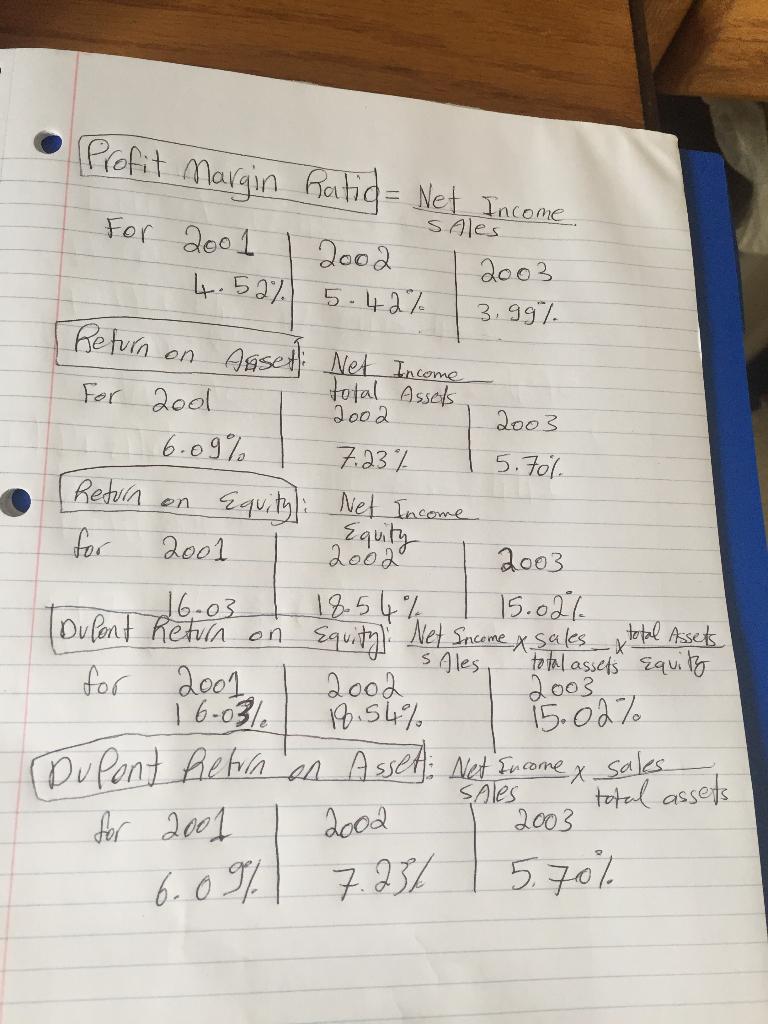

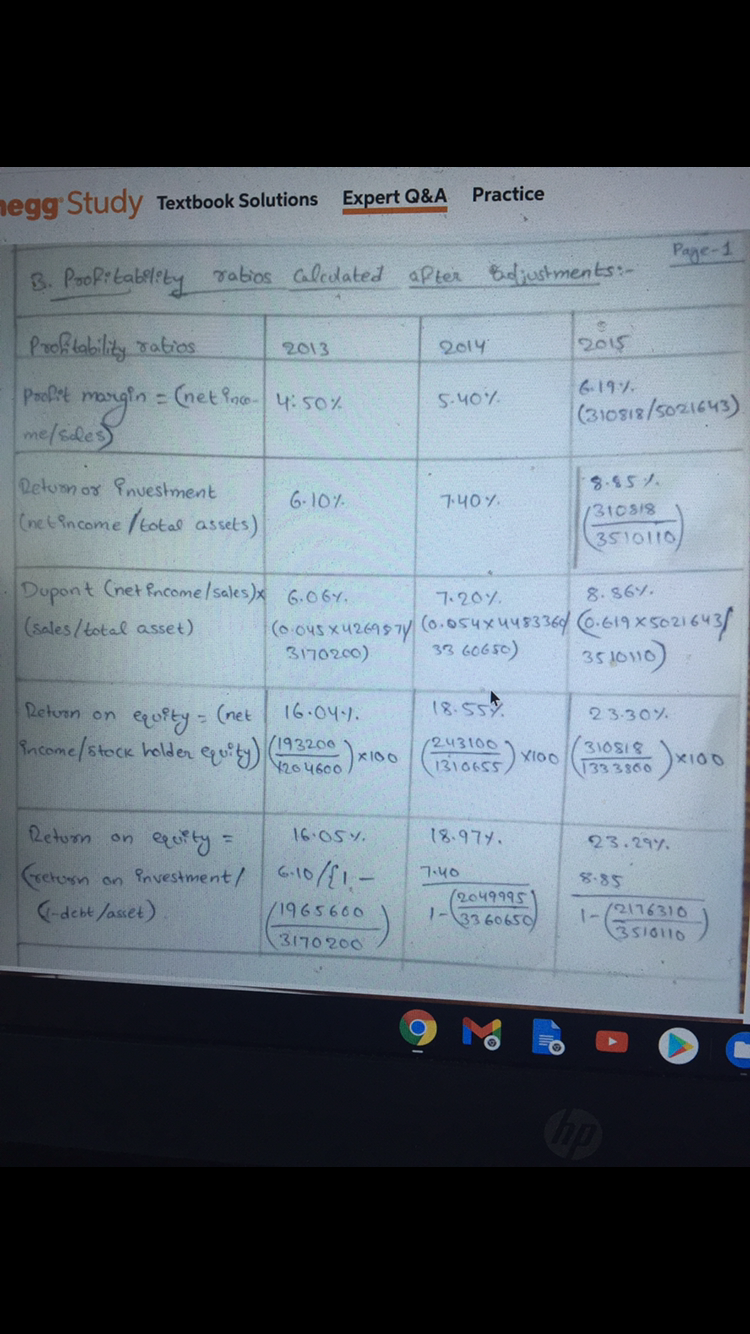

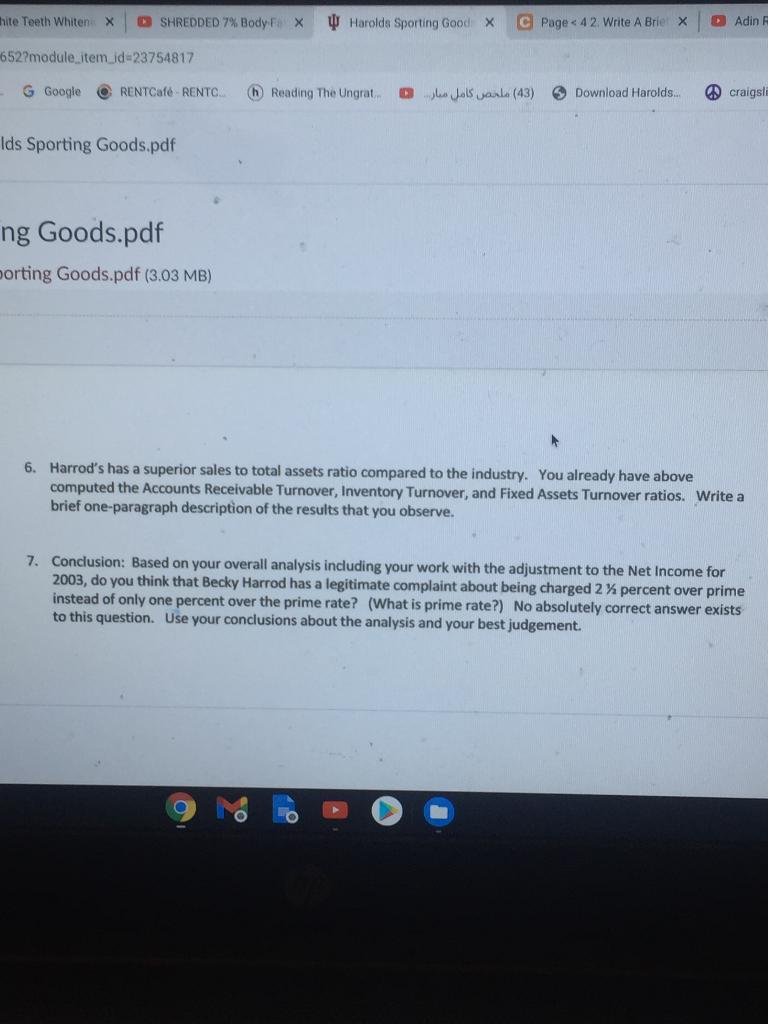

Picture 3 shows the analysis for the three years. Picture 4 shows the analysis after adjustments to the net income from question 3. with that being said, i need question number 7 answered please

Picture 3 shows the analysis for the three years. Picture 4 shows the analysis after adjustments to the net income from question 3. with that being said, i need question number 7 answered please

