities of 2,000,000 and Equity of 5,000,000 What is Health Cols Total Asset balance? i. 7,000,000 il 3,000,000 iii. Can not tell from the information provided iv. -3,000,000 Match the account name with the category where that account appears on the income statement Wages, salaries and benefits Patient service revenue Choose... Operating expense Operating revenue Net non-operating income (loss) Operating Expense Operating income Contributions Gains in investments and interest earned Depreciation Choose... 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started