Answered step by step

Verified Expert Solution

Question

1 Approved Answer

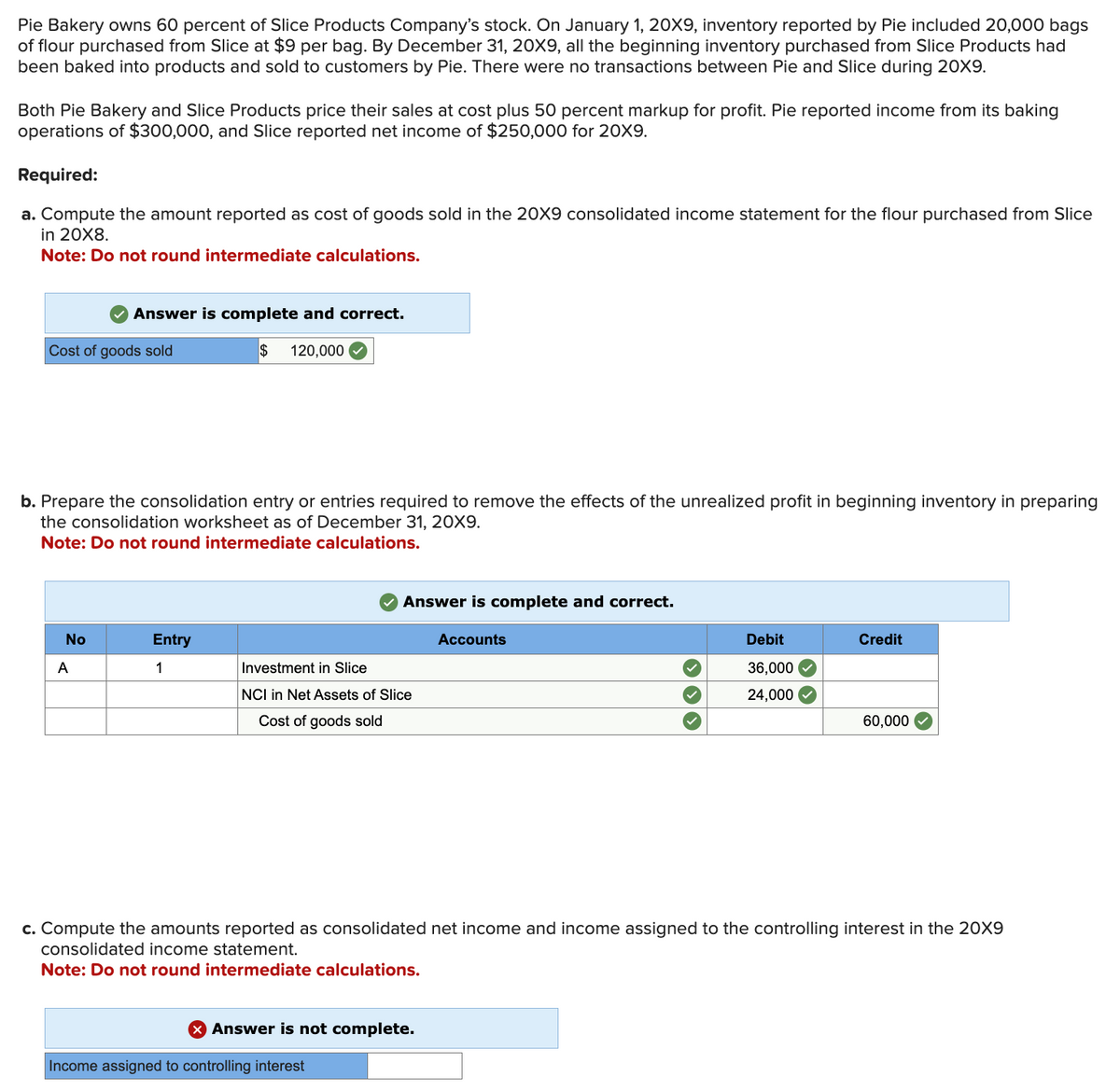

Pie Bakery owns 6 0 percent of Slice Products Company's stock. On January 1 , 2 0 X 9 , inventory reported by Pie included

Pie Bakery owns percent of Slice Products Company's stock. On January X inventory reported by Pie included bags

of flour purchased from Slice at $ per bag. By December X all the beginning inventory purchased from Slice Products had

been baked into products and sold to customers by Pie. There were no transactions between Pie and Slice during X

Both Pie Bakery and Slice Products price their sales at cost plus percent markup for profit. Pie reported income from its baking

operations of $ and Slice reported net income of $ for X

Required:

a Compute the amount reported as cost of goods sold in the X consolidated income statement for the flour purchased from Slice

in X

Note: Do not round intermediate calculations.

Answer is complete and correct.

Cost of goods sold

$

b Prepare the consolidation entry or entries required to remove the effects of the unrealized profit in beginning inventory in preparing

the consolidation worksheet as of December X

Note: Do not round intermediate calculations.

c Compute the amounts reported as consolidated net income and income assigned to the controlling interest in the X

consolidated income statement.

Note: Do not round intermediate calculations.

Answer is not complete.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started