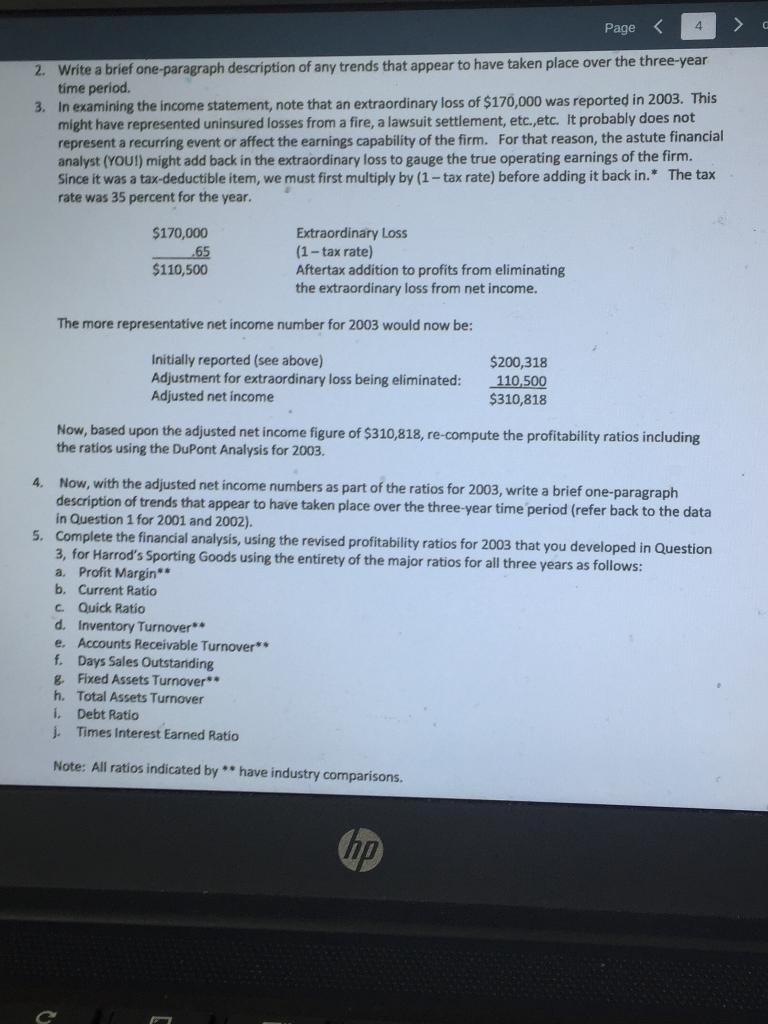

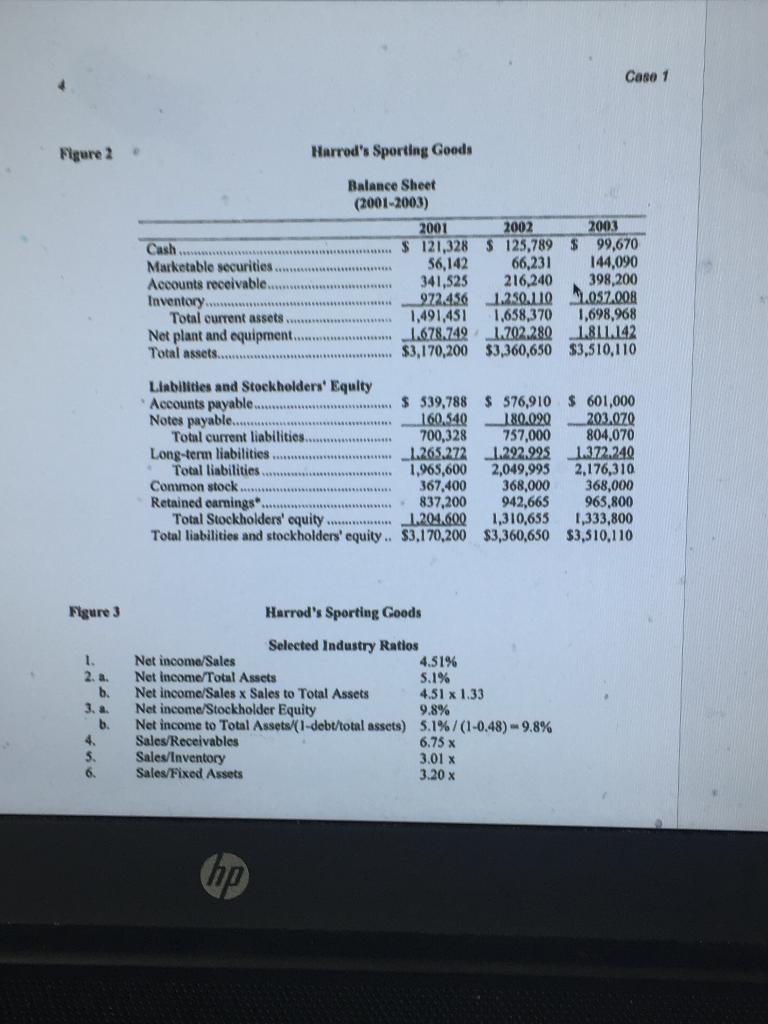

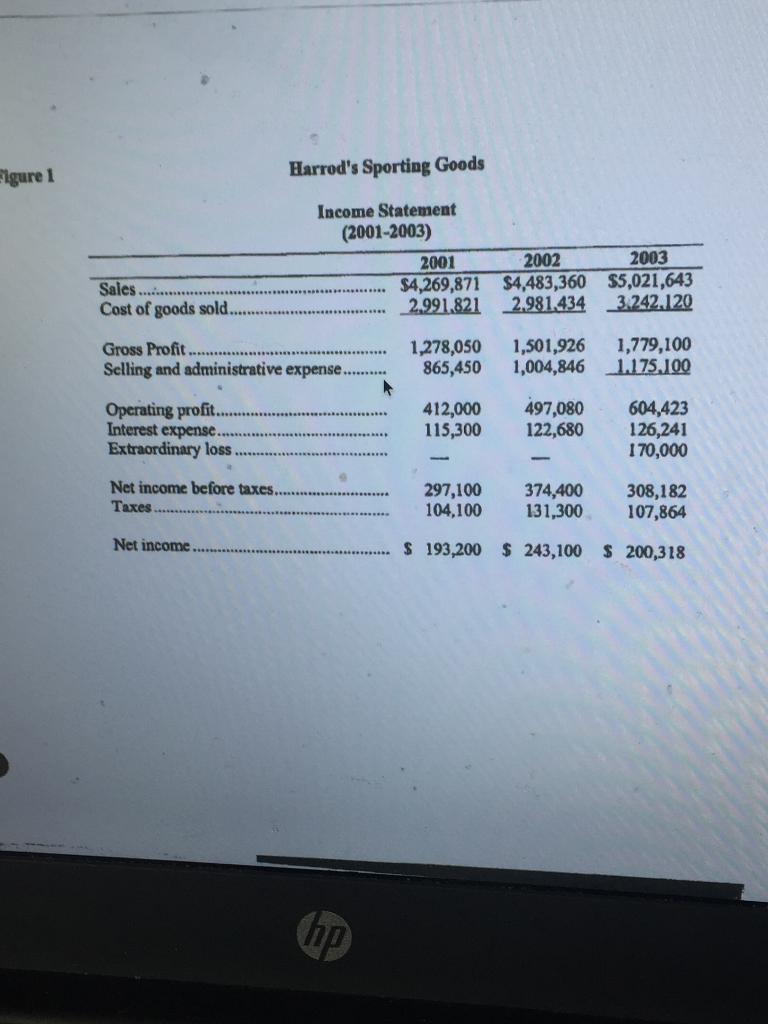

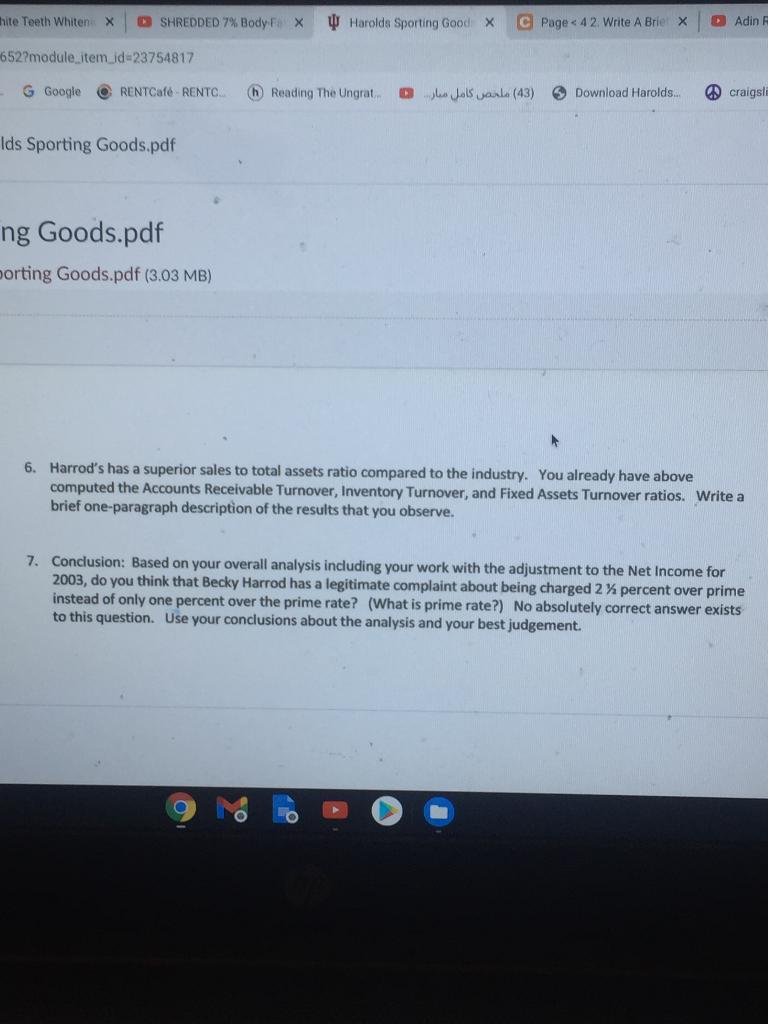

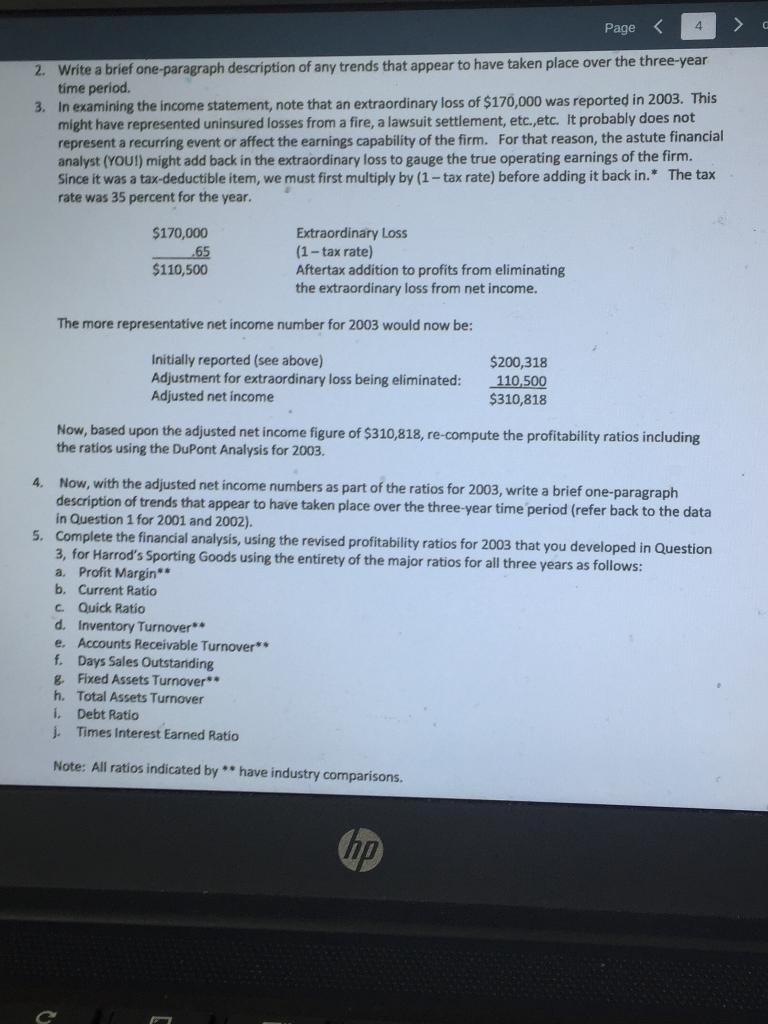

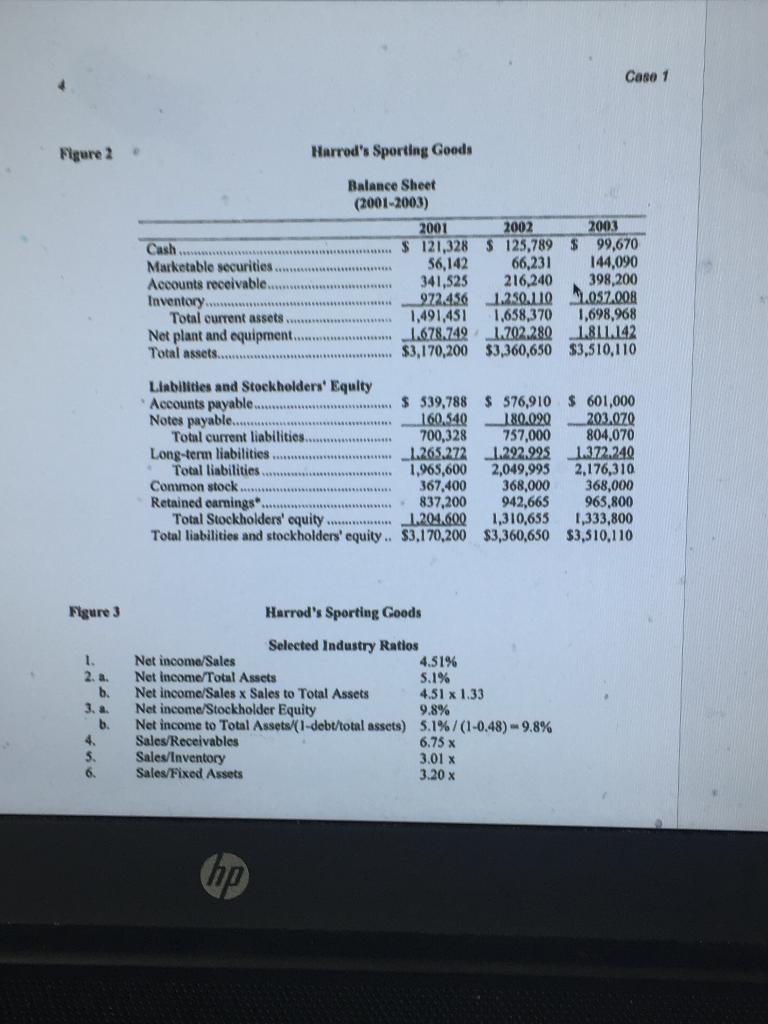

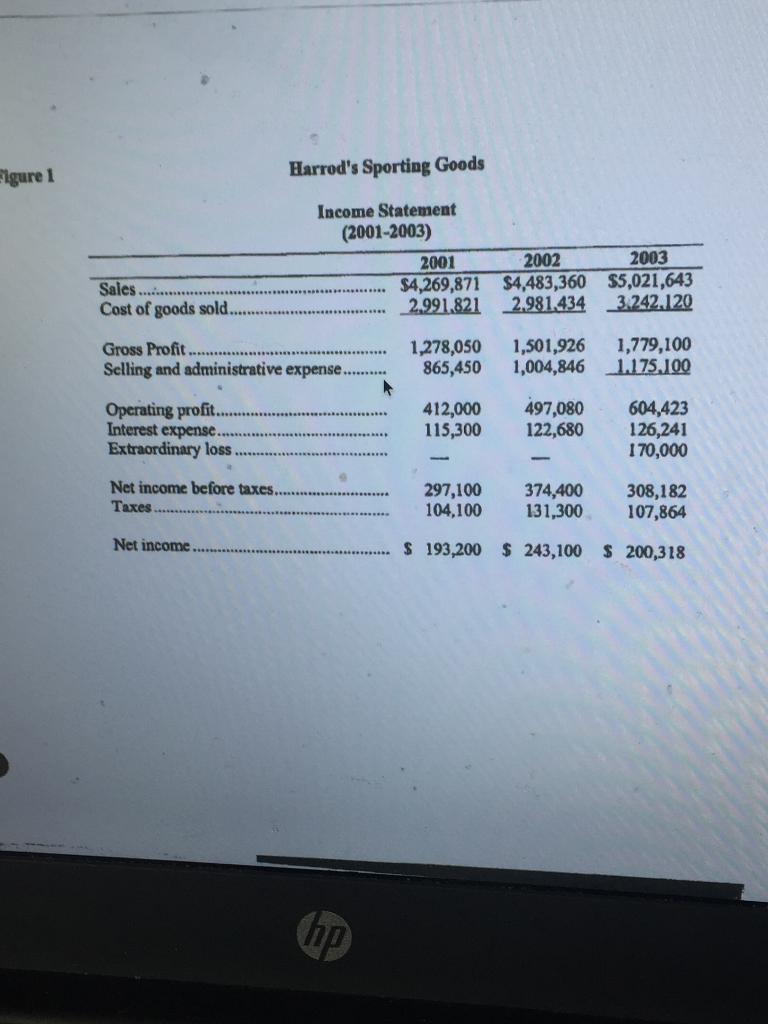

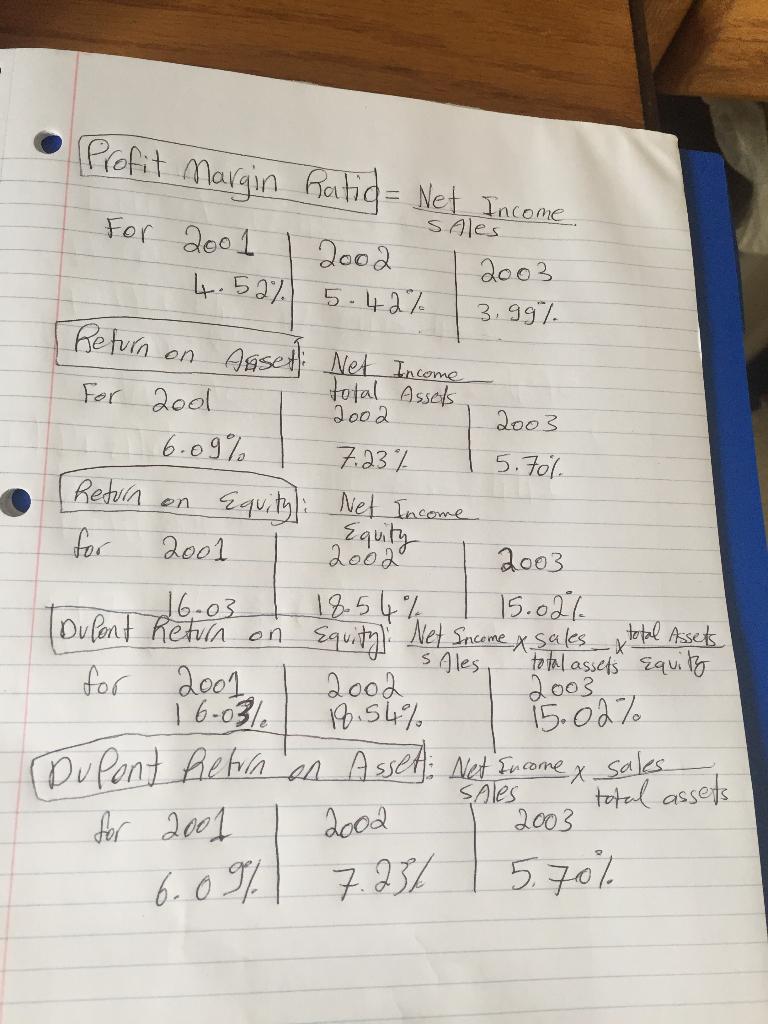

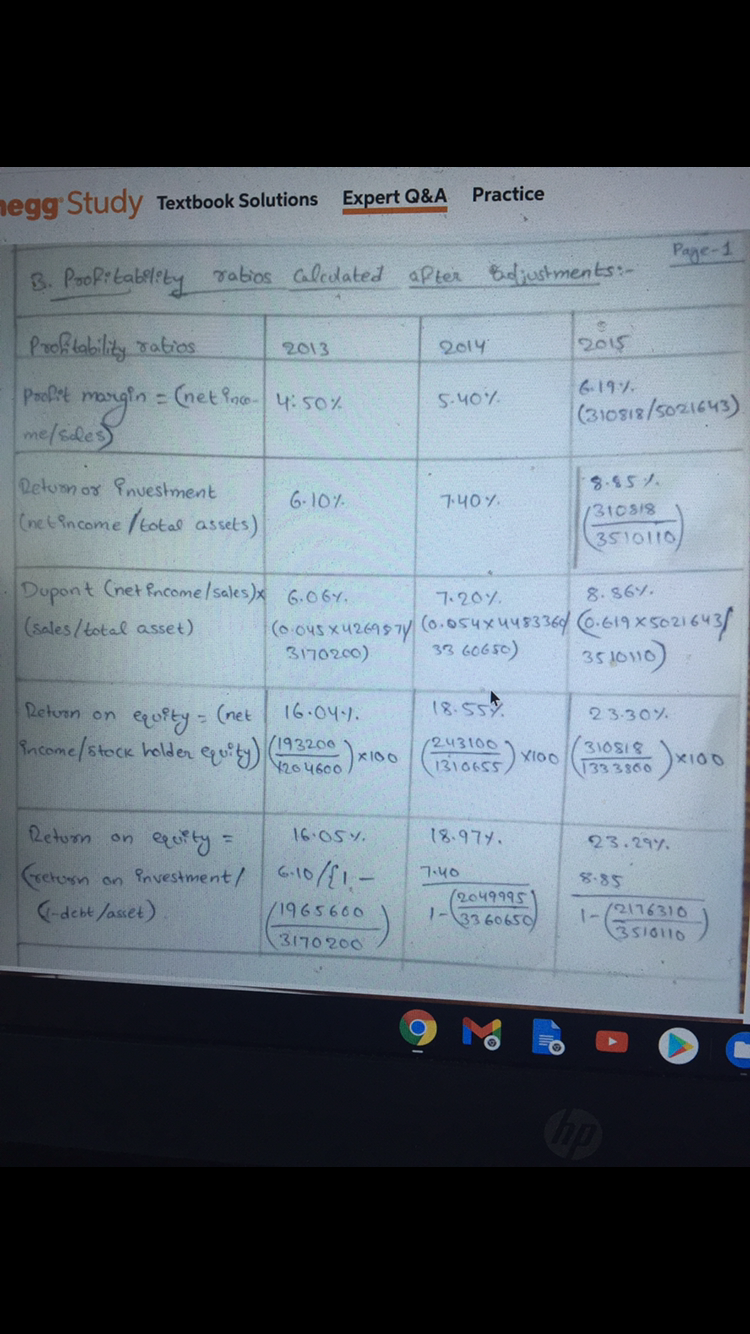

Case 1 Figure 2 Cash Harrods Sporting Goods Balance Sheet (2001-2003) 2001 2002 2003 $ 121,328 $ 125,789 $ 99,670 56,142 66,231 144,090 341,525 216,240 398,200 972.456 1.250.119.057.008 1,491,451 1,638,370 1,698,968 1.678,749 1.702.280 1.811.142 $3,170,200 $3,360,650 $3,510,110 Marketable securities Accounts receivable Inventory. Total current assets Net plant and equipment Total assets....... Liabilities and Stockholders' Equity Accounts payable. $ 539,788 $ 576,910 $ 601,000 Notes payable. 160.540 180.020 203.070 Total current liabilities. 700,328 757,000 804.070 Long-term liabilities 1.265.272 1.292.995 1.372.240 Total liabilities 1,965,600 2,049,995 2,176,310 Common stock 367,400 368,000 368,000 Retained earnings 837,200 942,665 965,800 Total Stockholders' equity ................ 1.204,800 1,310,655 1,333,800 Total liabilities and stockholders' equity. $3.170,200 $3,360,650 $3,510,110 Figure 3 5.1% 1. 2. a. b. 3. a b. 4. 5. 6. Harrod's Sporting Goods Selected Industry Ratios Net income/Sales 4.51% Net Income/Total Assets Net income/Sales x Sales to Total Assets 4.51 x 1.33 Net income/Stockholder Equity 9.8% Net income to Total Assets/(1-debt/total assets) 5.1%/(1-0.48) - 9.8% Sales Receivables Sales/Inventory 3.01 Sales/Fixed Assets 3.20 x 6.75 hp Figure 1 Harrod's Sporting Goods Income Statement (2001-2003) 2001 $4,269,871 2.991.821 Sales... 2002 2003 $4,483,360 $5,021,643 2.981.434 3.242.120 Cost of goods sold... Gross Profit Selling and administrative expense........... 