Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pie Corporation acquired 70 percent of Slice Company's common stock on December 31, 20X5, at underlying book value. The book values and fair values

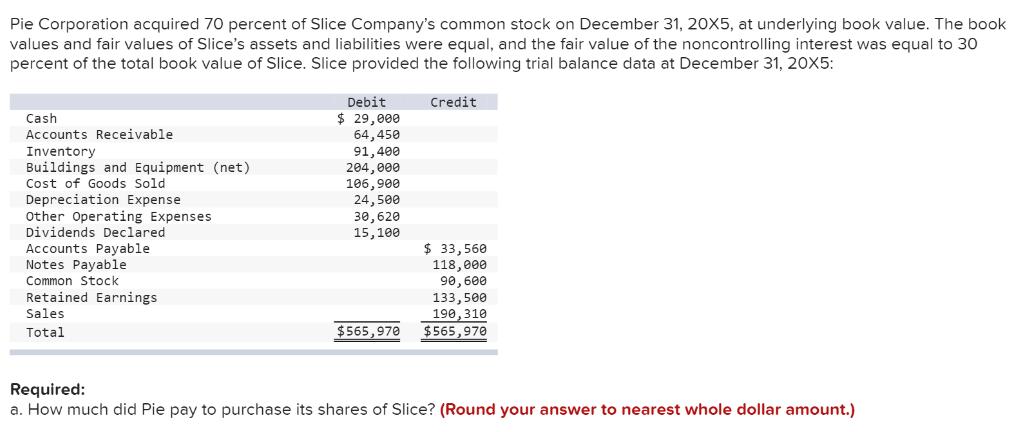

Pie Corporation acquired 70 percent of Slice Company's common stock on December 31, 20X5, at underlying book value. The book values and fair values of Slice's assets and liabilities were equal, and the fair value of the noncontrolling interest was equal to 30 percent of the total book value of Slice. Slice provided the following trial balance data at December 31, 20X5: Cash Accounts Receivable. Inventory Buildings and Equipment (net) Cost of Goods Sold Cost Depreciation Expense Other Operating Expenses Dividends Declared Accounts Payable. Notes Payable Common Stock Retained Earnings Sales Total Debit $ 29,000 64,450 91,400 204,000 106,900 24,500 30,620 15,100 $565,970 Credit $ 33,560 118,000 90,600 133,500 190,310 $565,970 Required: a. How much did Pie pay to purchase its shares of Slice? (Round your answer to nearest whole dollar amount.)

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Since Pie Corporation acquired 70 percent of Slice Companys common stock it means that Pie now owns ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started