Picture is to show how they want it: Part One: During the month of March, Crane Companys employees earned wages of $84,000. Withholdings related to

Picture is to show how they want it:

Part One:

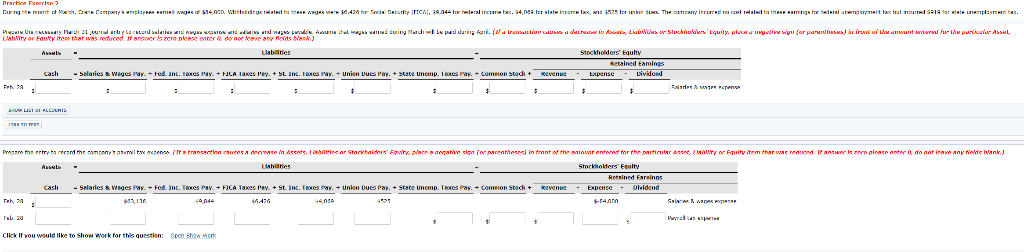

During the month of March, Crane Companys employees earned wages of $84,000. Withholdings related to these wages were $6,426 for Social Security (FICA), $9,844 for federal income tax, $4,069 for state income tax, and $525 for union dues. The company incurred no cost related to these earnings for federal unemployment tax but incurred $919 for state unemployment tax.

Part two: Prepare the entry to record the companys payroll tax expense. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced. If answer is zero please enter 0, do not leave any fields blank.) (line one)

| $63,136 | $9,844 | $6,426 | $4,069 | $525 | $-84,000 | Salaries & wages expense |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started