1,278,050 865,450 1,501,926 1,004,846 1,779,100 1.175.100 Operating profit.. Interest expense. Extraordinary loss 412,000 115,300 497,080 122,680 604,423 126,241 170,000 Net income before taxes. Taxes 297,100 104,100 374,400 131,300 308,182 107,864 Net income $ 193,200 $ 243,100 $ 200,318 (hp Profit margin Ratid - Net Income For 2001 4.52% on 2002 2003 on Sales 2002 2003 5.42% 3.997 Return Asset Net Income For cool total Assets 6.09% 7.23% 5.76% Return Equity: Net Income for Equity 2001 2002 " 2003 16.03 18.54% 15.026. Dulent Return on Equity Net Income x sales a total Assets s Ales for 2001 2002 2003 16.03% 9.54% Dupont Return on Asset: Net Income, for 2001 2003 5.70% 15.02% ex sales Sales total assets 2002 6.091 7.251 Practice negg Study Textbook Solutions Expert Q&A Page 1 3. Profitability rabios calculated after adjustments:- 2015 2013 2014 Profitability ratios Prolet margin= me/sales) = (net inco 4: 50% 6.19% 5.40% (310918/5021643) Detom or nuestment (net income /total assets) 6.10% 7.401 8.95 1310918 (3510110 7.20%. 8. 864 Dupont (net encome / sales)x 6.064. (sales/total asset) (0.04 x42698 77 (0.054x4483364 (6.619x5021643 3170200) 33 60650) 351010) Return on (net 16.04.1. 18.557 23.30% equity - income/stock holder equity) /193200 1243100 1204600)x100 Biooss) xoo 1310818 1333860 :)x100 Return on 16.057. 18.977. 23.297. equity = {return on investment/ (-debt/asset) 8.85 740 (2049995 6-10/1 - -) /1965600 1-3360650 1- 102176310 3510110 3170200 hite Teeth Whitenix SHREDDED 7% Body FX Harolds Sporting Good X C Page

Picture 3 shows the analysis for the three years. Picture 4 shows the analysis after adjustments to the net income from question 3. with that being said, i need question number 7 answered please

Picture 3 shows the analysis for the three years. Picture 4 shows the analysis after adjustments to the net income from question 3. with that being said, i need question number 7 answered please